As we dive into the latter half of the year, investors and financial analysts are keenly focused on the Dow Jones year-to-date performance. This vital metric provides a snapshot of the market's trajectory over the past 12 months, highlighting both the triumphs and challenges that investors have faced. In this article, we'll delve into the Dow Jones year-to-date performance, examining the key factors that have influenced it and offering insights into what the future may hold.

Understanding the Dow Jones Year-to-Date Performance

The Dow Jones Industrial Average (DJIA), often simply referred to as the Dow, is one of the most widely followed stock market indices in the world. It tracks the performance of 30 large companies across various sectors, representing a cross-section of the U.S. economy. The Dow Jones year-to-date performance, therefore, serves as a critical indicator of the broader market's health.

Key Factors Influencing the Dow Jones Year-to-Date Performance

Several factors have played a significant role in shaping the Dow Jones year-to-date performance. Here are some of the most notable:

Economic Indicators: The health of the U.S. economy is a primary driver of the Dow Jones year-to-date performance. Factors such as GDP growth, unemployment rates, and inflation data all contribute to the overall market sentiment.

Corporate Earnings: The earnings reports of companies listed on the Dow Jones have a substantial impact on the index's performance. Positive earnings reports can boost investor confidence and drive the market higher, while negative reports can have the opposite effect.

Global Events: Events such as political instability, trade disputes, and geopolitical tensions can have a significant impact on the Dow Jones year-to-date performance. These events can lead to market volatility and uncertainty, affecting investor sentiment.

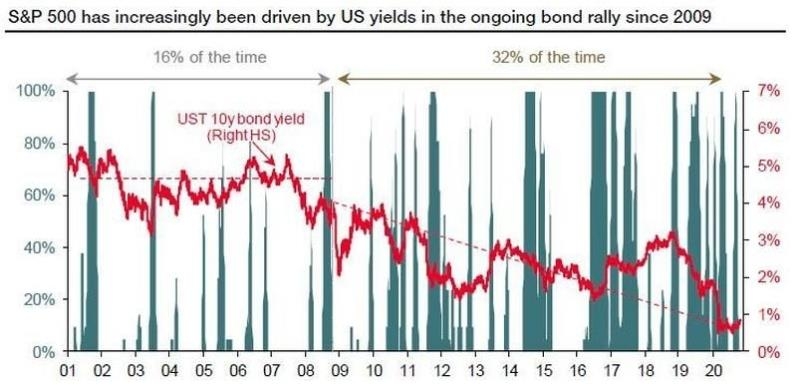

Interest Rates: The Federal Reserve's monetary policy, particularly changes in interest rates, can have a profound impact on the Dow Jones year-to-date performance. Higher interest rates can make borrowing more expensive for companies, potentially weighing on their earnings and the overall market.

Dow Jones Year-to-Date Performance: A Closer Look

As of [insert current date], the Dow Jones Industrial Average has seen a [insert percentage increase or decrease] in year-to-date performance. This movement can be attributed to several key factors:

Economic Growth: The U.S. economy has shown signs of steady growth, with GDP expanding at a moderate pace. This has helped boost investor confidence and contributed to the Dow Jones year-to-date performance.

Corporate Earnings: Many companies listed on the Dow have reported strong earnings, driven by factors such as increased demand, cost-cutting measures, and improved operational efficiency.

Global Events: Despite some challenges, such as the ongoing trade tensions between the U.S. and China, the market has largely remained resilient. This can be attributed to investors' optimism about the long-term prospects of the economy and corporate earnings.

Case Studies: The Impact of Key Events on the Dow Jones Year-to-Date Performance

To better understand the impact of key events on the Dow Jones year-to-date performance, let's examine a couple of recent case studies:

COVID-19 Pandemic: The outbreak of the COVID-19 pandemic in early 2020 sent shockwaves through the global economy and the stock market. The Dow Jones experienced significant volatility, but it eventually recovered and ended the year with a positive return. This highlights the resilience of the market and the ability of investors to adapt to unprecedented challenges.

U.S. Election: The 2020 U.S. presidential election brought significant uncertainty to the market. However, despite the volatility during the election period, the Dow Jones ultimately ended the year with a strong performance. This demonstrates the market's ability to move past short-term uncertainties and focus on long-term fundamentals.

Conclusion

The Dow Jones year-to-date performance serves as a critical indicator of the broader market's health and investor sentiment. By understanding the key factors that influence this performance, investors can better navigate the market and make informed decisions. As we continue to navigate the challenges of the year, the Dow Jones year-to-date performance will remain a vital tool for investors and financial analysts alike.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....