Introduction: The US stock exchange trading volume is a critical indicator of the health and activity level of the financial markets. It reflects the total number of shares being bought and sold on a given day. This article aims to provide a comprehensive understanding of the US stock exchange trading volume, its significance, and the factors that influence it.

What is US Stock Exchange Trading Volume?

The US stock exchange trading volume refers to the total number of shares bought and sold on the US stock exchanges during a specific trading day. This figure is crucial for investors, traders, and market analysts as it provides insights into the level of activity and liquidity in the market.

Significance of US Stock Exchange Trading Volume

Market Liquidity: A higher trading volume indicates higher market liquidity, making it easier for investors to enter and exit positions without significantly impacting the stock price.

Market Sentiment: The trading volume can indicate the overall sentiment of the market. For instance, a surge in trading volume may suggest strong investor confidence, while a decline in trading volume may indicate a lack of interest or uncertainty.

Market Efficiency: Higher trading volumes often lead to more efficient pricing, as there are more buyers and sellers in the market.

Factors Influencing US Stock Exchange Trading Volume

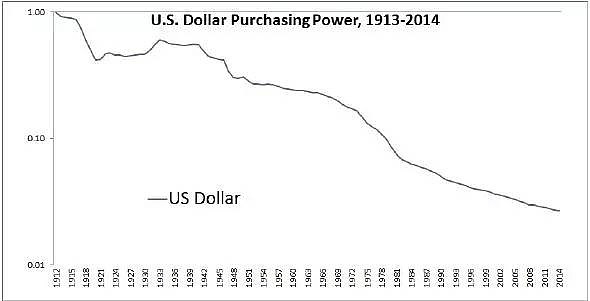

Economic Indicators: Economic data, such as GDP, unemployment rates, and inflation, can significantly impact trading volumes. Positive economic indicators often lead to higher trading volumes, while negative indicators can cause a decline.

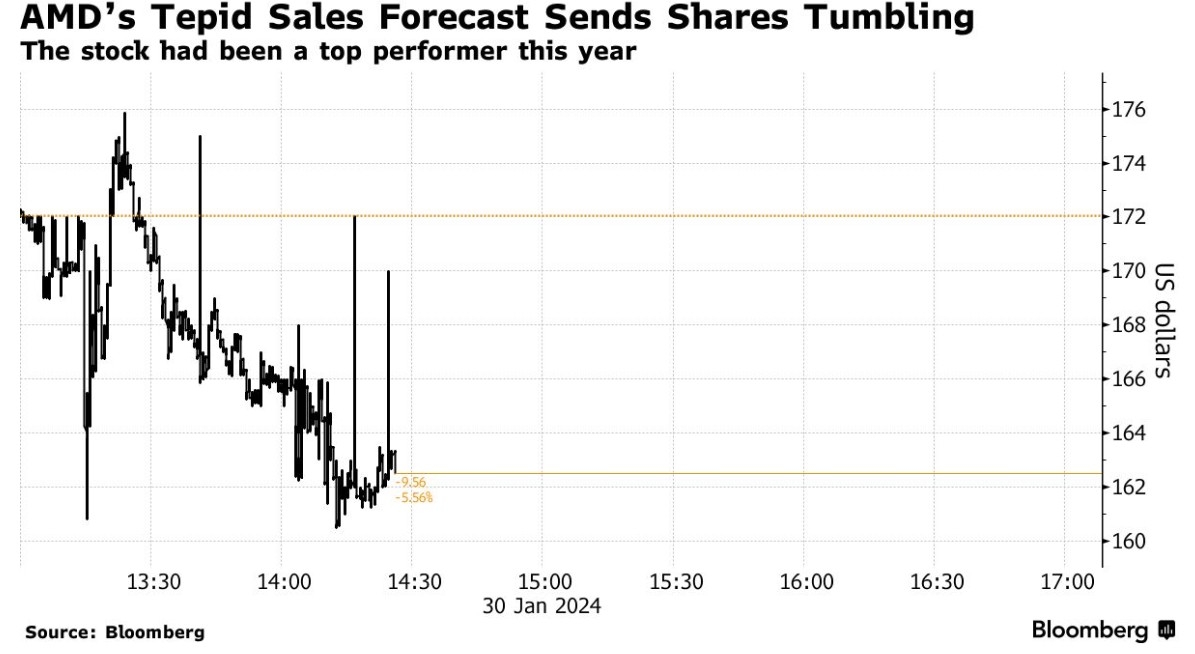

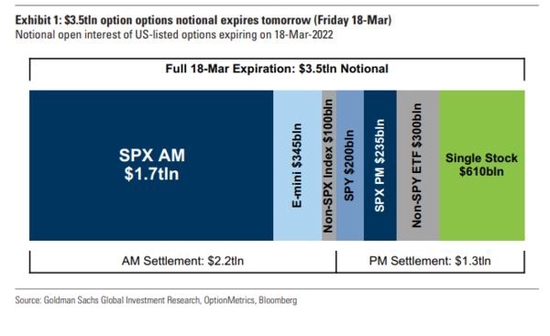

Market Events: Major market events, such as earnings reports, mergers and acquisitions, and political developments, can trigger sudden spikes or declines in trading volumes.

Market Sentiment: Investor sentiment plays a crucial role in determining trading volumes. Factors such as fear of missing out (FOMO), market speculation, and sentiment indicators can influence trading activity.

Technological Advancements: The rise of online trading platforms and mobile applications has made it easier for investors to trade, leading to higher trading volumes.

Case Study: The 2018 Market Crash

One notable example of how trading volume can impact the market is the 2018 market crash. In early February 2018, the S&P 500 experienced a significant drop in trading volume, which was followed by a rapid sell-off. This event highlighted the importance of trading volume in predicting market movements.

Conclusion

In conclusion, the US stock exchange trading volume is a vital indicator of market activity and sentiment. By understanding the factors influencing trading volumes and their significance, investors and traders can make more informed decisions. Monitoring trading volume is essential for staying ahead of market trends and identifying potential opportunities.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....