The stock market's unpredictability has always been a topic of discussion among investors. The question, "How low will the market go?" has become increasingly prevalent, especially in times of economic uncertainty. In this article, we'll explore the factors contributing to market downturns and provide insights into potential future trends.

Understanding Market Volatility

First and foremost, it's important to recognize that the stock market is subject to volatility. Several factors contribute to this volatility, including economic indicators, political events, and company performance. To determine how low the market might go, we must analyze these factors.

Economic Indicators

One of the most crucial factors influencing the stock market is the economy. Economic indicators, such as GDP, unemployment rates, and inflation, can all play a significant role in market performance. For instance, when the economy is performing well, companies tend to see increased profits, leading to a rise in stock prices. Conversely, during economic downturns, investors may become cautious, leading to a drop in stock prices.

Political Events

Political events can also significantly impact the stock market. Elections, policy changes, and international relations all play a part in investor confidence. In some cases, political events can cause short-term volatility, but their long-term effects may vary. It's essential for investors to stay informed about political developments to anticipate potential market movements.

Company Performance

Company performance is another critical factor influencing stock prices. Strong earnings reports and positive business outlooks can lead to increased investor confidence and higher stock prices. Conversely, poor performance or negative news can cause investors to sell off, leading to a decrease in stock prices.

Predicting Future Trends

Predicting how low the market might go is a challenging task. However, there are several indicators that can provide some insight into potential future trends:

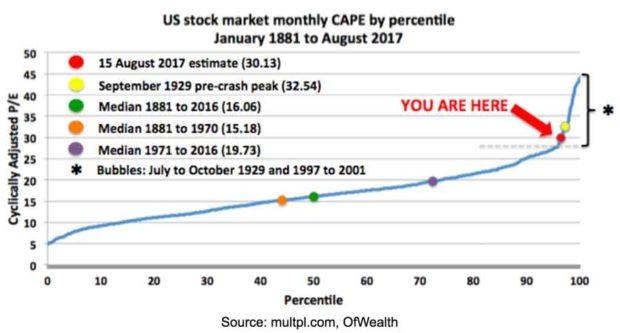

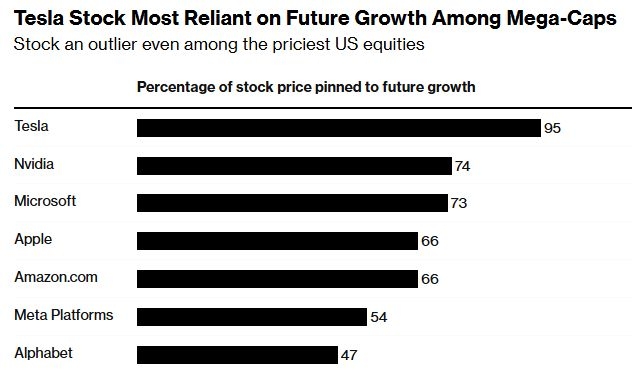

Market Valuations: A highly-valued market may be at a higher risk of a downturn compared to a market with more reasonable valuations.

Sentiment Analysis: Monitoring investor sentiment can provide clues about the market's direction. When sentiment becomes excessively bullish or bearish, it may indicate an impending reversal.

Historical Data: Analyzing past market downturns can offer insights into potential future trends. For instance, historical data has shown that the stock market tends to bottom out during bear markets after a certain number of months.

Case Studies

To further illustrate the factors contributing to market downturns, let's examine a few historical cases:

The 2008 financial crisis was primarily caused by the housing market collapse and the subsequent credit crunch. The market dropped significantly, with the S&P 500 losing approximately 57% of its value from its peak to its trough.

The dot-com bubble burst in the early 2000s, with the tech-heavy NASDAQ losing about 80% of its value from its peak to its trough. The bubble was primarily driven by excessive optimism and unrealistic valuations of tech companies.

The 2020 stock market crash was primarily caused by the COVID-19 pandemic and subsequent lockdown measures. The S&P 500 dropped approximately 34% from its peak to its trough, but recovered within a few months.

In conclusion, the question of "How low will the market go?" cannot be answered definitively. However, by analyzing economic indicators, political events, company performance, and historical data, investors can gain a better understanding of potential future trends. Staying informed and prepared is the key to navigating the unpredictable nature of the stock market.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....