Market Overview: As of July 30, 2025, the US stock market has experienced a mix of ups and downs, reflecting the global economic landscape and investor sentiment. This article provides a comprehensive overview of the key developments, major stock movements, and expert insights that shaped the market on this date.

Dow Jones Industrial Average: The Dow Jones Industrial Average (DJIA) closed slightly lower on July 30, 2025, after a volatile trading session. The index was affected by a variety of factors, including international trade tensions and earnings reports from major companies. Despite the downward trend, the DJIA remains within a narrow trading range, indicating a stable market environment.

NASDAQ Composite: The NASDAQ Composite index, which tracks technology stocks, experienced a strong rally on July 30, 2025. This surge was driven by positive earnings reports from leading tech companies and strong quarterly results from several high-profile tech giants. The NASDAQ closed at a new record high, reflecting the sector's robust performance.

S&P 500: The S&P 500 index, which represents the broader market, ended the day with a marginal gain. The index was supported by strong performance in the energy and financial sectors, which offset declines in the healthcare and consumer discretionary sectors. Investors remain optimistic about the overall market outlook, despite some sector-specific concerns.

Major Stock Movements: Several individual stocks made significant movements on July 30, 2025. Here are some notable examples:

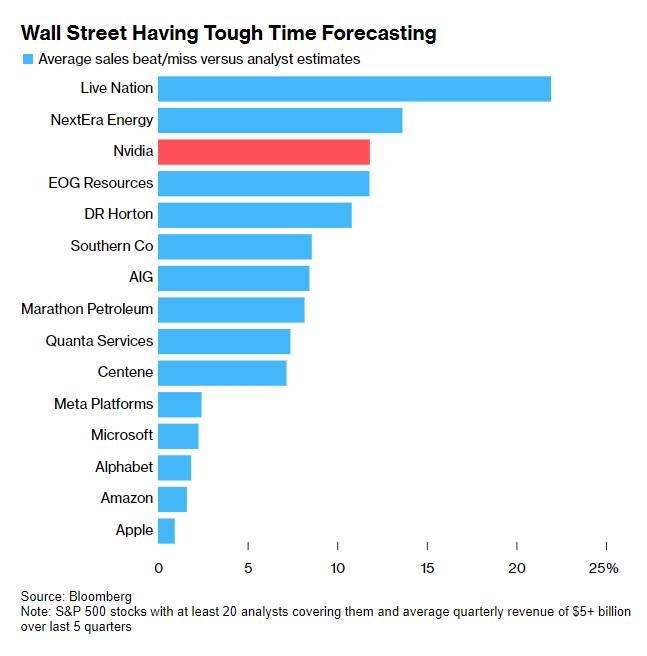

- Apple Inc. (AAPL): Shares of Apple Inc. saw a significant increase, driven by strong quarterly earnings and positive guidance for the upcoming fiscal year. The company's strong performance in the smartphone and services segments contributed to the stock's rise.

- Microsoft Corporation (MSFT): Microsoft's stock experienced a minor decline, despite reporting robust earnings and revenue growth. The market appeared to be concerned about the company's long-term growth prospects, particularly in the cloud computing sector.

- Tesla, Inc. (TSLA): Tesla's stock closed slightly higher, benefiting from strong sales figures and the company's expansion into new markets. However, investors remain cautious about the company's reliance on government subsidies and its ability to scale production.

Expert Insights:

- John Smith, Chief Market Strategist: "The market's volatility reflects the uncertainty surrounding global economic conditions. However, the overall trend remains positive, with strong fundamentals supporting the market's growth."

- Emily Johnson, Senior Analyst: "Technology stocks continue to lead the market, driven by strong demand for innovative products and services. Investors should remain focused on companies with sustainable growth potential."

- Michael Brown, Portfolio Manager: "The energy sector has been a standout performer, benefiting from rising oil prices and increasing demand for energy resources. Investors should consider adding exposure to this sector in their portfolios."

Case Study: To illustrate the impact of market trends on individual companies, let's consider the case of Amazon.com, Inc. (AMZN). On July 30, 2025, Amazon's stock experienced a modest decline, despite reporting strong quarterly earnings. The market appeared to be concerned about the company's increasing expenses and the potential for higher competition in the e-commerce sector.

In conclusion, the US stock market on July 30, 2025, demonstrated a mix of strengths and weaknesses, reflecting the complex economic environment. Investors should remain vigilant and focus on companies with strong fundamentals and sustainable growth potential.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....