As we dive into August 2025, the US stock market continues to evolve, presenting investors with a mix of opportunities and challenges. Understanding the current trends is crucial for making informed investment decisions. In this article, we'll explore the key developments in the US stock market this month, highlighting potential areas of growth and risks.

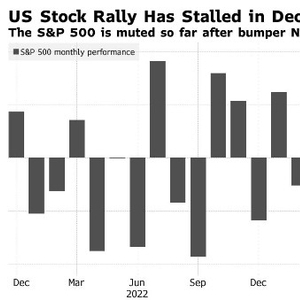

Market Overview: The US stock market has seen a remarkable recovery since the onset of the pandemic. The S&P 500, a widely followed benchmark index, has experienced significant growth over the past few years. However, the market has faced several headwinds, including rising inflation, geopolitical tensions, and economic uncertainties.

Key Trends:

Technology Sector: The technology sector has been a major driver of the US stock market's growth. Companies like Apple, Microsoft, and Amazon have continued to dominate the market, with strong earnings reports and innovative product launches. However, the sector has also faced regulatory scrutiny and concerns over valuation.

Healthcare Sector: The healthcare sector has emerged as a standout performer in recent years. With the aging population and advancements in medical technology, healthcare companies are well-positioned for growth. Key players like Johnson & Johnson and Pfizer have seen strong performance, driven by their diverse product portfolios and robust pipelines.

Energy Sector: The energy sector has seen a significant rebound, particularly in the wake of the global energy crisis. As demand for oil and natural gas increases, companies like ExxonMobil and Chevron have experienced strong gains. However, concerns over rising carbon emissions and the transition to renewable energy remain a potential threat.

Real Estate Investment Trusts (REITs): The real estate sector has been a steady performer, with REITs offering investors a way to gain exposure to the property market. As the economy continues to recover, REITs have seen strong demand, driven by improving fundamentals and attractive dividend yields.

Emerging Markets: The US stock market has also seen growing interest in emerging markets, with companies like Alibaba and Tencent experiencing significant growth. However, investors should be cautious, as emerging markets often come with higher volatility and political risks.

Case Study: One notable case study is the rise of electric vehicle (EV) manufacturers, such as Tesla and Nikola. These companies have seen substantial growth, driven by increasing consumer demand for sustainable transportation options. However, the sector faces challenges, including high production costs and fierce competition.

Conclusion: As we navigate the current US stock market trends in August 2025, it's essential to remain informed and adaptable. The market offers a range of opportunities across various sectors, but investors must be mindful of the risks involved. By staying focused on fundamentals and maintaining a diversified portfolio, investors can position themselves for long-term success.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....