In a significant move that has sent ripples through the financial markets, President Donald Trump recently announced a pause on additional tariffs on Chinese goods. This unexpected decision has led to a surge in the US stock market, raising optimism among investors and businesses alike. In this article, we will delve into the implications of this tariff pause and how it is boosting US stocks.

Understanding the Tariff Pause

The tariff pause comes in the wake of negotiations between the US and China. While the details of these negotiations are yet to be finalized, the mere fact that a pause has been agreed upon is seen as a positive sign for the global economy. The tariffs, which were set to impact a wide range of goods, had the potential to further escalate trade tensions between the two nations.

Impact on the US Stock Market

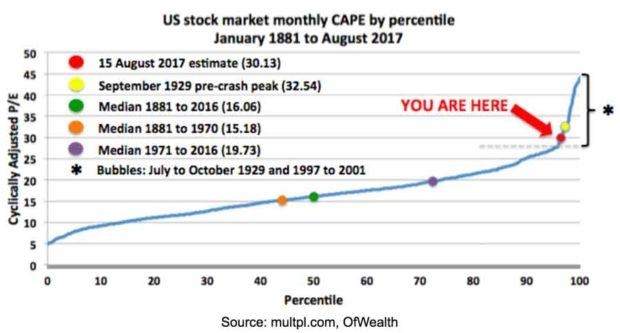

The news of the tariff pause has had a significant impact on the US stock market. Major indices, such as the S&P 500 and the Dow Jones Industrial Average, have seen sharp increases following the announcement. This is because investors believe that a prolonged trade war would have had a detrimental effect on the economy, particularly on US businesses that rely heavily on exports to China.

Benefits for Businesses

The tariff pause is expected to have several positive effects on businesses. Firstly, it will prevent the increase in costs associated with additional tariffs, which could have led to higher prices for consumers. Secondly, it will allow businesses to continue operating without the threat of higher tariffs hanging over their heads. This will boost confidence and encourage investment in the long term.

Case Study: Apple

A prime example of a company that stands to benefit from the tariff pause is Apple Inc. The tech giant relies heavily on China for manufacturing its products, and any increase in tariffs would have had a significant impact on its profits. With the pause in additional tariffs, Apple can continue to produce its products at competitive prices, ensuring its profitability and market dominance.

Conclusion

In conclusion, President Trump's tariff pause has been a significant factor in boosting US stocks. By preventing the escalation of trade tensions, it has provided businesses with some much-needed relief and restored investor confidence. While the full implications of this decision are yet to be seen, it is clear that the tariff pause is a positive step for the US economy.

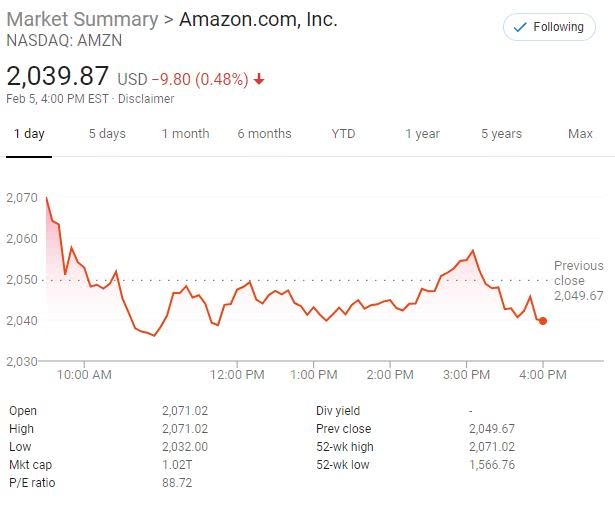

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....