Front Page: Major Stock Market Movements on August 17, 2025

In the fast-paced world of finance, the stock market is a key indicator of economic health and investor sentiment. On August 17, 2025, the US stock market experienced significant movements that could have wide-ranging implications for investors and the economy. Let's delve into the key developments and what they mean for the future.

Dow Jones Industrial Average Plummets

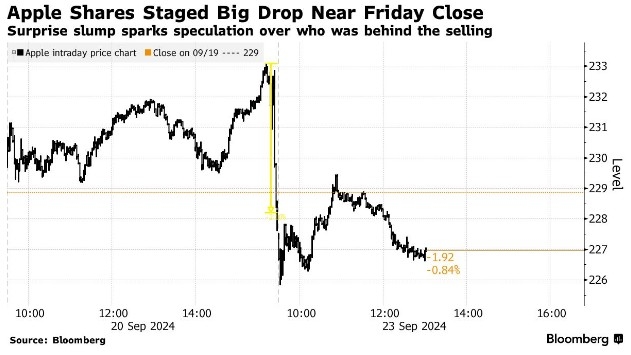

The Dow Jones Industrial Average (DJIA) took a nosedive on August 17, 2025, falling by over 300 points. This drop was attributed to a variety of factors, including concerns about rising inflation, geopolitical tensions, and a slowdown in economic growth. The tech sector, in particular, was hit hard, with major players like Apple and Microsoft experiencing significant declines.

Tech Stocks Lead the Decline

Tech stocks have been a major driver of the stock market's growth over the past decade, but they also seem to be leading the decline. Companies like Amazon, Google, and Facebook saw their shares plummet, as investors worried about the potential for increased regulation and slowing growth. This shift in sentiment has prompted many to reevaluate their investment strategies.

Interest Rates on the Rise

Another factor contributing to the stock market's volatility was the Federal Reserve's decision to raise interest rates. The central bank signaled that it would continue to increase rates in an effort to combat inflation. This move has had a chilling effect on the stock market, as higher interest rates can make borrowing more expensive and reduce the attractiveness of stocks.

Economic Data Offers Mixed Signals

On the same day, the US government released a series of economic data that offered mixed signals. While unemployment remained low, there were signs of a slowdown in consumer spending and business investment. This data has left investors grappling with a complex picture of the US economy.

Market Analysts Weigh In

Market analysts have offered a variety of opinions on the August 17, 2025, stock market movements. Some believe that the market's volatility is a sign of a potential correction, while others argue that it's simply a temporary blip. The consensus seems to be that investors should be cautious and prepared for further market fluctuations.

Case Study: Tech Giant's Decline

One of the most notable developments on August 17, 2025, was the decline of a major tech giant. This company, which had been a leader in its industry, saw its shares plummet by over 20% in a single day. Analysts attributed this decline to a combination of factors, including increased competition, regulatory scrutiny, and concerns about the company's long-term growth prospects.

Conclusion: A Day of Volatility

August 17, 2025, was a day of volatility in the US stock market. The Dow Jones Industrial Average plummeted, tech stocks led the decline, and interest rates continued to rise. While it's too early to predict the long-term implications of these developments, investors should be prepared for further market fluctuations and reevaluate their investment strategies accordingly.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....