Introduction: The stock market has always been a reflection of the economic health and political climate of a nation. The presidency of Donald Trump has been no exception, as his policies and decisions have had a significant impact on the US stock market. In this article, we will delve into the various factors that have contributed to the rise and fall of the stock market under Trump's presidency and analyze the implications for investors.

1. Tax Cuts and Economic Growth

One of the most significant actions taken by the Trump administration was the Tax Cuts and Jobs Act of 2017. This act aimed to reduce corporate tax rates from 35% to 21%, which was a historic low. This move was intended to boost economic growth and incentivize companies to invest in the US.

As a result, the stock market responded positively. Companies experienced higher profits due to lower tax liabilities, which translated into higher stock prices. The S&P 500 index, for instance, reached an all-time high during Trump's presidency.

2. Regulatory Rollback

Another factor that contributed to the stock market's growth under Trump was the rollback of regulations. The administration aimed to reduce the burden on businesses by repealing several regulations imposed by previous administrations.

This rollback was particularly beneficial for industries such as banking and healthcare, which saw an increase in mergers and acquisitions. The reduction in regulations allowed companies to focus more on growth and innovation, leading to higher stock prices.

3. Trade Policies

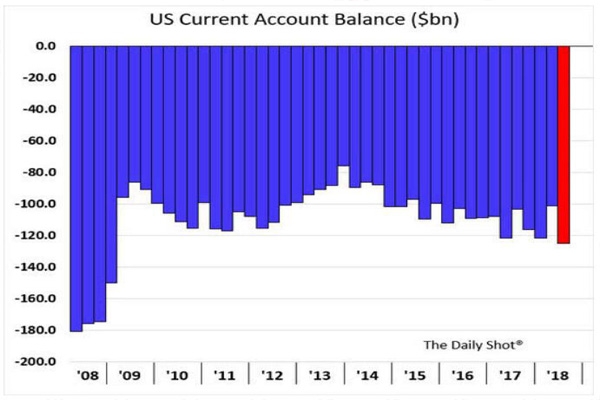

The Trump administration's trade policies, particularly the trade war with China, have been a mixed bag for the stock market. While the initial tariffs on Chinese goods led to increased demand for American-made products, they also caused disruptions in global supply chains and inflationary pressures.

However, the stock market has largely shrugged off these challenges, as investors have been optimistic about the long-term prospects of the US economy. The Trump administration's efforts to renegotiate trade agreements have also provided some level of certainty for investors.

4. Case Studies

One notable case study is the performance of tech companies during Trump's presidency. Despite the president's rhetoric against big tech companies, these companies have continued to thrive. For example, Apple's stock price reached an all-time high during Trump's presidency, as the company benefited from increased demand for its products and services.

Another example is the performance of energy companies. The Trump administration's support for fossil fuels and the rollback of environmental regulations have led to a surge in energy stocks, particularly in the oil and gas sector.

Conclusion:

In conclusion, the Trump administration's policies and decisions have had a significant impact on the US stock market. While some of these policies have contributed to the stock market's growth, others have posed challenges. Investors should remain vigilant and stay informed about the evolving economic and political landscape to make informed decisions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....