In today's interconnected global market, the relationship between the United States and China has a significant impact on the stock market. This article delves into the latest US-China stock news, providing insights into market trends, key developments, and potential opportunities for investors.

US-China Trade Tensions and Stock Market Impact

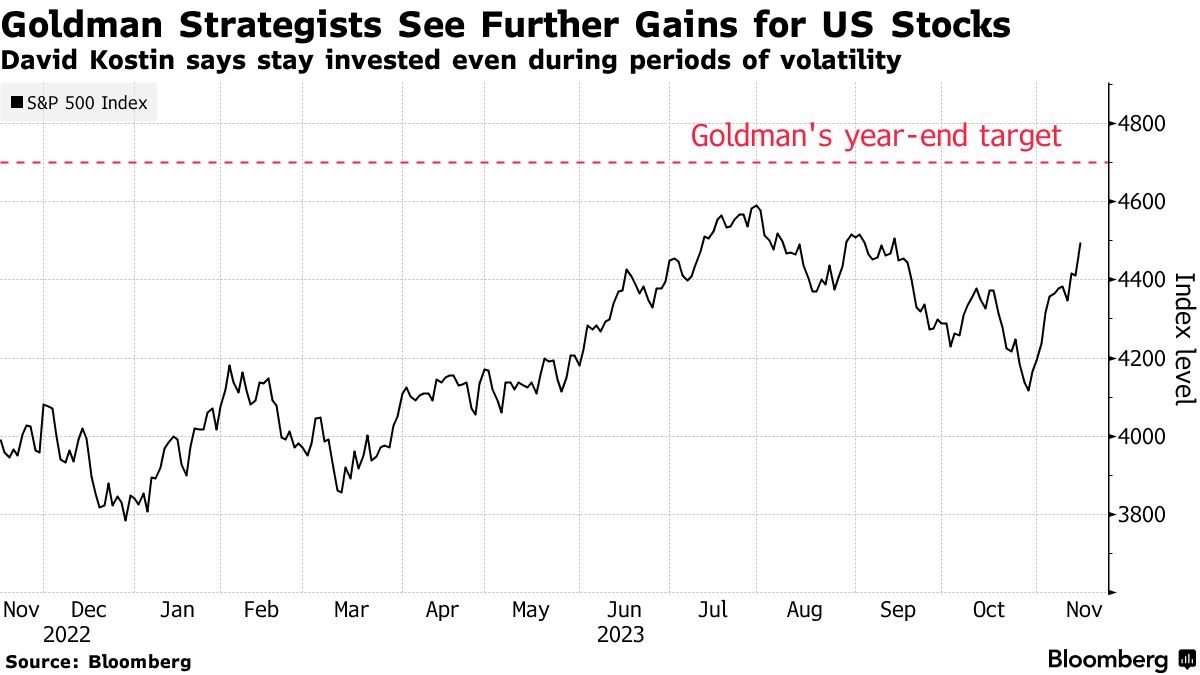

One of the most prominent factors affecting the US-China stock market relationship is trade tensions. Over the past few years, the US and China have been engaged in a trade war, which has had a ripple effect on global markets. Trade tensions have led to uncertainty, causing volatility in the stock market.

For instance, in 2019, when the US imposed tariffs on Chinese goods, the stock market experienced a downturn. However, as trade negotiations progressed, the market recovered. This highlights the importance of keeping an eye on trade news and its impact on the stock market.

Key Stock Market Developments

The US-China stock market relationship is also influenced by various other factors. Here are some key developments:

- Tech Giants: Both the US and China are home to major tech companies, such as Apple, Alibaba, and Tencent. The performance of these companies can significantly impact the stock market. For example, when Apple's earnings report was released, it had a notable impact on the stock market, as it is one of the largest companies in the world.

- Economic Indicators: Economic indicators from both countries, such as GDP growth, inflation rates, and employment data, play a crucial role in shaping the stock market. A strong economic performance in either country can boost investor confidence and drive stock prices higher.

- Regulatory Changes: Regulatory changes in both the US and China can impact the stock market. For instance, the US government's decision to impose restrictions on Huawei had a significant impact on the Chinese stock market.

Investment Opportunities and Risks

Investing in the US-China stock market relationship comes with both opportunities and risks. Here are some key considerations:

- Opportunities: The growing middle class in both countries presents a significant opportunity for companies in various sectors, such as consumer goods, technology, and healthcare.

- Risks: The volatile nature of the US-China relationship and trade tensions can pose risks to investors. It is crucial to stay informed and be prepared for market fluctuations.

Case Study: Alibaba's IPO

One notable example of the US-China stock market relationship is Alibaba's IPO in 2014. The IPO was the largest in US history, raising $21.8 billion. The success of the IPO highlighted the potential of Chinese tech companies in the global market.

Conclusion

The US-China stock market relationship is complex and dynamic. By staying informed about the latest developments and understanding the factors that influence the market, investors can make informed decisions and capitalize on potential opportunities. Whether you are a seasoned investor or just starting out, keeping an eye on US-China stock news is essential for success in the global market.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....