Are you a U.S. citizen looking to sell Canadian stock? If so, you've come to the right place. This comprehensive guide will walk you through the process, helping you understand the nuances and potential tax implications involved. Whether you're a seasoned investor or a beginner, this article will equip you with the knowledge you need to navigate this transaction successfully.

Understanding Canadian Stock

First, let's clarify what we mean by "Canadian stock." It refers to shares of companies listed on the Toronto Stock Exchange (TSX) or the TSX Venture Exchange. These companies are incorporated and operate in Canada, and their shares are traded in Canadian dollars.

The Selling Process

When selling Canadian stock, there are several steps to follow:

Assess Your Holdings: Review your portfolio to identify Canadian stocks you own. This is crucial to determine the potential tax implications.

Understand the Tax Implications: U.S. citizens are required to report all foreign income, including capital gains from the sale of Canadian stock. The tax rate will depend on your overall income and the holding period of the stock.

Calculate Capital Gains: To determine the capital gains, subtract the purchase price from the selling price. If the result is positive, it represents a capital gain.

Report the Sale: File Form 8949 and Schedule D with your U.S. tax return. This will ensure that the IRS is aware of the sale and any associated capital gains.

Pay Taxes: Depending on your tax bracket and the holding period of the stock, you may be subject to capital gains tax. Be sure to factor this into your financial planning.

Key Considerations

Here are some important factors to consider when selling Canadian stock:

- Currency Conversion: Since Canadian stock is denominated in Canadian dollars, you'll need to convert the proceeds back to U.S. dollars when selling. Be aware of exchange rate fluctuations and fees associated with currency conversion.

- Tax Withholding: Canadian brokers are required to withhold taxes on certain distributions paid to U.S. residents. This may affect the amount you receive from the sale.

- Transfer Agents: If you hold Canadian stock through a brokerage firm, you may need to work with a transfer agent to facilitate the sale.

Case Study: John’s Canadian Stock Sale

Let's consider a hypothetical example to illustrate the process. John purchased 100 shares of a Canadian company at

- Calculate Capital Gains: John's capital gain is

1,000 ( 20 per share x 100 shares - $10 per share x 100 shares). - Report the Sale: John would report the sale on Form 8949 and Schedule D.

- Pay Taxes: Assuming John's overall income is within the 15% capital gains tax bracket, he would pay $150 in capital gains tax.

Conclusion

Selling Canadian stock as a U.S. citizen requires careful planning and attention to tax implications. By following the steps outlined in this guide, you can navigate the process successfully and ensure compliance with U.S. tax laws. Remember to consult with a tax professional for personalized advice and assistance.

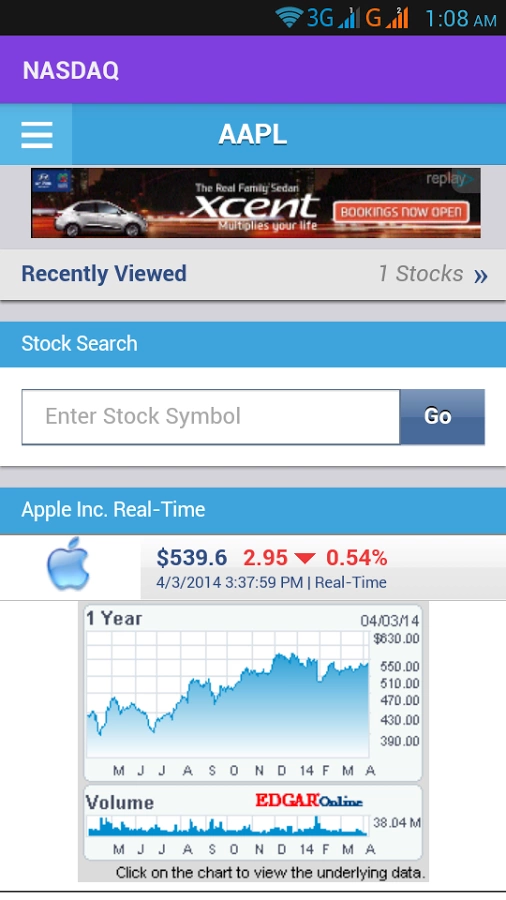

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....