The US election and the stock market have long been closely intertwined. Investors closely monitor political developments, as they can significantly impact the financial markets. This article delves into the relationship between the US election and the stock market, exploring the potential implications of election outcomes on investment strategies.

Understanding the Relationship

The US election can influence the stock market in several ways. First, the election outcome can lead to changes in government policies, which can affect various sectors of the economy. For instance, a Democratic win might lead to increased regulations in certain industries, while a Republican win could result in tax cuts and reduced regulations.

Second, investors often react to election outcomes with heightened volatility. This is because the election can introduce uncertainty about the future economic landscape. For example, if the polls show a tight race, investors might become nervous, leading to increased selling pressure in the stock market.

Historical Examples

Several historical examples illustrate the relationship between the US election and the stock market. For instance, in the 2016 election, the stock market experienced a surge after Donald Trump's victory. This was due to expectations of tax cuts and reduced regulations under a Republican administration.

Similarly, in the 2008 election, the stock market plummeted after Barack Obama's victory. This was because investors were concerned about the potential for increased government spending and regulations under a Democratic administration.

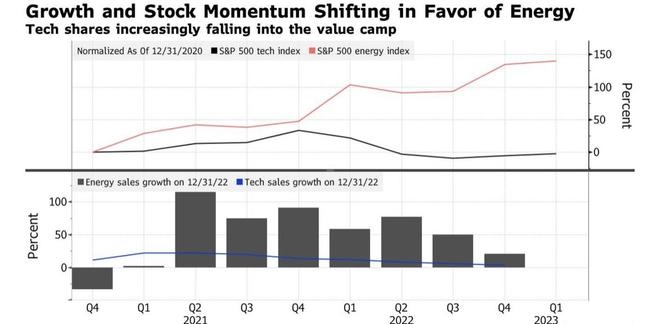

Sector-Specific Implications

The US election can also have sector-specific implications. For example, a win for the Democratic party might benefit industries such as healthcare, renewable energy, and education, while a win for the Republican party might benefit sectors such as energy, finance, and defense.

Investor Strategies

Given the potential impact of the US election on the stock market, investors should consider incorporating election-related factors into their investment strategies. This can include:

- Diversification: Diversifying your portfolio across different sectors and asset classes can help mitigate the risk associated with election outcomes.

- Thematic Investing: Investing in companies that are likely to benefit from specific election outcomes can be a viable strategy. For example, investing in renewable energy companies might be a good bet if a Democratic candidate wins.

- Staying Informed: Keeping up-to-date with election news and developments can help investors make more informed decisions.

Conclusion

The US election and the stock market are inextricably linked. While it is difficult to predict the exact impact of election outcomes on the stock market, understanding the potential implications can help investors make more informed decisions. By diversifying their portfolios, focusing on thematic investments, and staying informed, investors can navigate the complexities of the stock market during election cycles.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....