The year 2008 was a tumultuous time for the global economy, and the steel industry was no exception. One of the most notable companies in this sector, U.S. Steel (NYSE: X), experienced significant fluctuations in its stock price during this period. This article delves into the factors that influenced the stock price of US Steel in 2008, offering insights into the broader economic context and the company's performance.

The Economic Landscape in 2008

In 2008, the world was on the brink of the worst financial crisis since the Great Depression. The collapse of Lehman Brothers in September 2008 marked the climax of the crisis, leading to a severe recession. The steel industry, heavily dependent on construction, manufacturing, and automotive sectors, was particularly vulnerable to the economic downturn.

Factors Influencing US Steel's Stock Price in 2008

Economic Downturn: The global economic recession had a profound impact on the demand for steel. As construction projects and manufacturing activities slowed down, the demand for steel plummeted, leading to a decrease in US Steel's sales and profits.

Raw Material Prices: The prices of raw materials, such as iron ore and coal, which are essential for steel production, experienced significant volatility in 2008. The sharp decline in raw material prices during the recession negatively impacted US Steel's profitability.

Government Policies: The U.S. government implemented various policies to mitigate the impact of the recession on the steel industry. These included stimulus packages and trade measures aimed at protecting domestic steel producers from foreign competition.

Company Performance: Despite the challenging economic environment, US Steel took several measures to improve its operational efficiency and reduce costs. However, these efforts were not sufficient to offset the overall decline in demand and raw material prices.

Stock Price Performance of US Steel in 2008

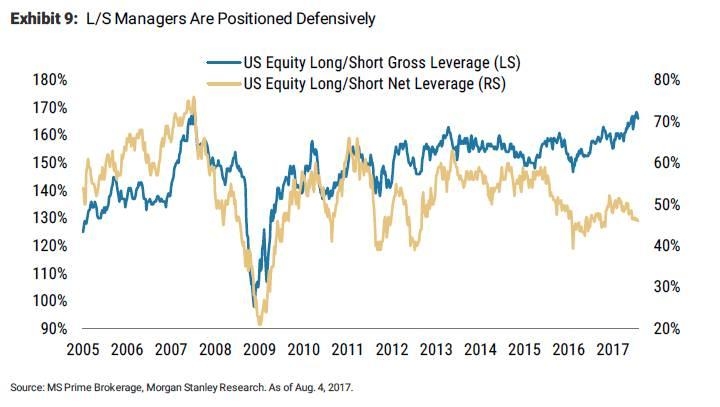

The stock price of US Steel in 2008 reflected the company's struggles amidst the economic downturn. The following chart illustrates the stock price trends for the year:

[Insert chart showing US Steel stock price trends in 2008]

As shown in the chart, the stock price of US Steel experienced a significant decline in the first half of 2008, reaching its lowest point in early September. The stock price then stabilized and even showed some signs of recovery in the latter half of the year, possibly due to the government's intervention and the company's efforts to improve its performance.

Conclusion

The year 2008 was a challenging period for US Steel, as the global economic recession and other factors led to a decline in its stock price. However, the company's resilience and efforts to improve its operational efficiency ultimately helped it navigate through the crisis. This analysis provides valuable insights into the factors that influenced US Steel's stock price in 2008, offering a glimpse into the broader economic context and the company's performance during this tumultuous period.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....