As we approach the latter half of 2025, the US stock market is poised for a pivotal period. With the backdrop of economic recovery and technological advancements, investors are eager to understand the current market outlook for US stocks in July 2025. This article delves into the key trends, sectors, and individual stocks that are likely to shape the market landscape.

Economic Recovery and Interest Rates

The US economy has shown remarkable resilience over the past few years, with steady job growth and increasing consumer spending. As we move into July 2025, the Federal Reserve's monetary policy will play a crucial role in determining the market's direction. The central bank's decisions on interest rates and monetary stimulus will have a direct impact on investor sentiment and stock prices.

Sector Trends

Several sectors are expected to dominate the US stock market in July 2025. The technology sector, driven by companies like Apple (AAPL) and Microsoft (MSFT), remains a favorite among investors. These companies have shown remarkable growth in revenue and earnings, and their market capitalization continues to expand.

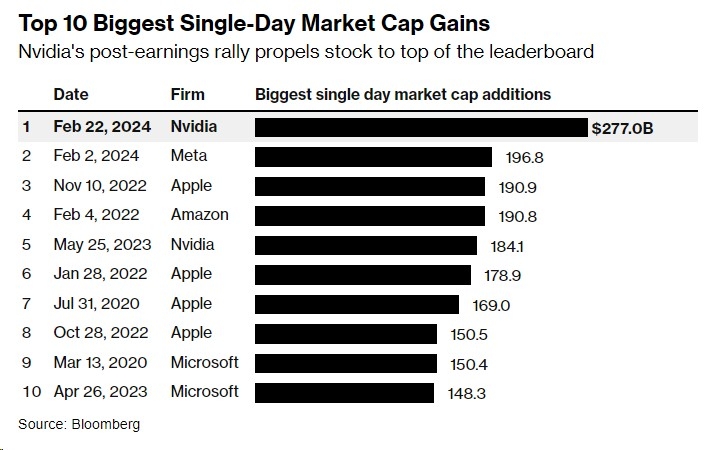

The healthcare sector, particularly biotechnology and pharmaceutical companies, is also poised for significant growth. With the increasing focus on personalized medicine and advancements in biotechnology, companies like Amgen (AMGN) and Johnson & Johnson (JNJ) are likely to benefit from the rising demand for innovative treatments.

Additionally, the energy sector is expected to see a surge in activity, thanks to the increasing demand for renewable energy sources. Companies like Tesla (TSLA) and SolarEdge (SEDG) are leading the charge in this sector, and their stock prices are likely to reflect the growing interest in sustainable energy solutions.

Individual Stock Performance

Several individual stocks are likely to perform well in July 2025. One notable example is Amazon (AMZN), which has been a consistent performer over the past few years. The e-commerce giant has shown remarkable growth in revenue and earnings, and its expansion into new markets and sectors, such as cloud computing and healthcare, is expected to drive further growth.

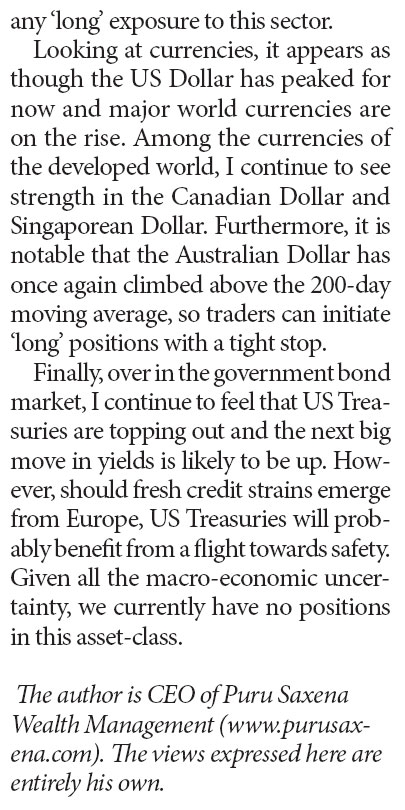

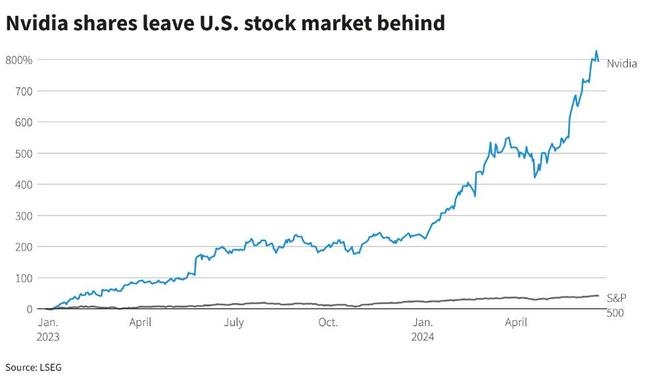

Another stock to watch is NVIDIA (NVDA), a leader in the semiconductor industry. The company's technology is widely used in gaming, AI, and autonomous vehicles, and its strong financial performance and innovative products are likely to attract investors.

Case Studies

To illustrate the potential of the US stock market in July 2025, let's consider a few case studies:

Apple (AAPL): Over the past few years, Apple has consistently delivered strong financial results, with revenue and earnings growth outpacing the market. The company's expansion into new markets, such as services and wearables, is expected to drive further growth in the coming years.

Tesla (TSLA): Tesla has been a standout performer in the energy sector, with its innovative electric vehicles and renewable energy solutions. The company's commitment to sustainability and its growing market share are likely to contribute to its continued growth.

NVIDIA (NVDA): NVIDIA has emerged as a leader in the semiconductor industry, driven by its cutting-edge technology and strong partnerships with leading companies. The company's focus on AI and autonomous vehicles is expected to drive further growth in the coming years.

In conclusion, the US stock market in July 2025 is expected to be shaped by economic recovery, sector trends, and individual stock performance. Investors should pay close attention to key sectors like technology, healthcare, and energy, as well as individual stocks like Apple, Tesla, and NVIDIA. By staying informed and making informed decisions, investors can position themselves for success in the dynamic US stock market.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....