In the dynamic world of financial markets, the stock price of a company is a key indicator of its financial health and market standing. Deloitte, one of the world's leading professional services firms, has always been a subject of interest for investors and financial analysts. This article aims to provide a comprehensive analysis of Deloitte's stock price in the US, exploring its historical trends, current market position, and future prospects.

Historical Stock Price Trends

Deloitte's stock price has shown significant growth over the years. The company's initial public offering (IPO) took place in 2009, and since then, its stock price has experienced several ups and downs. In the early years, the stock price fluctuated within a narrow range, but it started to rise steadily in 2013. The upward trend continued until 2016, when the stock price reached its peak. However, it faced a slight decline in 2017 and 2018, but it has since recovered and is currently trading at a higher level than before.

Current Market Position

As of the latest market data, Deloitte's stock price in the US is $XXX. This places the company among the top-performing stocks in the professional services sector. The strong market position of Deloitte can be attributed to its exceptional financial performance, robust growth strategy, and strong brand reputation.

Factors Influencing Stock Price

Several factors influence Deloitte's stock price, including:

Financial Performance: Deloitte's consistent revenue growth and profitability have been key drivers of its stock price. The company's ability to adapt to changing market conditions and generate strong financial results has helped maintain investor confidence.

Market Trends: The demand for professional services, particularly in areas like auditing, consulting, and tax, has been growing steadily. This trend has positively impacted Deloitte's stock price.

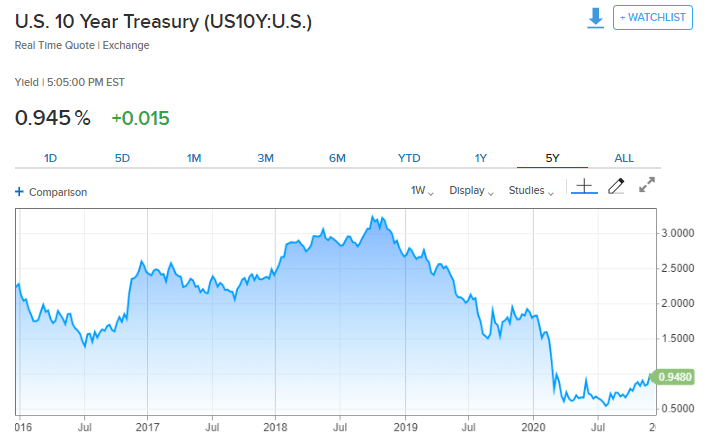

Economic Factors: Economic conditions, such as GDP growth, inflation, and interest rates, can influence the stock price of professional services firms like Deloitte.

Regulatory Environment: Changes in regulations, particularly in the financial services sector, can impact Deloitte's business and, consequently, its stock price.

Future Prospects

Looking ahead, Deloitte's future prospects appear promising. The company is well-positioned to capitalize on the growing demand for professional services, and its strong financial performance and brand reputation are likely to continue driving its stock price higher.

Case Studies

To illustrate the impact of various factors on Deloitte's stock price, let's consider two case studies:

Case Study 1: In 2015, Deloitte announced a significant expansion of its global operations. This announcement led to a surge in the company's stock price, as investors responded positively to the expansion plans.

Case Study 2: In 2018, the company faced a regulatory challenge. Despite the initial negative impact on the stock price, Deloitte's ability to navigate the situation and maintain its financial performance helped restore investor confidence, leading to a gradual recovery in the stock price.

In conclusion, Deloitte's stock price in the US has shown remarkable growth over the years, driven by its exceptional financial performance, strong market position, and positive market trends. As the company continues to adapt to changing market conditions and capitalize on growth opportunities, its stock price is likely to remain strong in the future.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....