In the fast-paced world of finance, understanding stock market prices is crucial for investors and traders alike. The stock market is a complex ecosystem where the value of shares is constantly fluctuating. This article delves into the intricacies of stock market prices, providing insights into how they are determined and what factors influence them.

What Are Stock Market Prices?

Stock market prices represent the value of a company's shares on a given day. These prices are influenced by a multitude of factors, including the company's financial performance, market sentiment, and broader economic conditions. When you buy or sell stocks, you're essentially trading pieces of a company, and the price you pay or receive is determined by the market's perception of the company's worth.

Determining Stock Market Prices

The primary determinant of stock market prices is the supply and demand for a particular stock. If there is more demand for a stock than there is supply, the price tends to rise. Conversely, if there is more supply than demand, the price tends to fall. This dynamic is influenced by several factors:

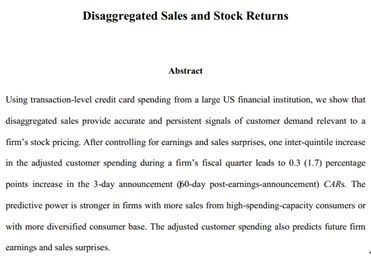

- Company Performance: Strong financial results, such as high revenue and profits, can drive up stock prices. Conversely, poor performance can lead to a decline in prices.

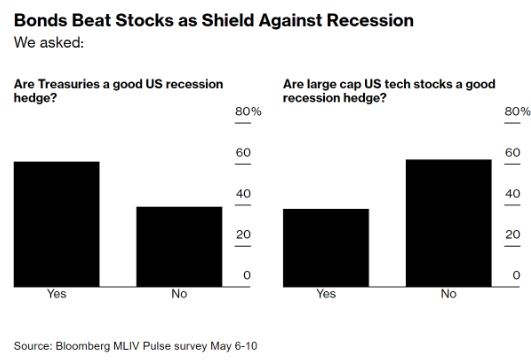

- Market Sentiment: The overall mood of the market can have a significant impact on stock prices. Positive news, such as a strong economic report or a successful product launch, can boost investor confidence and drive up prices. Negative news, such as a company scandal or a global economic crisis, can have the opposite effect.

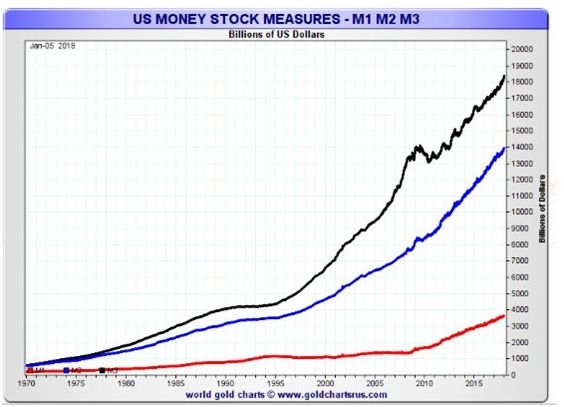

- Economic Conditions: The broader economic environment, including interest rates, inflation, and employment data, can influence stock market prices. For example, higher interest rates can make borrowing more expensive for companies, which can lead to lower stock prices.

Understanding Market Trends

One of the key skills in navigating the stock market is understanding market trends. This involves analyzing historical data and identifying patterns that can help predict future price movements. Here are a few common market trends:

- Trending Up: When a stock's price is consistently rising over a period of time, it's considered to be in an uptrend. This trend can be driven by strong company performance or positive market sentiment.

- Trending Down: Conversely, when a stock's price is consistently falling over a period of time, it's considered to be in a downtrend. This trend can be driven by poor company performance or negative market sentiment.

- Sideways: When a stock's price is moving within a relatively narrow range, it's considered to be in a sideways trend. This trend can be driven by uncertainty or indecision in the market.

Case Study: Apple Inc.

To illustrate how stock market prices are influenced by various factors, let's consider the case of Apple Inc. (AAPL). In the past few years, Apple has been a strong performer, driven by its innovative products and strong financial results. However, the stock has also experienced significant volatility, reflecting broader market trends and economic conditions.

For example, during the COVID-19 pandemic, Apple's stock price surged as demand for its products increased. However, as the market recovered from the pandemic, the stock price experienced some volatility, reflecting uncertainty about the future economic outlook.

Conclusion

Understanding stock market prices is essential for anyone looking to invest or trade in the stock market. By analyzing various factors, including company performance, market sentiment, and economic conditions, investors can gain valuable insights into how stock prices are determined. By staying informed and adapting to market trends, investors can make more informed decisions and potentially achieve greater success in the stock market.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....