The S&P 500, a widely followed stock market index, has been a significant indicator of the U.S. stock market's performance over the past decade. This article delves into the S&P 500's journey over the last 10 years, examining its growth, volatility, and key trends.

Growth and Performance

Over the past 10 years, the S&P 500 has experienced significant growth, with the index soaring from around 1,800 points in 2012 to over 4,800 points by the end of 2021. This represents a compound annual growth rate (CAGR) of approximately 11.5%. The robust performance can be attributed to various factors, including strong economic growth, low interest rates, and favorable corporate earnings.

Volatility and Market Corrections

Despite the overall upward trend, the S&P 500 has experienced periods of volatility and market corrections. For instance, the index faced significant challenges during the global financial crisis of 2008, plummeting from over 1,500 points to around 676 points in March 2009. Similarly, in 2020, the index saw a sharp decline due to the COVID-19 pandemic, but it quickly recovered and reached new highs by the end of the year.

Key Trends

Several key trends have shaped the S&P 500's performance over the last 10 years:

- Technology Sector: The technology sector has been a major driver of the S&P 500's growth, with companies like Apple, Microsoft, and Amazon leading the charge. The rise of cloud computing, artificial intelligence, and e-commerce has propelled these companies to new heights.

- Dividend Payouts: The S&P 500 has seen a steady increase in dividend payouts over the past decade, providing investors with a steady stream of income.

- Inflation and Interest Rates: The U.S. economy has experienced relatively low inflation and interest rates, which have supported stock market growth.

Case Studies

Several case studies highlight the S&P 500's performance over the last 10 years:

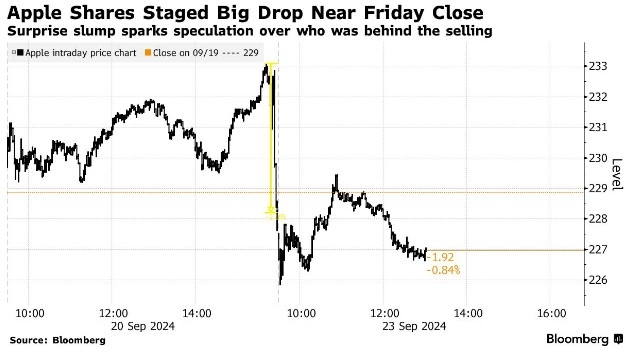

- Apple: Apple's stock has surged over the past decade, with the company becoming the world's most valuable publicly traded company. The company's success can be attributed to its innovative products, strong brand, and aggressive expansion into new markets.

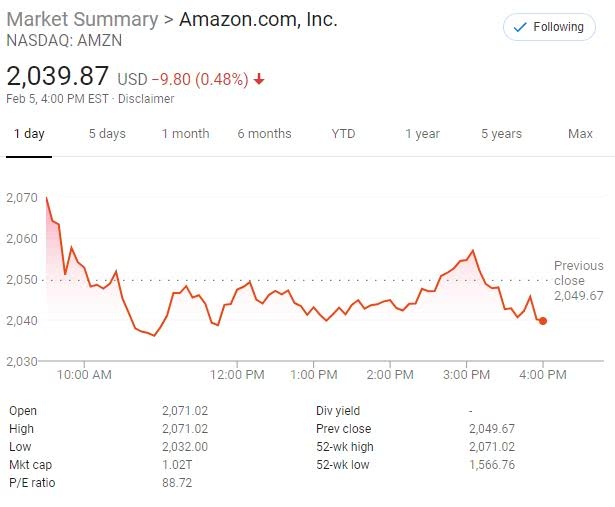

- Amazon: Amazon has become a dominant force in the retail industry, with its e-commerce platform revolutionizing the way consumers shop. The company's investment in cloud computing and logistics has further bolstered its position in the market.

Conclusion

The S&P 500's performance over the last 10 years has been impressive, with significant growth and innovation driving the index's upward trajectory. While the market has experienced periods of volatility, the overall trend has been positive. Investors looking to gain exposure to the U.S. stock market should consider including the S&P 500 in their portfolio.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....