In the ever-evolving world of financial markets, share trading US has emerged as a powerful tool for investors looking to capitalize on market fluctuations. This guide delves into the nuances of share trading in the United States, providing valuable insights and strategies to help you navigate this dynamic landscape successfully.

Understanding Share Trading US

Before diving into the intricacies of share trading in the US, it's essential to understand what it entails. Share trading refers to the buying and selling of shares of publicly traded companies. This is typically done on stock exchanges like the New York Stock Exchange (NYSE) or the NASDAQ.

The US Stock Market Landscape

The US stock market is one of the largest and most diverse in the world. It's home to some of the most influential companies, including tech giants like Apple, Google, and Microsoft, as well as established corporations across various industries. This diversity provides investors with a wide array of options for share trading US.

Choosing a Broker

The first step in your share trading journey is to choose a reputable broker. A broker acts as an intermediary between you and the stock exchange, facilitating the buying and selling of shares. When selecting a broker, consider factors such as fees, trading platform, customer service, and the range of services offered.

Top Strategies for Share Trading US

Long-term Investing: This strategy involves buying shares and holding them for the long term, allowing your investments to grow over time. This approach is suitable for investors with a long-term perspective and a low risk tolerance.

Day Trading: Day trading involves buying and selling shares within the same trading day. This high-octane strategy requires quick decision-making and a thorough understanding of market trends.

Dividend Investing: This strategy focuses on investing in companies that consistently pay dividends. Dividends provide investors with regular income and can be a stable source of returns.

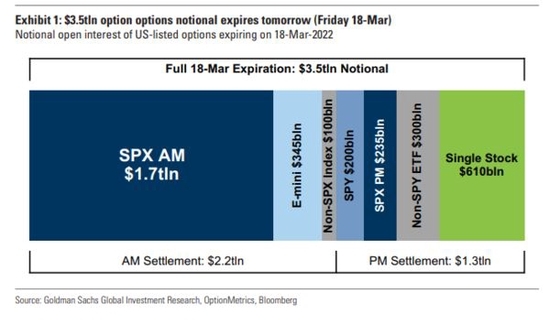

Options Trading: Options trading involves trading contracts that give the buyer the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specified time frame. This strategy can be used to hedge risks or speculate on market movements.

Case Studies: Share Trading US Success Stories

Facebook (FB): Many investors made substantial profits by investing in Facebook shares after its initial public offering (IPO). Those who bought and held the shares for several years have seen significant gains.

Tesla (TSLA): Tesla has been a popular choice for investors due to its disruptive technology and strong growth prospects. Those who invested in Tesla's shares early on have experienced substantial returns.

Conclusion

Share trading US can be a lucrative venture for those who approach it with knowledge and strategy. By understanding the market, selecting the right broker, and adopting a suitable trading strategy, you can increase your chances of success. Whether you're a seasoned investor or just starting out, this guide provides the foundation you need to embark on your share trading journey.

us stock market today

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....