In the world of stock markets, insider trading stands as a topic of significant concern. This article delves into the ins and outs of US stock insider trading, examining its legal implications, the risks involved, and real-life cases that have shaped public perception.

What is Insider Trading?

Insider trading refers to the practice of trading stocks or other securities based on material, non-public information. In the United States, the Securities and Exchange Commission (SEC) enforces strict regulations against insider trading to maintain fair and transparent markets.

Legal Implications

Insider trading is illegal under both federal and state laws. Individuals caught engaging in such practices face severe penalties, including fines, imprisonment, and the loss of their professional licenses.

The Risks Involved

Engaging in insider trading is not just illegal; it also poses significant risks. The potential for severe legal consequences is a major deterrent. Additionally, the moral and ethical implications of exploiting non-public information to gain an unfair advantage in the market are profound.

Real-Life Cases

Several high-profile cases of insider trading have shed light on the practice. One notable case is that of Raj Rajaratnam, who was sentenced to 11 years in prison for his role in a massive insider trading scheme. His case highlighted the sophisticated methods used by insider traders and the need for strict enforcement of the laws.

Another prominent case is that of Michael Milken, often referred to as "the junk bond king." He was convicted of insider trading and other securities fraud charges in the 1980s and served 22 months in prison.

The SEC's Role

The SEC plays a crucial role in detecting and investigating insider trading cases. The agency uses advanced technologies and data analytics to identify patterns that may indicate illegal activities. The SEC also collaborates with other regulatory bodies and law enforcement agencies to combat insider trading.

Conclusion

US stock insider trading is a serious issue that threatens the integrity of the financial markets. The illegal practices and the severe penalties involved serve as a reminder of the importance of maintaining fair and transparent markets. The cases mentioned above underscore the need for continued vigilance and strict enforcement to protect investors and the market as a whole.

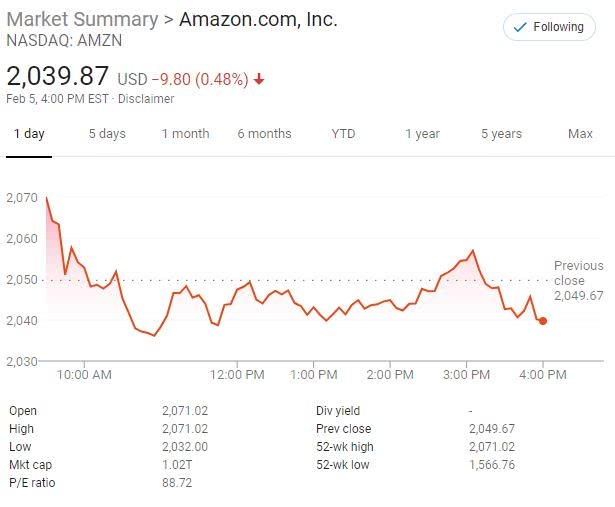

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....