In today's dynamic real estate market, investing in US real estate stocks can be a lucrative venture. One of the most notable players in this sector is Equity Residential. This article delves into the details of Equity Residential US real estate stocks, providing investors with a comprehensive guide to understand their potential and risks.

Understanding Equity Residential

Equity Residential is one of the largest publicly traded real estate investment trusts (REITs) in the United States. The company owns, manages, and develops high-quality apartment properties across the country. With a diversified portfolio, Equity Residential offers investors exposure to various geographic markets and property types.

Why Invest in Equity Residential US Real Estate Stocks?

1. Strong Market Position: Equity Residential has a strong market position in the US real estate sector. The company's extensive portfolio includes over 180,000 apartment homes, making it one of the largest REITs in the country. This robust market presence allows Equity Residential to capitalize on market trends and generate consistent returns for investors.

2. Diversified Portfolio: Equity Residential's diversified portfolio spans various geographic markets and property types. This approach helps mitigate risks associated with market fluctuations in any particular region or property type. Investors can benefit from a well-diversified investment that offers exposure to different market dynamics.

3. Consistent Dividends: Equity Residential has a long history of paying consistent dividends to its shareholders. The company's commitment to generating stable cash flows for investors makes it an attractive option for income-seeking investors.

4. Strong Financial Performance: Equity Residential has demonstrated strong financial performance over the years. The company's revenue and net income have shown consistent growth, making it a reliable investment choice for long-term investors.

Analyzing Equity Residential US Real Estate Stocks

To better understand the potential of Equity Residential US real estate stocks, let's look at a few key metrics:

1. Price-to-Earnings (P/E) Ratio: The P/E ratio is a valuation metric that compares the company's stock price to its earnings per share (EPS). A lower P/E ratio indicates that the stock may be undervalued. As of the latest data, Equity Residential's P/E ratio is in line with its peers, suggesting a fair valuation.

2. Dividend Yield: The dividend yield is a measure of the annual dividends paid by the company relative to its stock price. Equity Residential offers a dividend yield of around 3.5%, which is competitive compared to other REITs in the market.

3. Return on Equity (ROE): ROE measures the profitability of a company relative to its shareholders' equity. Equity Residential has a ROE of around 14%, indicating a healthy return on investment for shareholders.

Conclusion

Investing in Equity Residential US real estate stocks can be a wise decision for investors looking to gain exposure to the US real estate market. With a strong market position, diversified portfolio, consistent dividends, and strong financial performance, Equity Residential offers a compelling investment opportunity. However, as with any investment, it's crucial to conduct thorough research and consider individual investment goals and risk tolerance before making any investment decisions.

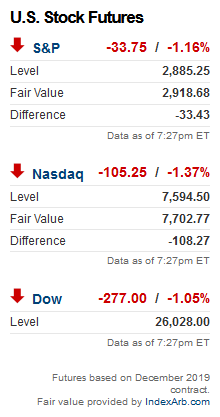

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....