In recent years, the imposition of tariffs by the United States has become a significant factor influencing global stock markets. This article delves into the impact of these tariffs on various economies and the potential consequences for investors worldwide.

Understanding the Tariffs

Tariffs are essentially taxes imposed on imported goods and services. The U.S. government has levied tariffs on several countries, including China, Mexico, and the European Union, among others. These tariffs are aimed at protecting domestic industries and correcting trade imbalances.

Impact on Stock Markets

The introduction of tariffs has had a profound impact on global stock markets. Here are some key areas where tariffs have made their mark:

1. Stock Market Volatility

One of the most immediate effects of tariffs has been increased stock market volatility. When tariffs are imposed, investors often experience uncertainty about the future of global trade and economic growth. This uncertainty leads to volatile trading conditions, as investors react to the latest news and announcements.

2. Sector-Specific Impacts

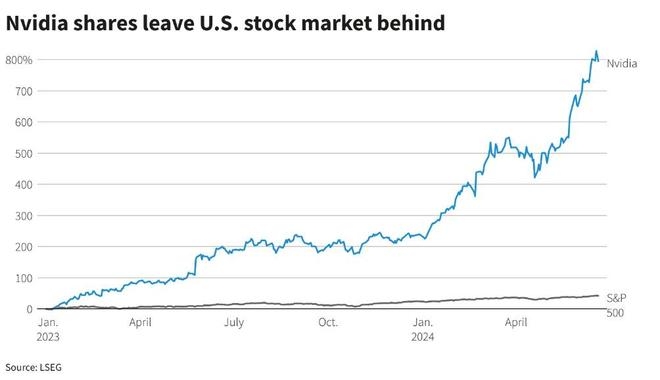

Certain sectors have been more affected by tariffs than others. Industries such as agriculture, manufacturing, and technology have seen significant fluctuations in their stock prices due to the imposition of tariffs. For example, the U.S. tariffs on steel and aluminum have had a direct impact on the steel industry, leading to increased prices and reduced demand for steel products.

3. Geopolitical Concerns

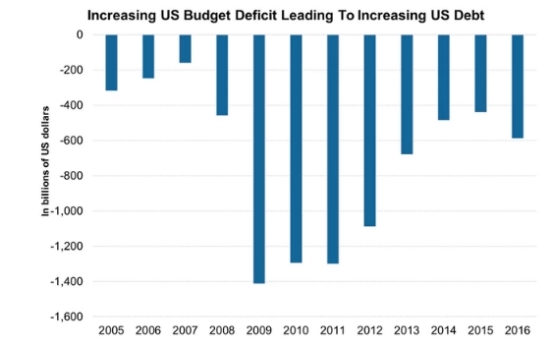

The imposition of tariffs has also raised geopolitical concerns among investors. As tensions between the U.S. and other countries escalate, investors are increasingly wary of the potential for broader trade wars and their impact on the global economy.

Case Studies

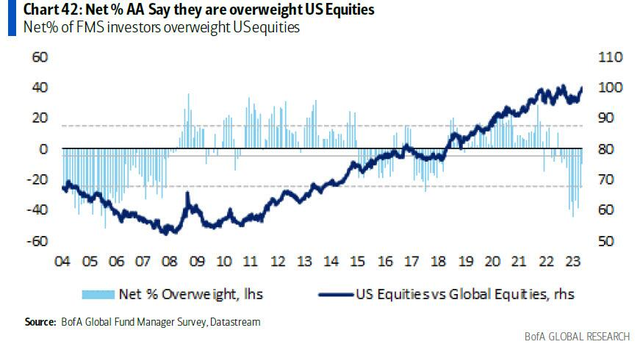

1. The Impact of Tariffs on the U.S. Stock Market

When the U.S. imposed tariffs on China in 2018, the S&P 500 experienced significant volatility. The tech sector, which is heavily reliant on trade with China, saw some of the most dramatic declines. Companies like Apple and Microsoft, which generate a significant portion of their revenue from China, experienced significant stock price fluctuations.

2. The Impact of Tariffs on the Chinese Stock Market

Similarly, the Chinese stock market has been affected by the U.S. tariffs. The Shanghai Composite Index experienced a sharp decline following the imposition of tariffs, as investors were concerned about the impact on the Chinese economy and the potential for a broader trade war.

Conclusion

The impact of U.S. tariffs on global stock markets has been significant. While some sectors have been more affected than others, the overall effect has been increased volatility and uncertainty. As the global economy continues to navigate the complexities of trade relations, investors must remain vigilant and adapt to the evolving landscape.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....