In recent years, there has been a significant increase in Indian investors looking to diversify their portfolios by investing in the US stock market. This trend is driven by various factors, including economic growth in India, the allure of higher returns, and the stability offered by the US market. This article delves into the reasons behind this growing trend and explores the potential benefits and risks for Indian investors.

Economic Growth in India

India has been experiencing robust economic growth in recent years, which has led to an increase in disposable income for its citizens. As a result, more individuals are looking for investment opportunities to grow their wealth. The US stock market, with its diverse range of companies and sectors, has emerged as an attractive destination for Indian investors.

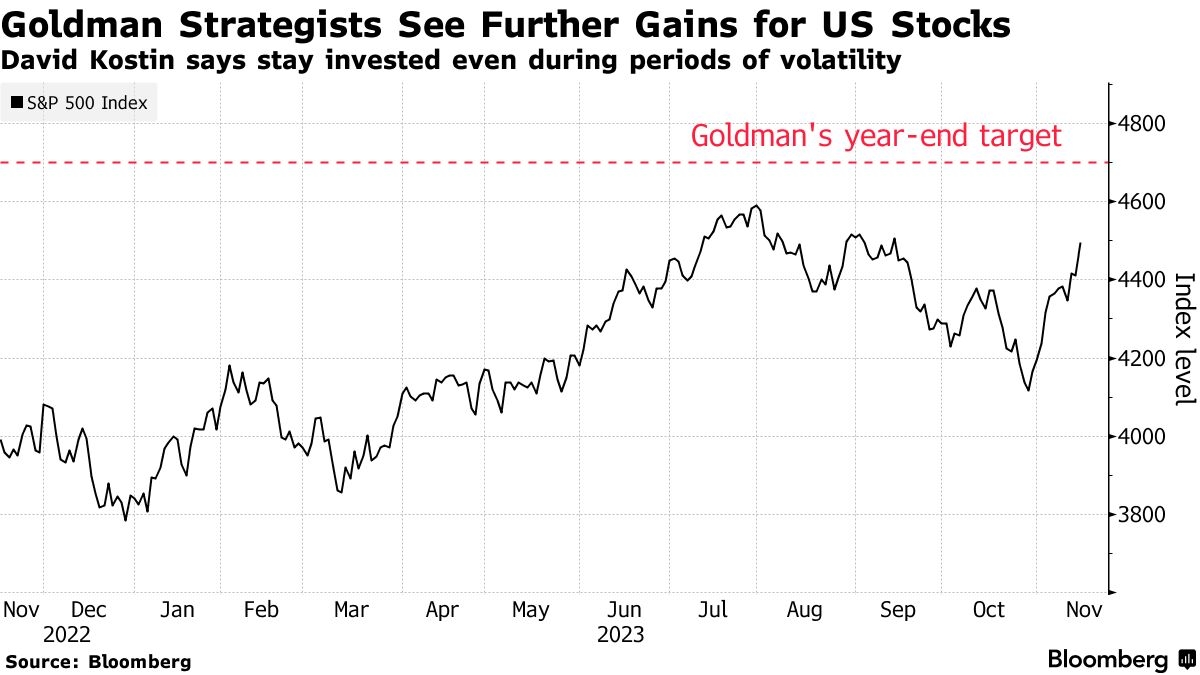

Higher Returns

The US stock market has historically offered higher returns compared to the Indian market. This is due to several factors, including higher growth rates, technological advancements, and a more mature market structure. Indian investors are attracted to the potential for higher returns and are increasingly investing in US stocks to capitalize on this opportunity.

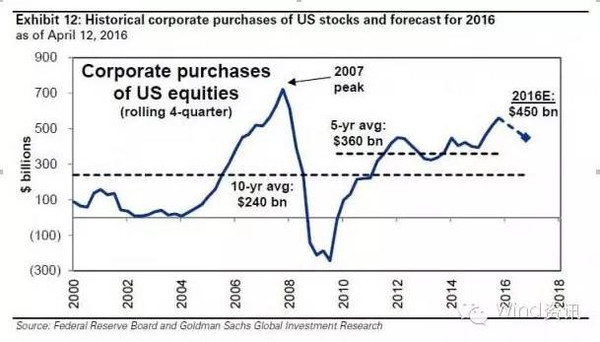

Stability and Diversification

The US stock market is known for its stability and resilience. This makes it an ideal investment destination for Indian investors looking to diversify their portfolios and reduce risk. By investing in US stocks, Indian investors can gain exposure to a wide range of sectors and industries, which can help mitigate the risks associated with investing solely in the Indian market.

Investment Platforms and Tools

The ease of accessing the US stock market has also contributed to the growing trend of Indian investors investing in US stocks. There are several online platforms and tools available that make it simple for Indian investors to buy and sell US stocks. These platforms offer a range of features, including real-time market data, research tools, and educational resources, which make it easier for investors to make informed decisions.

Case Studies

One notable example is the Indian tech giant, Infosys, which has been investing in US stocks for several years. The company has diversified its investment portfolio by purchasing shares of various US companies, including Apple, Microsoft, and Amazon. This strategy has helped Infosys reduce its exposure to the Indian market and capitalize on the growth potential of the US market.

Another example is the Indian investor, Mr. Gupta, who recently invested in US stocks through a brokerage platform. He has been able to monitor his investments in real-time and access a wealth of information and resources to help him make informed decisions.

Conclusion

Investing in the US stock market is becoming an increasingly popular choice for Indian investors. The allure of higher returns, stability, and diversification makes it an attractive option for those looking to grow their wealth. However, it is important for investors to conduct thorough research and understand the risks associated with investing in the US market before making any investment decisions.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....