Are you considering investing in US stocks but unsure whether it's the right time? The stock market can be unpredictable, and making an informed decision is crucial. In this article, we'll discuss the factors you should consider before deciding to buy US stocks. We'll also look at some historical trends and expert opinions to help you make an informed decision.

Understanding the Current Market

The stock market is influenced by a variety of factors, including economic indicators, political events, and corporate earnings. It's essential to understand the current market conditions before making any investment decisions.

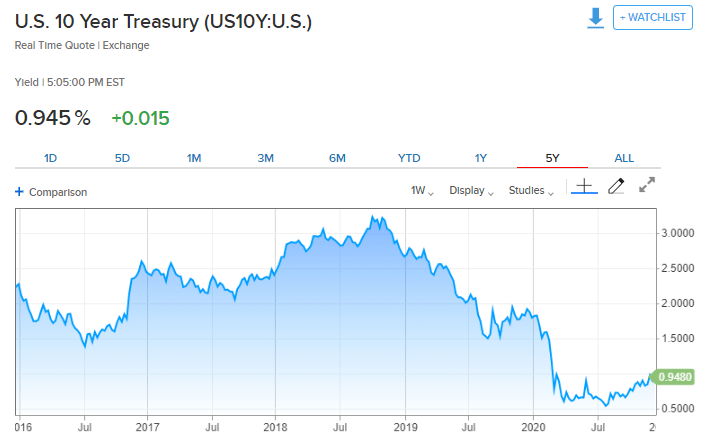

As of now, the US stock market is facing challenges such as inflation, rising interest rates, and geopolitical tensions. However, it's also important to note that the stock market has historically been a long-term investment vehicle that has outperformed other investment options like bonds and cash.

Economic Indicators

Economic indicators provide insights into the health of the economy. Some key indicators to consider include:

- GDP Growth: A growing GDP indicates a strong economy, which can be beneficial for stocks.

- Unemployment Rate: A low unemployment rate suggests a healthy job market, which can lead to increased consumer spending and corporate profits.

- Inflation: High inflation can erode purchasing power and negatively impact stocks.

According to recent data, the US economy has shown moderate growth, with a low unemployment rate and moderate inflation. This suggests that the current market conditions may be favorable for investing in US stocks.

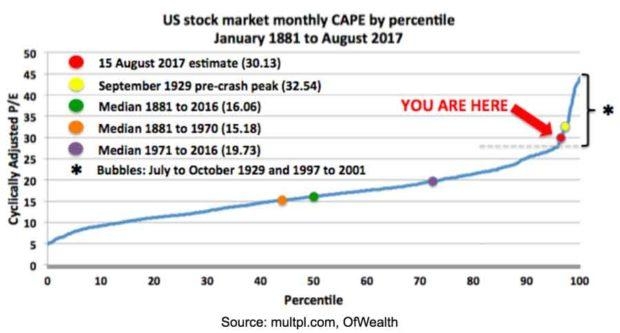

Historical Trends

Historical trends can provide valuable insights into the stock market's behavior. Over the past few decades, the US stock market has experienced several bull and bear markets. Here's a brief overview:

- Bull Market: A period of rising stock prices. The US stock market has experienced several bull markets over the past few decades, with the most recent one starting in 2009 and continuing until 2020.

- Bear Market: A period of falling stock prices. The most recent bear market began in February 2020 and ended in March 2021.

It's important to note that bear markets are a natural part of the stock market cycle. Investors who stay invested through these periods often come out ahead in the long run.

Expert Opinions

Several experts have shared their opinions on whether it's a good time to buy US stocks:

- Jim Cramer: The renowned investor and host of "Mad Money" on CNBC suggests that investors should focus on high-quality companies with strong fundamentals and long-term growth potential.

- Ray Dalio: The founder of Bridgewater Associates, one of the world's largest hedge funds, believes that US stocks are still a good investment option, especially if you're a long-term investor.

Case Studies

Several companies have thrived in the current market conditions, including:

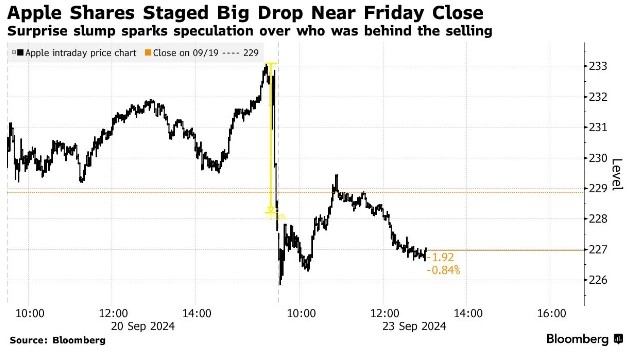

- Apple: The tech giant has continued to grow its revenue and earnings, making it a popular investment choice.

- Amazon: The e-commerce giant has seen significant growth in its cloud computing division, which has helped offset the decline in online sales.

- Microsoft: The software giant has expanded its cloud computing business and continues to innovate, making it a stable investment option.

Conclusion

Deciding whether to buy US stocks now depends on your investment goals, risk tolerance, and market conditions. By considering economic indicators, historical trends, and expert opinions, you can make an informed decision. Remember, investing in the stock market involves risks, so it's essential to do your research and consult with a financial advisor before making any investment decisions.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....