In today's fast-paced stock market, staying ahead of the curve is crucial. For investors looking to gain insights into the semiconductor industry, one company stands out: Taiwan Semiconductor Manufacturing Company (TSMC). With its impressive track record and significant market share, TSMC's stock performance is a key indicator for investors. This article delves into the TSMC US stock price chart, offering a comprehensive analysis and valuable insights for those interested in this semiconductor giant.

Understanding TSMC's Stock Performance

To understand TSMC's stock performance, it's essential to analyze the TSMC US stock price chart. Over the years, this chart has shown several trends and patterns that can help investors make informed decisions. Below are some key aspects to consider when examining the TSMC US stock price chart.

Historical Stock Performance

The TSMC US stock price chart reveals a strong upward trend over the past decade. From a low of around

Market Trends and Influences

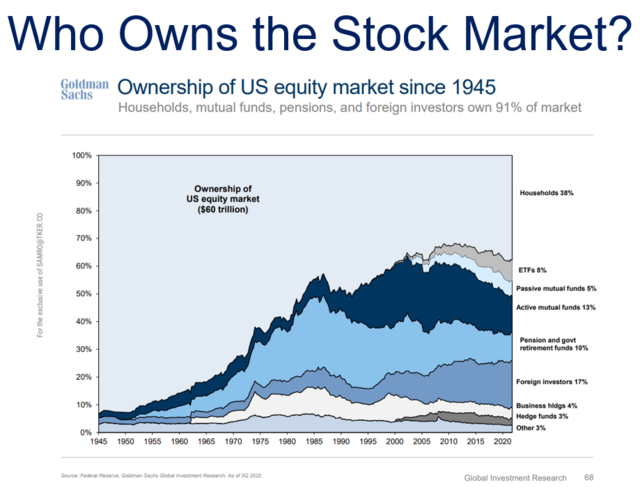

Several factors influence the TSMC US stock price. One of the primary drivers is the demand for semiconductors, particularly in the smartphone, automotive, and cloud computing sectors. As these industries grow, TSMC's market share and profitability increase, positively impacting its stock price.

Moreover, geopolitical tensions and trade wars between the United States and China have also played a role in shaping TSMC's stock performance. With TSMC being a significant supplier to U.S. companies, any disruptions in trade can impact its stock price.

Dividend Yield and Financial Health

Another important aspect of TSMC's stock is its dividend yield. Over the years, TSMC has consistently increased its dividend, making it an attractive investment for income-focused investors. Additionally, TSMC's financial health, with strong revenue growth and profitability, adds to its appeal as a long-term investment.

Analyzing the TSMC US Stock Price Chart

To analyze the TSMC US stock price chart, investors should consider the following metrics:

- Volume: Examining trading volume can help identify periods of high interest in the stock, indicating potential buying or selling pressure.

- Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can provide insights into the stock's trend over different time frames.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements, helping to identify overbought or oversold conditions.

Case Study: TSMC's Stock Performance During the COVID-19 Pandemic

One notable case study in TSMC's stock performance is during the COVID-19 pandemic. As the world grappled with the virus, there was a surge in demand for electronic devices, leading to increased demand for semiconductors. TSMC, being a major player in the industry, saw a significant boost in its stock price during this period.

Despite the challenges posed by the pandemic, TSMC managed to maintain its market share and profitability. This resilience is a testament to the company's strong fundamentals and ability to adapt to changing market conditions.

Conclusion

The TSMC US stock price chart offers valuable insights into the semiconductor giant's performance and potential future growth. By analyzing historical trends, market influences, and financial metrics, investors can make informed decisions regarding their investments in TSMC. As the semiconductor industry continues to grow, TSMC remains a key player to watch, and its stock price chart is a valuable tool for investors seeking to stay ahead in this dynamic market.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....