In the vast landscape of the United States, the stock market is a cornerstone of the nation's economic health. It's a marketplace where businesses can raise capital, and investors can potentially earn significant returns. The term "total stocks in US" refers to the aggregate number of stocks listed on various American stock exchanges. Understanding this number can provide valuable insights into the market's size, activity, and potential opportunities.

The Size of the US Stock Market

As of 2023, the total market capitalization of the US stock market exceeds $40 trillion. This is a remarkable figure, reflecting the sheer scale of investment opportunities available to investors. The S&P 500, which is a widely followed index representing the 500 largest companies in the United States, is a significant part of this total. It currently accounts for approximately 20% of the US stock market's total value.

Key Exchanges and Market Indices

The total stocks in the US are primarily traded on three major exchanges: the New York Stock Exchange (NYSE), the NASDAQ, and the American Stock Exchange (AMEX). The NYSE, established in 1792, is the oldest and largest stock exchange in the United States. It lists a diverse range of companies, from financial institutions to consumer goods companies.

The NASDAQ, on the other hand, is known for its tech-heavy composition and was established in 1971. It lists numerous high-tech companies, including many of the world's largest and most innovative firms. The AMEX, which is part of the NYSE, lists smaller companies that may not qualify for listing on the NYSE or NASDAQ.

Several key market indices track the performance of the total stocks in the US. The S&P 500, as mentioned earlier, is one of the most widely followed indices. Others include the Dow Jones Industrial Average, the NASDAQ Composite, and the Russell 3000.

Understanding Market Activity

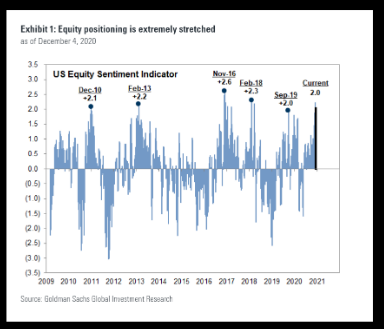

The total stocks in the US are not just a number; they represent the market's activity and investor sentiment. When the number of stocks rises, it often indicates that investors are optimistic about the market's prospects. Conversely, a decline in the total number of stocks might suggest investor caution or concern.

Potential Opportunities and Risks

Investing in the total stocks in the US can offer numerous opportunities. However, it's crucial to understand the associated risks. The stock market can be volatile, and the value of investments can fluctuate widely. It's essential for investors to conduct thorough research, diversify their portfolios, and consider their risk tolerance before investing.

Case Study: Tesla's Impact on the US Stock Market

One notable example of a company's impact on the US stock market is Tesla, an electric vehicle and clean energy company. Since going public in 2010, Tesla has become one of the most valuable companies in the world. Its inclusion in the S&P 500 index has had a significant impact on the index's performance, showcasing how individual companies can influence the broader market.

Conclusion

The term "total stocks in US" refers to the aggregate number of stocks listed on American stock exchanges. Understanding this number can provide valuable insights into the market's size, activity, and potential opportunities. Whether you're a seasoned investor or just starting out, understanding the US stock market is essential for making informed investment decisions.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....