The markets have experienced a tumultuous period recently, marked by volatility and uncertainty. However, U.S. and European stocks have managed to stage a remarkable rally following these turbulent times. This article delves into the factors contributing to this rally and analyzes how investors can capitalize on this trend.

Market Turmoil and Its Impact

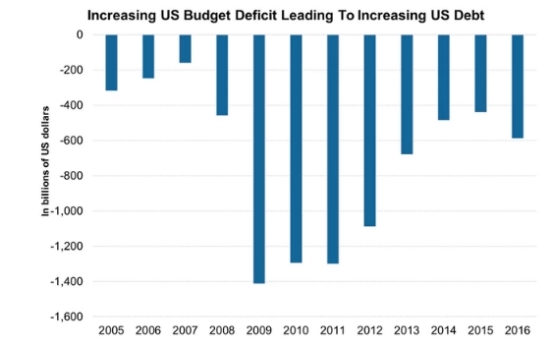

The recent market turmoil can be attributed to various factors, including geopolitical tensions, rising interest rates, and economic uncertainties. Geopolitical conflicts, such as those in Eastern Europe, have added to the anxiety, while central banks around the world are increasing interest rates to combat inflation. This environment has led to a significant amount of volatility in the markets.

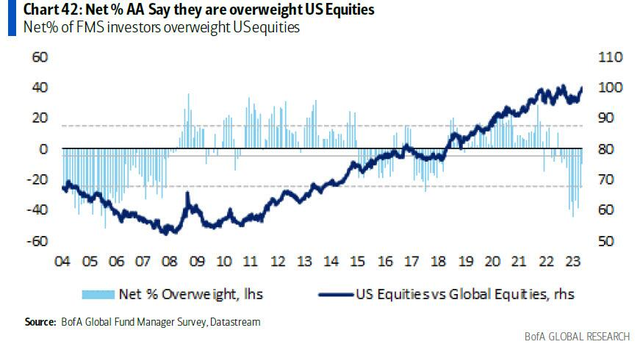

Despite the challenges, investors have seen opportunities in this volatile environment. One key factor has been the resilience of the U.S. and European stock markets. These markets have shown remarkable strength, bouncing back from their recent lows.

Key Factors Contributing to the Rally

Economic Data: The latest economic data from the U.S. and Europe has been relatively positive. This includes strong employment figures, robust consumer spending, and manufacturing data. These indicators have helped boost investor confidence and contributed to the rally.

Central Bank Policy: While central banks are increasing interest rates to combat inflation, they have also signaled that they will take a cautious approach. This has helped alleviate concerns about a possible economic slowdown and further supported the stock markets.

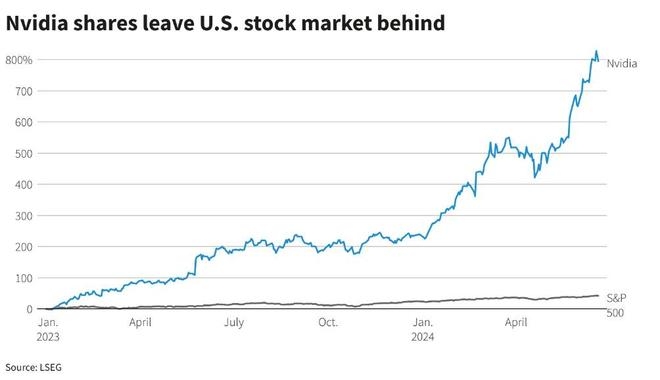

Technological Advancements: The technological sector, which is a significant part of the U.S. and European stock markets, has continued to perform well. Advancements in AI, 5G, and biotechnology have contributed to this growth, attracting investors to these markets.

Investment Opportunities

Given the current market conditions, investors should consider the following opportunities:

Technology Stocks: As mentioned earlier, the technology sector has shown remarkable resilience. Companies like Apple, Microsoft, and Amazon have continued to perform well, offering a good investment opportunity.

Consumer Discretionary Stocks: With the global economy recovering, consumer discretionary stocks are likely to benefit. Retail, travel, and leisure companies are some examples of sectors that could see significant growth.

Value Stocks: In the current market environment, value stocks could offer a good opportunity. These stocks are typically undervalued and have the potential for significant growth in the long term.

Case Study: Netflix

To illustrate the resilience of the U.S. stock market, let's consider the case of Netflix (NFLX). Despite facing challenges such as rising content costs and increased competition, Netflix has managed to grow its subscriber base and increase its revenue. This has helped the stock to recover from its recent lows and offer a good investment opportunity.

In conclusion, U.S. and European stocks have staged a remarkable rally following the recent turmoil. Investors should consider the factors contributing to this rally and capitalize on the opportunities available in the market. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....