In the United States, stock options are a common form of employee compensation, particularly in the tech industry. However, understanding the capital gains tax implications of these options can be complex. This article delves into the intricacies of the US capital gains tax on stock options, providing clarity and insights for individuals and businesses alike.

What are Stock Options?

Stock options are contracts that give employees the right to purchase company stock at a predetermined price, known as the exercise price or strike price. These options can be in-the-money (when the current stock price is higher than the exercise price) or out-of-the-money (when the current stock price is lower than the exercise price).

Taxation of Stock Options

The taxation of stock options in the US depends on whether they are employee stock options (ESOs) or incentive stock options (ISOs).

Employee Stock Options (ESOs):

ESOs are generally taxed as ordinary income when they are exercised. This means that the difference between the exercise price and the fair market value of the stock at the time of exercise is considered income, subject to ordinary income tax rates.

Example: Let's say an employee has ESOs with an exercise price of

Incentive Stock Options (ISOs):

ISOs offer more favorable tax treatment. When ISOs are exercised, the income from the difference between the exercise price and the fair market value of the stock at the time of exercise is taxed at the lower capital gains rate.

Example: Using the same scenario as above, if the employee exercises ISOs, they will pay

Capital Gains Tax on Stock Sales

Once the stock is sold, any gains are subject to capital gains tax. The capital gains rate depends on the holding period of the stock.

Short-term Capital Gains: If the stock is sold within one year of exercise, the gains are taxed as short-term capital gains, which are taxed at ordinary income tax rates.

Long-term Capital Gains: If the stock is held for more than one year, the gains are taxed at the lower capital gains rate, which is typically 0%, 15%, or 20%, depending on the individual's taxable income.

Case Study

Consider an employee who exercises ISOs with an exercise price of

Conclusion

Understanding the US capital gains tax on stock options is crucial for both employees and employers. By familiarizing themselves with the tax implications, individuals can make informed decisions regarding their stock options and optimize their tax liabilities.

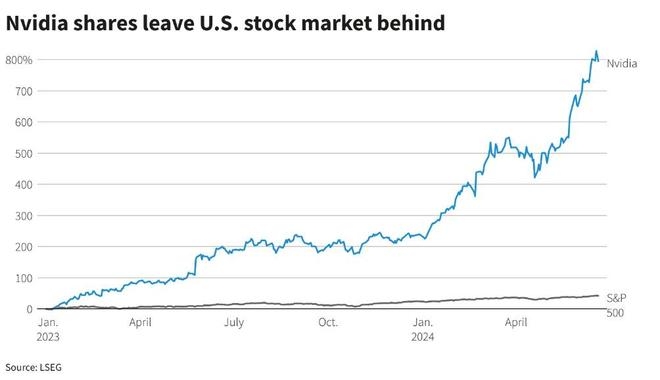

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....