Investing in the stock market can be a daunting task, especially for those new to the game. However, with the right investment vehicle, such as the BlackRock US Large Company Stocks Fund, you can navigate the complexities and potentially achieve significant returns. This article delves into the details of this fund, its investment strategy, and why it might be a compelling choice for your investment portfolio.

Understanding the BlackRock US Large Company Stocks Fund

The BlackRock US Large Company Stocks Fund is designed to invest in a diversified portfolio of large-cap U.S. companies. These are typically companies with a market capitalization of over $10 billion, which are considered to be more stable and established in the market. The fund aims to provide investors with long-term capital appreciation and current income.

Investment Strategy

BlackRock's investment strategy for this fund is centered around a fundamental analysis of the companies in which it invests. The fund's managers look for companies with strong financial health, solid growth prospects, and a competitive advantage in their respective industries. This approach ensures that the fund invests in companies that are well-positioned to weather market downturns and generate sustainable returns over time.

Key Features of the Fund

- Diversification: The fund invests in a wide range of large-cap companies across various sectors, which helps to reduce risk and protect against market volatility.

- Professional Management: BlackRock, one of the world's largest asset managers, manages the fund, bringing decades of experience and expertise to the table.

- Low Expense Ratio: The fund has a competitive expense ratio, which means a higher percentage of your investment goes towards generating returns rather than fund management fees.

- Access to Diverse Opportunities: The fund offers exposure to some of the largest and most influential companies in the U.S., including tech giants, healthcare leaders, and consumer goods powerhouses.

Performance History

The BlackRock US Large Company Stocks Fund has a strong track record of performance. Over the past five years, the fund has outperformed its benchmark index, providing investors with consistent growth and income. This performance is a testament to the fund's disciplined investment strategy and the expertise of BlackRock's management team.

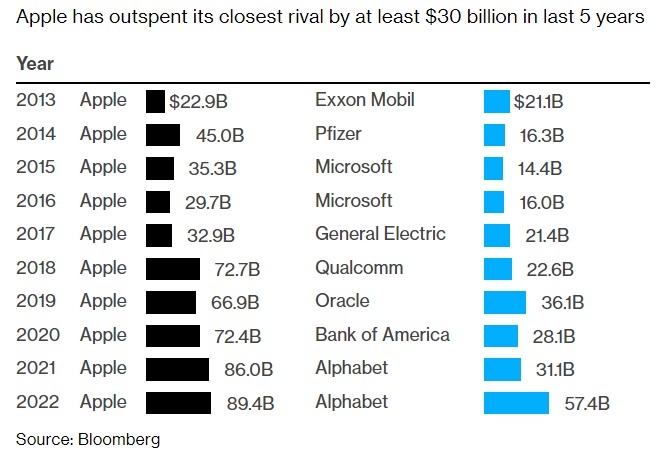

Case Study: Apple Inc.

One of the companies held in the BlackRock US Large Company Stocks Fund is Apple Inc. Apple has been a significant contributor to the fund's performance, thanks to its consistent growth and innovation. The fund's managers recognized Apple's potential early on and have continued to hold the stock, allowing investors to benefit from the company's impressive growth trajectory.

Conclusion

The BlackRock US Large Company Stocks Fund is a compelling investment option for those seeking exposure to large-cap U.S. companies. With its diversified portfolio, professional management, and strong performance history, this fund can be a valuable addition to any investment portfolio. Whether you're a seasoned investor or just starting out, the BlackRock US Large Company Stocks Fund offers a solid foundation for long-term growth and income.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....