In the bustling financial markets of the United States, the number of stock traders has been a subject of intrigue and curiosity. With the advent of technology and the rise of online trading platforms, the landscape has evolved significantly. But just how many stock traders are there in the US? Let's delve into this fascinating topic.

The Rise of Online Trading

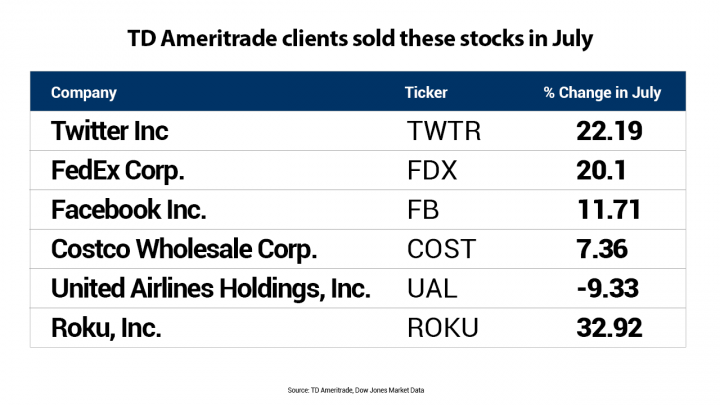

In recent years, online trading has become increasingly popular, particularly among younger investors. Platforms like Robinhood, TD Ameritrade, and E*TRADE have democratized access to the stock market, making it possible for anyone to trade stocks from the comfort of their home. This shift has led to a surge in the number of stock traders in the US.

Estimated Numbers

According to a report by the Investment Company Institute (ICI), as of 2021, there were approximately 45 million individual investors in the US. This number includes stock traders, mutual fund investors, and exchange-traded fund (ETF) holders. However, it's important to note that not all individual investors are active stock traders.

To get a more accurate estimate, we can look at the number of active traders. According to the same report, there were around 24 million active traders in the US as of 2021. This number is derived from data on margin accounts, which are a common feature among active traders.

Types of Stock Traders

The US stock trading community is diverse, with traders ranging from amateur investors to seasoned professionals. Here are some of the key types:

- Active Traders: These traders engage in frequent trading activities, often looking for short-term profits.

- Day Traders: Day traders buy and sell stocks within the same trading day, aiming to capitalize on small price movements.

- Long-Term Investors: These traders hold stocks for an extended period, usually months or years, with the goal of capitalizing on long-term growth.

- Retail Investors: Retail investors are individuals who trade stocks on their own behalf, without the assistance of a financial advisor.

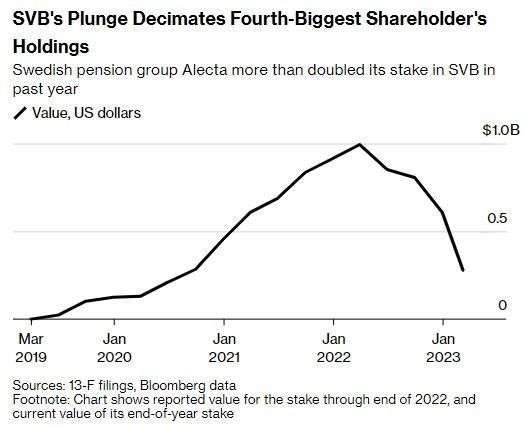

- Institutional Investors: Institutional investors include mutual funds, pension funds, and endowments, among others. They typically trade in large volumes.

Case Study: The Impact of Online Trading Platforms

The rise of online trading platforms has had a significant impact on the stock trading landscape. One notable example is Robinhood, which was founded in 2013. Robinhood's user-friendly interface and low-cost trading fees have attracted millions of new investors to the stock market. In fact, Robinhood's user base surpassed 13 million in 2020.

The impact of platforms like Robinhood cannot be overstated. They have not only made stock trading more accessible but have also sparked a renewed interest in the stock market among younger generations. This shift has the potential to reshape the traditional investment landscape in the years to come.

Conclusion

Determining the exact number of stock traders in the US is a challenging task, but it's clear that the number is on the rise. With the advent of online trading platforms and the increasing popularity of stock trading among younger investors, the stock trading community in the US is more diverse and active than ever before. As the financial landscape continues to evolve, it will be intriguing to see how the number of stock traders in the US grows in the years to come.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....