In the ever-evolving world of finance, understanding how to accurately value stocks is crucial for investors looking to make informed decisions. When it comes to US Ecology stocks, there are several key factors to consider that can significantly impact their valuation. This article delves into the intricacies of US Ecology stock valuation, providing insights and strategies to help investors navigate this complex landscape.

Understanding the Basics of Stock Valuation

Stock valuation is the process of determining the intrinsic value of a company's stock. This is done by analyzing various financial metrics and comparing them to industry benchmarks. For US Ecology stocks, some of the most important factors to consider include:

Financial Performance: Assessing a company's financial performance is crucial when valuing its stock. Key metrics to consider include revenue growth, earnings per share (EPS), and return on equity (ROE). Companies with strong financial performance are typically more attractive to investors.

Market Capitalization: Market capitalization is the total value of a company's outstanding shares. It is calculated by multiplying the number of shares outstanding by the current market price. Understanding a company's market cap can help investors gauge its size and growth potential.

Industry Comparisons: Comparing a company's financial metrics to those of its industry peers can provide valuable insights into its relative performance. This can help investors identify undervalued or overvalued stocks within the US Ecology sector.

Key Factors Influencing US Ecology Stock Valuation

Several factors can influence the valuation of US Ecology stocks. Here are some of the most significant:

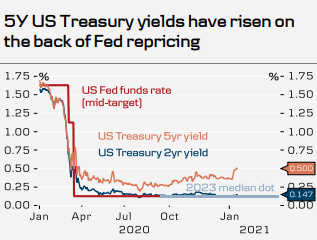

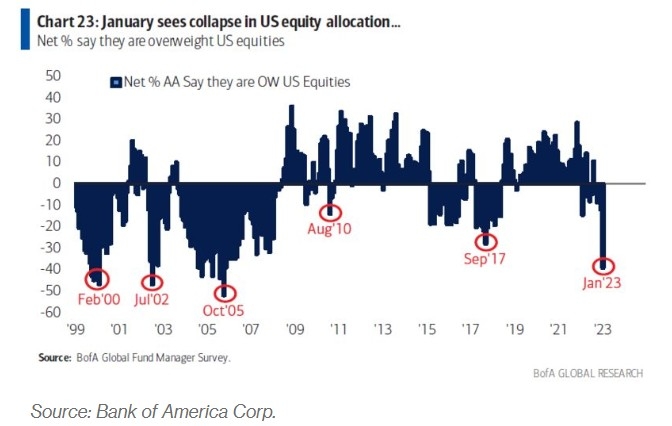

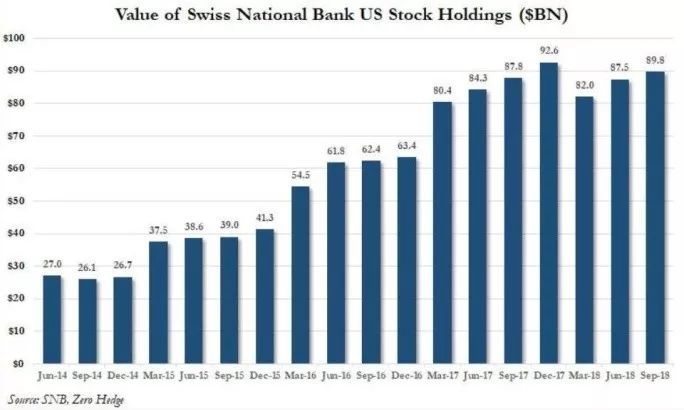

Economic Conditions: Economic conditions, such as interest rates, inflation, and GDP growth, can have a significant impact on the valuation of US Ecology stocks. For example, during periods of economic growth, these stocks may be more attractive to investors.

Regulatory Changes: Changes in environmental regulations can have a profound impact on the valuation of US Ecology stocks. Companies that are well-positioned to comply with these regulations may see their stock prices rise, while those that are not may see their prices decline.

Technological Advancements: Technological advancements can also play a crucial role in the valuation of US Ecology stocks. Companies that are able to innovate and adapt to new technologies may see their stock prices increase.

Case Study: Company X

To illustrate the importance of these factors, let's consider the case of Company X, a leading US Ecology company. Over the past year, Company X has experienced strong revenue growth and has been able to maintain a high ROE. However, the company has faced some regulatory challenges, which have caused its stock price to fluctuate.

Despite these challenges, investors who conducted a thorough analysis of Company X's financial performance and market position may have identified it as an undervalued stock. By considering the factors mentioned earlier, these investors were able to make informed decisions about their investments in Company X.

Conclusion

Valuing US Ecology stocks requires a comprehensive understanding of various financial metrics and industry-specific factors. By analyzing these factors and staying informed about economic and regulatory changes, investors can make more informed decisions about their investments in this sector. Remember, thorough research and a well-thought-out strategy are key to successful stock valuation.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....