As we step into May 2025, the US stock market is poised to face several significant events that could potentially impact investor sentiment and market performance. From economic indicators to geopolitical developments, several factors are set to shape the market landscape. In this article, we'll delve into the key events expected to affect the US stock market in May 2025.

1. Federal Reserve Interest Rate Decision

One of the most crucial events expected to affect the stock market is the Federal Reserve's interest rate decision. The Federal Open Market Committee (FOMC) meets regularly to assess economic conditions and make decisions regarding interest rates. Any indication of a rate hike or cut can have a significant impact on investor sentiment and market performance.

In May 2025, the Federal Reserve is expected to release its interest rate decision. Analysts are closely watching for any indication of whether the Fed will continue its policy of gradual rate hikes or shift its stance based on recent economic data. A rate hike could lead to higher borrowing costs, potentially dampening consumer and business spending, while a rate cut could signal a loosening of monetary policy, potentially boosting investor confidence.

2. Corporate Earnings Reports

Another key event affecting the US stock market in May 2025 will be the release of corporate earnings reports. As companies report their financial results for the first quarter, investors will be looking for signs of economic health and growth potential.

Historically, strong earnings reports have been a positive indicator for the stock market, while weak earnings can lead to sell-offs. In May 2025, investors will be particularly interested in earnings reports from tech giants, as well as companies in other key sectors such as energy, financials, and healthcare.

3. Geopolitical Developments

Geopolitical developments can also have a significant impact on the US stock market. In May 2025, several key events are on the horizon that could influence market sentiment.

For instance, tensions between the United States and China continue to be a major concern for investors. Any escalation in trade disputes or military tensions could lead to increased volatility in the stock market. Similarly, political events such as elections or policy changes in key economies could also have a significant impact on investor sentiment.

4. Economic Indicators

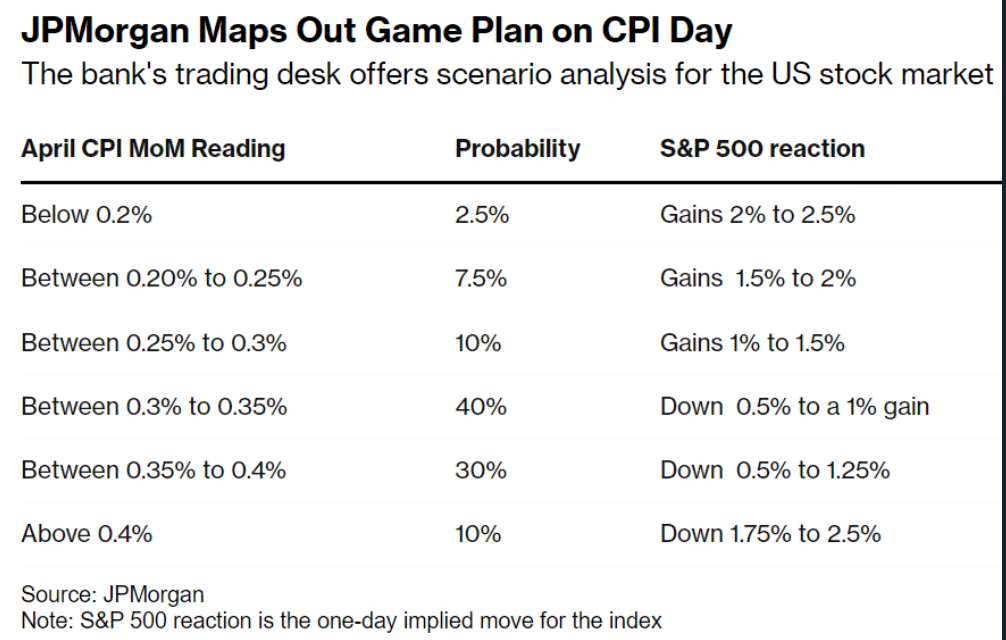

Economic indicators are another key factor affecting the US stock market. In May 2025, several key economic indicators are expected to be released, including the unemployment rate, inflation data, and GDP growth.

These indicators can provide valuable insights into the overall health of the economy and the potential for future market performance. For example, a strong jobs report or low inflation could signal economic growth and potentially boost investor confidence, while weak economic data could lead to increased market uncertainty.

Conclusion

In conclusion, the US stock market in May 2025 is expected to be influenced by a variety of events, including the Federal Reserve's interest rate decision, corporate earnings reports, geopolitical developments, and economic indicators. As investors navigate these potential risks and opportunities, it's important to stay informed and stay focused on the long-term fundamentals of their investments.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....