In the ever-evolving landscape of the financial world, understanding the ebb and flow of capital is crucial. Removing money from US stock markets is a topic that has been making waves among investors and financial experts alike. This article delves into the reasons behind this trend and its potential impact on the market.

Why Investors are Pulling Out

The primary reasons for investors removing money from US stock markets include economic uncertainty, market volatility, and a desire for higher returns in other asset classes. The COVID-19 pandemic has undoubtedly contributed to this trend, with many investors seeking safer havens for their capital.

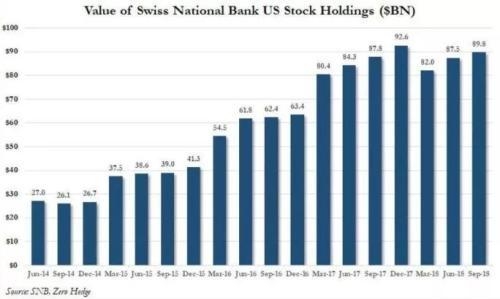

One of the key factors driving investors away from US stocks is the increased market volatility. The stock market has seen unprecedented swings in recent years, with the S&P 500 index reaching record highs and lows in rapid succession. This volatility has made it difficult for investors to predict market movements and has led many to seek alternative investment opportunities.

Seeking Higher Returns

Another reason for the exodus from US stock markets is the search for higher returns. With interest rates at historic lows, many investors are looking for more profitable investments. This has led to a shift towards alternative asset classes such as real estate, commodities, and emerging markets.

Impact on the Market

The removal of money from US stock markets has several implications for the market. Firstly, it can lead to a decrease in stock prices. When investors sell their stocks, it puts downward pressure on prices, potentially leading to a bear market.

Secondly, the reduction in liquidity can make it more difficult for companies to raise capital. This can lead to a decrease in investment and potentially slow down economic growth.

Case Studies

To illustrate the impact of removing money from US stock markets, let's look at two recent case studies.

In 2022, the crypto market experienced a significant downturn, leading many investors to pull their money out of digital assets. This resulted in a decrease in liquidity and a sharp decline in prices, affecting the entire market.

Another example is the real estate market. In recent years, many investors have shifted their focus from stocks to real estate, leading to a tightening of the housing market and increased competition for properties.

Conclusion

Removing money from US stock markets is a trend that is unlikely to fade anytime soon. As investors seek higher returns and safer investments, the market will continue to evolve. Understanding the implications of this trend is crucial for investors looking to navigate the complex financial landscape.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....