The stock market is a dynamic landscape, constantly evolving with economic shifts, technological advancements, and political changes. As we look ahead to 2026, it's crucial to analyze the potential top US stocks that could offer substantial returns. This article delves into the outlook for the top US stocks in 2026, highlighting key sectors and companies poised for growth.

Tech Sector Dominance

The technology sector has been a powerhouse in the US stock market, and this trend is expected to continue in 2026. Companies like Apple, Microsoft, and Amazon are at the forefront of innovation, driving growth and profitability. Apple is expected to benefit from increased demand for its iPhone, iPad, and Mac products, while Microsoft continues to expand its cloud computing services. Amazon remains a dominant force in e-commerce and cloud computing, with its Amazon Web Services (AWS) division leading the way.

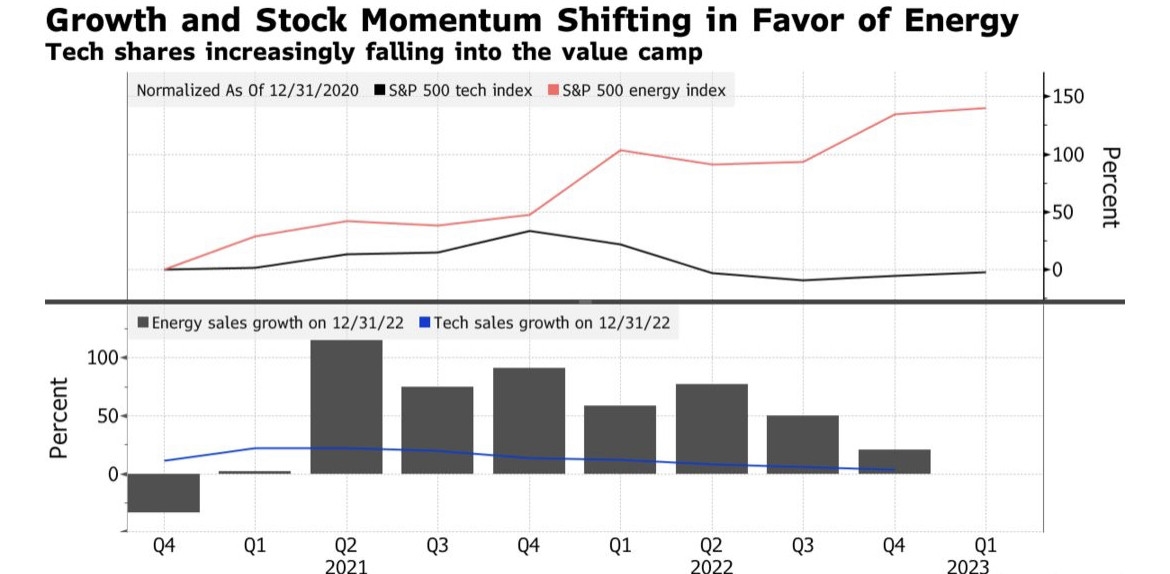

Energy Sector Resilience

The energy sector has seen significant growth in recent years, and this trend is likely to persist in 2026. With the rise of renewable energy sources, companies like Tesla, NVIDIA, and BP are poised to benefit. Tesla has become a leader in electric vehicles (EVs) and renewable energy solutions, while NVIDIA powers the AI and autonomous driving technologies that are transforming the industry. BP has made significant investments in renewable energy and is well-positioned to capitalize on the global shift towards sustainability.

Healthcare Sector Innovation

The healthcare sector is another area where significant growth is expected in 2026. Companies like Johnson & Johnson, Merck, and Amgen are at the forefront of medical innovation, developing new treatments and therapies. Johnson & Johnson has a diverse portfolio of healthcare products, from consumer healthcare to medical devices. Merck is known for its pharmaceuticals and biotechnology products, while Amgen specializes in biopharmaceuticals and has a strong pipeline of new drug candidates.

Financial Sector Stability

The financial sector remains a cornerstone of the US stock market, with companies like JPMorgan Chase, Goldman Sachs, and Bank of America leading the way. These companies have demonstrated resilience in the face of economic uncertainty and are well-positioned to benefit from the ongoing recovery. JPMorgan Chase is a leader in investment banking, while Goldman Sachs excels in wealth management and investment services. Bank of America offers a comprehensive range of financial products and services, including retail banking, investment banking, and wealth management.

Case Study: Tesla's Impact on the Electric Vehicle Market

Tesla's impact on the electric vehicle (EV) market is a prime example of how a single company can revolutionize an entire industry. Since its inception, Tesla has been at the forefront of EV innovation, pushing the boundaries of what's possible. The company's success has spurred competition from traditional automakers and has led to a global shift towards sustainable transportation. As the market for EVs continues to grow, companies like Tesla are well-positioned to capitalize on this trend and offer substantial returns to investors.

In conclusion, the top US stocks in 2026 are expected to come from a variety of sectors, including technology, energy, healthcare, and finance. By understanding the potential growth opportunities within these sectors, investors can make informed decisions and position themselves for success in the years ahead.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....