In the global financial landscape, the US dollar reigns supreme as the world's primary reserve currency. Its strength is often seen as a sign of economic stability. However, what if the US dollar fails? Could all stocks be in danger? This article delves into this critical question, exploring the potential risks and the impact on the stock market.

Understanding the Role of the US Dollar

The US dollar's status as the world's reserve currency means that most international transactions are conducted in dollars. This position of power makes the US economy a bellwether for global economic health. However, the dollar's stability is not absolute. Several factors could contribute to its potential downfall, including economic downturns, political instability, and trade wars.

The Potential Risks

If the US dollar were to fail, it would likely lead to several significant risks for the stock market:

- Inflation: A weakened dollar could lead to higher inflation, eroding the purchasing power of investors. This would likely lead to a decline in stock prices, as companies' profits may be impacted by increased costs.

- Currency Risk: Companies with significant international operations may face increased currency risk if the dollar weakens. This could lead to lower profits and a decline in stock prices.

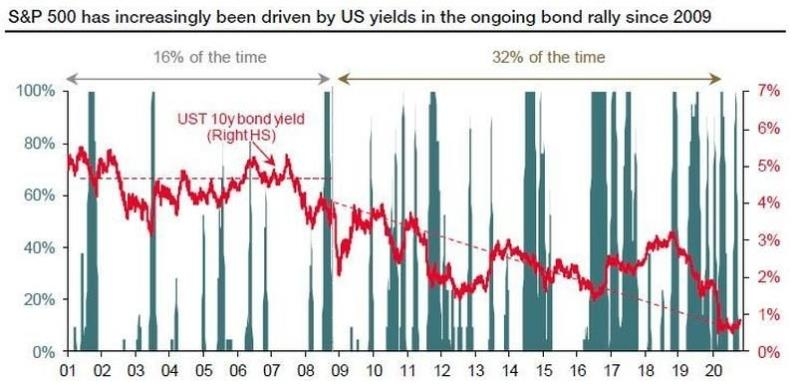

- Interest Rate Fluctuations: The Federal Reserve sets interest rates in the US. If the dollar fails, the Fed may need to adjust rates to stabilize the economy. This could lead to volatility in the stock market.

Impact on Different Stock Markets

The impact of a failing US dollar would likely vary across different stock markets:

- Emerging Markets: Emerging market economies are particularly vulnerable to currency fluctuations. A weaker dollar could lead to a devaluation of their currencies, making imports more expensive and potentially leading to economic downturns.

- Developed Markets: Developed market economies are generally more resilient to currency fluctuations. However, a failing US dollar could still lead to volatility in their stock markets, especially for companies with significant international operations.

- US Stock Market: The US stock market is the largest and most influential in the world. A failing US dollar could lead to significant volatility, as investors reassess the value of their investments.

Case Studies

To illustrate the potential impact of a failing US dollar, consider the following case studies:

- 1997 Asian Financial Crisis: The Asian financial crisis of 1997 was partly caused by the devaluation of the Thai baht, which was heavily influenced by the US dollar. This crisis led to significant stock market declines in Asia.

- 2008 Global Financial Crisis: The 2008 global financial crisis was partly caused by the US subprime mortgage crisis. The crisis led to a significant decline in stock markets worldwide, including the US.

Conclusion

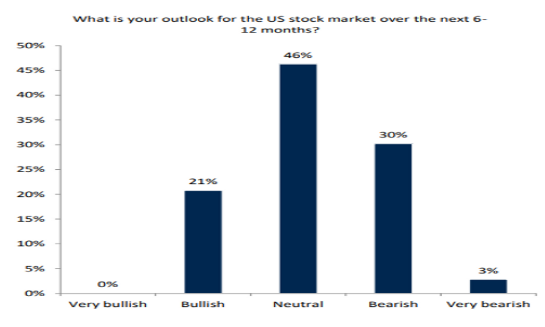

While a failing US dollar presents significant risks, it is not guaranteed to lead to a stock market collapse. The impact would likely vary across different stock markets and sectors. Investors should be aware of these risks and consider diversifying their portfolios to mitigate potential losses.

In summary, while a failing US dollar could pose significant risks to the stock market, the extent of the impact would depend on various factors, including the global economic landscape and the response of central banks. It is crucial for investors to stay informed and prepared for potential market volatility.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....