The US stock market experienced a rollercoaster of emotions on April 21, 2025, as investors navigated through a mix of economic data and geopolitical tensions. Here's a comprehensive summary of the key developments that shaped the market on that day.

Market Open and Early Moves

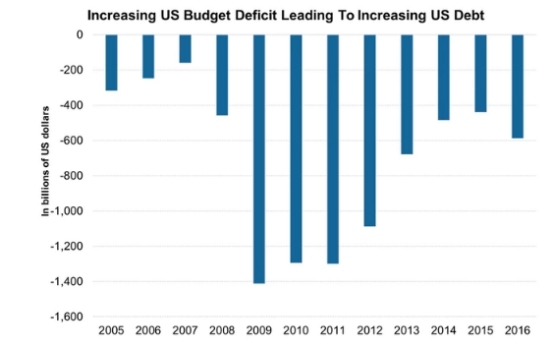

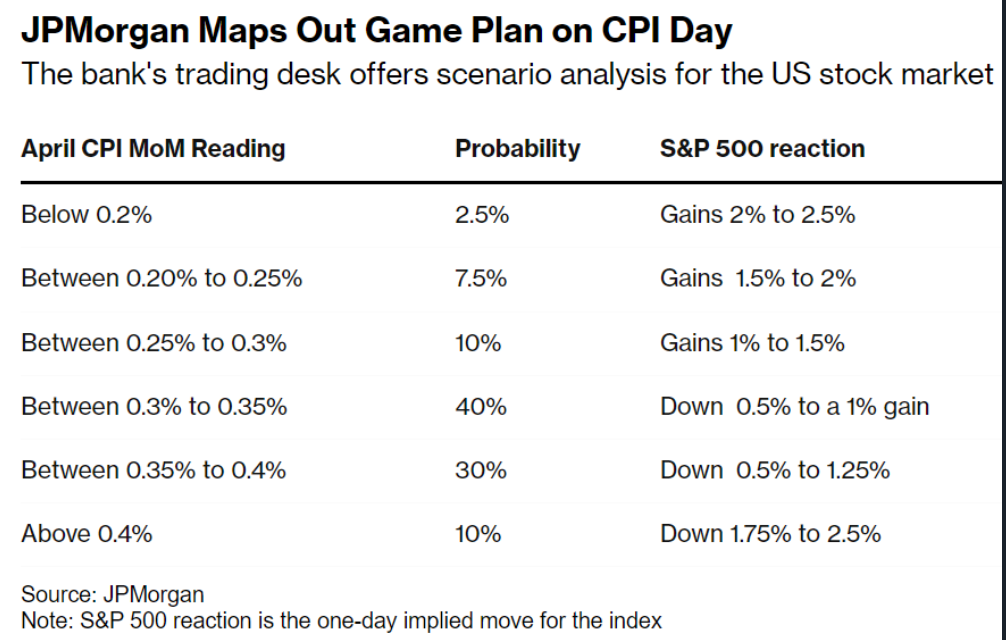

The day began with the S&P 500 opening slightly lower, reflecting cautious optimism amidst a backdrop of rising inflation concerns and geopolitical tensions. Early trading saw a mix of positive and negative economic data. While consumer confidence remained strong, indicating a robust consumer spending environment, the release of March's inflation data revealed a higher-than-expected increase in the Consumer Price Index (CPI).

Sector Performance

- Technology Stocks Take a Hit: Tech stocks, which have been a major driver of the market's growth over the past few years, suffered a setback. Companies like Apple and Microsoft saw their shares decline as investors worried about the impact of rising inflation on consumer spending and corporate earnings.

- Energy Sector Soars: In contrast, the energy sector surged. Oil prices climbed as tensions in the Middle East escalated, prompting investors to seek refuge in energy-related investments. Companies like ExxonMobil and Chevron saw their shares soar on the day.

- Healthcare Stocks Gain Traction: Healthcare stocks gained traction as investors sought out defensive sectors. Companies like Johnson & Johnson and Pfizer saw their shares rise on the day.

Economic Data and Market Sentiment

The release of March's retail sales data provided some relief to investors, as it showed a modest increase in spending. However, the higher-than-expected inflation data cast a shadow over the market, prompting some investors to question the Federal Reserve's policy stance.

Geopolitical Tensions and Market Impact

Geopolitical tensions continued to play a significant role in market movements. The escalating situation in the Middle East led to a spike in oil prices, while tensions between the US and China created uncertainty in the market.

Key Stock Movements

- Apple: The tech giant saw its shares decline by 2% on the day, with investors concerned about the impact of rising inflation on consumer spending.

- ExxonMobil: The energy giant saw its shares surge by 4% on the day, benefiting from the rise in oil prices.

- Johnson & Johnson: The healthcare giant saw its shares rise by 1% on the day, as investors sought refuge in defensive sectors.

Conclusion

The US stock market on April 21, 2025, was shaped by a mix of economic data, geopolitical tensions, and sector performance. While the market faced challenges, it also demonstrated resilience, with investors navigating through a complex landscape of factors. As the day came to a close, the market closed slightly lower, reflecting the cautious optimism of investors amidst a backdrop of uncertainty.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....