In the dynamic world of energy stocks, NRG Energy stands out as a significant player. This article delves into the intricacies of NRG Energy US stocks, offering investors a comprehensive guide to understanding and capitalizing on this investment opportunity.

NRG Energy: A Brief Overview

NRG Energy, Inc. (NYSE: NRG) is a leading integrated power company based in the United States. The company operates across the energy spectrum, from generation to distribution, and has a diverse portfolio of energy solutions. NRG Energy's focus on innovation and sustainability has positioned it as a key player in the energy sector.

Understanding NRG Energy US Stocks

When considering NRG Energy US stocks, it's essential to understand the company's financial health, market position, and growth prospects. Here's a breakdown of these key factors:

1. Financial Health

NRG Energy has a strong financial foundation, with a diverse revenue stream that includes electricity generation, retail energy sales, and renewable energy projects. The company's robust financial health is reflected in its strong credit ratings and steady dividend payments.

2. Market Position

NRG Energy is well-positioned in the energy market, with a significant presence in key regions such as Texas, New York, and New Jersey. The company's strategic partnerships and investments in renewable energy projects have further strengthened its market position.

3. Growth Prospects

Looking ahead, NRG Energy's growth prospects are promising. The company is actively investing in renewable energy projects, which are expected to drive long-term growth. Additionally, the company's focus on innovation and digital transformation is poised to create new revenue streams and enhance operational efficiency.

Key Investment Considerations

Investing in NRG Energy US stocks requires careful consideration of several key factors:

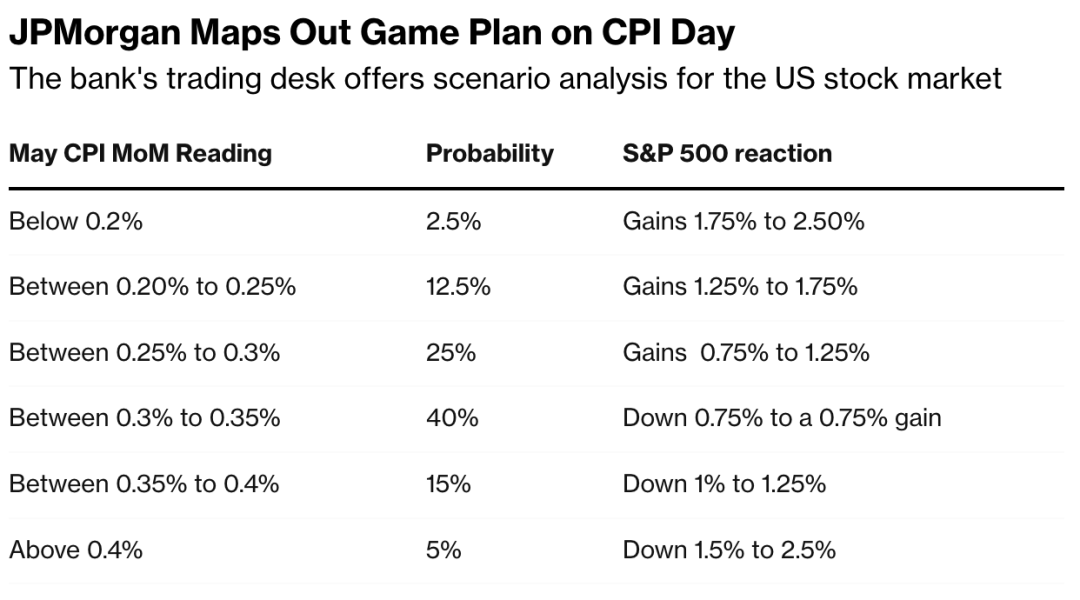

1. Industry Trends

Energy industry trends, such as increasing demand for renewable energy and regulatory changes, can significantly impact NRG Energy's performance. Staying informed about these trends is crucial for making informed investment decisions.

2. Company News and Announcements

Regularly monitoring NRG Energy's news and announcements is essential for understanding the company's strategic direction and potential impact on its stock price.

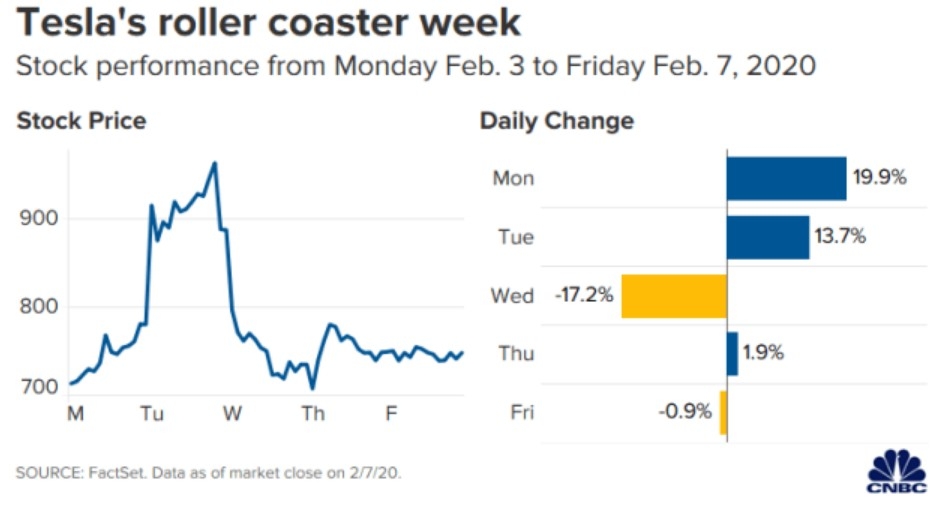

3. Technical Analysis

Technical analysis can provide valuable insights into the short-term price movements of NRG Energy US stocks. Analyzing historical price data and trading volumes can help investors identify potential entry and exit points.

Case Studies: Successful NRG Energy Investments

Several investors have successfully capitalized on NRG Energy US stocks. Here are a couple of case studies:

1. John, a long-term investor, noticed NRG Energy's commitment to renewable energy projects. He invested in the company's stock and has seen a significant return over the past five years.

2. Sarah, a short-term trader, used technical analysis to identify a strong uptrend in NRG Energy's stock. She entered a position and exited with a profit within a few months.

Conclusion

NRG Energy US stocks present a compelling investment opportunity for those looking to diversify their portfolio in the energy sector. By understanding the company's financial health, market position, and growth prospects, investors can make informed decisions and potentially reap substantial returns. Keep abreast of industry trends and company news to stay ahead in the dynamic world of energy stocks.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....