The Dow Jones Industrial Average (DJIA) has been a benchmark for investors for over a century. However, on certain days, it experiences downward trends that leave investors scratching their heads. Today, the Dow Jones is down, and there are several factors at play. Let's delve into the key reasons behind this decline.

Economic Indicators and Inflation Concerns

One of the primary reasons for the Dow Jones' downward trend today is the release of economic indicators. For instance, the Consumer Price Index (CPI) has been rising, leading to concerns about inflation. When the CPI increases, it indicates that the cost of living is also on the rise, which can erode purchasing power. This situation can negatively impact stocks, leading to a drop in the DJIA.

Geopolitical Tensions

Another significant factor contributing to the Dow Jones' decline is geopolitical tensions. Issues such as trade wars, political instability, and conflicts can create uncertainty in the market. Investors tend to avoid risk in such situations, leading to a sell-off of stocks and a drop in the DJIA.

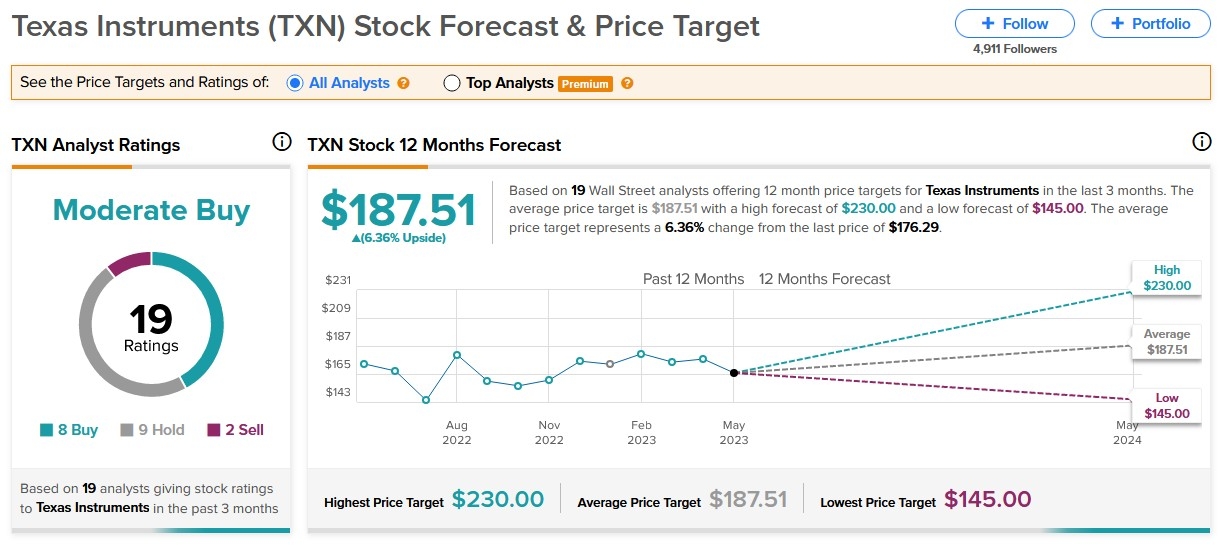

Corporation Earnings Reports

The performance of individual companies also plays a crucial role in the Dow Jones' movement. Today, several companies have released their earnings reports, and some of them have missed expectations. This situation can lead to a sell-off of their stocks, which in turn impacts the overall DJIA.

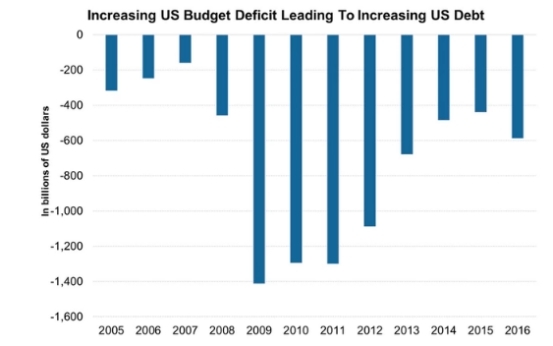

Interest Rate Hikes by the Federal Reserve

The Federal Reserve's decision to raise interest rates can also cause the Dow Jones to decline. Higher interest rates make borrowing more expensive, which can lead to a decrease in consumer spending and corporate investment. This situation can negatively impact the stock market, leading to a drop in the DJIA.

Technological Stock Decline

The technology sector has been a significant component of the DJIA for years. However, today, several technology stocks have experienced a decline. This situation can be attributed to various factors, including concerns about regulatory scrutiny and competition in the market. The decline in these stocks has contributed to the overall drop in the DJIA.

Impact of Cryptocurrency Market

The recent volatility in the cryptocurrency market has also played a role in the Dow Jones' decline. As the cryptocurrency market continues to grow, it has become increasingly intertwined with traditional financial markets. The decline in cryptocurrency values can lead to a sell-off of related stocks, impacting the overall DJIA.

Conclusion

The Dow Jones' decline today can be attributed to a combination of factors, including economic indicators, geopolitical tensions, corporation earnings reports, interest rate hikes, technological stock decline, and the impact of the cryptocurrency market. While it's essential to stay informed about these factors, it's also crucial to remember that the stock market is unpredictable and can experience ups and downs. Investors should focus on their long-term investment strategy and avoid making impulsive decisions based on short-term market movements.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....