The stock market is a pivotal component of any nation's economy, reflecting the health and direction of its financial system. When comparing two of the world's largest economies, Canada and the United States, their stock markets offer unique insights into the strengths and weaknesses of each country. This article delves into a comprehensive comparison of the Canadian and US stock markets, highlighting key differences and similarities.

Market Size and Capitalization

The first noticeable difference between the Canadian and US stock markets is their size. The US stock market, often referred to as the world's largest, boasts a market capitalization of over

This disparity in size can be attributed to the United States' larger population and more developed financial system. The NYSE and NASDAQ, the two main stock exchanges in the US, are among the most significant in the world, offering a wide range of investment opportunities.

Market Composition

The composition of the Canadian and US stock markets also differs significantly. The US market is home to a diverse array of industries, including technology, healthcare, and finance. Tech giants like Apple, Microsoft, and Google are listed on the NASDAQ, contributing to its high market capitalization.

In contrast, the Canadian market is heavily weighted towards natural resources, particularly oil and gas. Companies like Suncor Energy and Royal Bank of Canada dominate the TSX. This concentration in a single sector can make the Canadian market more volatile and sensitive to changes in commodity prices.

Investment Opportunities

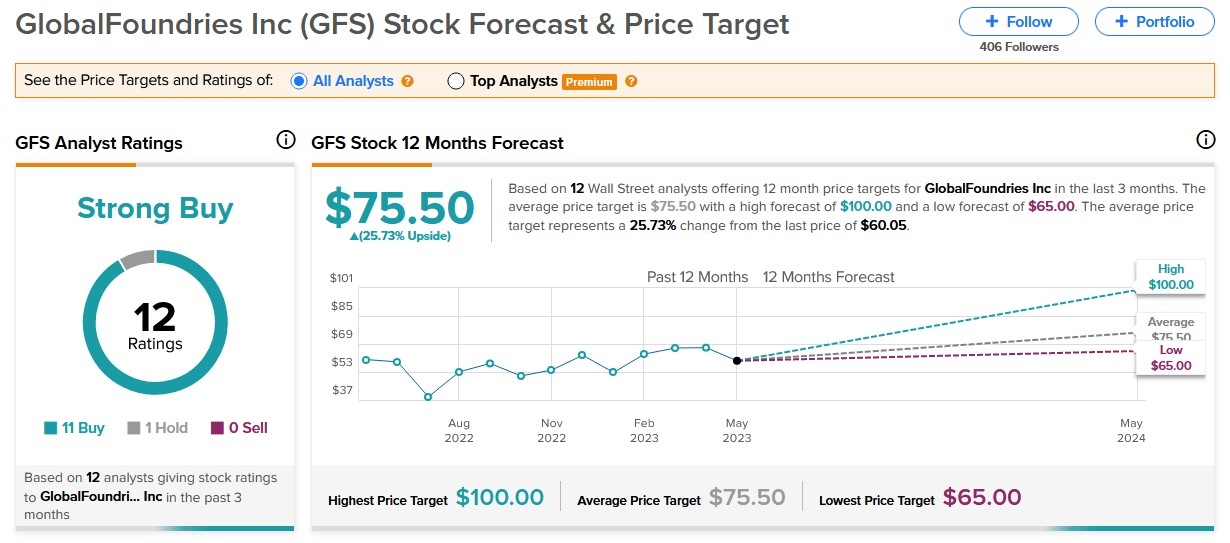

Investors looking for exposure to emerging industries and high-growth companies may find the US market more appealing. The US has a vibrant tech sector, with numerous start-ups and established companies offering significant growth potential. The NASDAQ 100 is a popular benchmark for tracking tech stocks in the US.

On the other hand, investors interested in stable, dividend-paying companies may prefer the Canadian market. Canadian companies tend to offer higher dividend yields, making them attractive to income investors. The S&P/TSX 60 is a popular index for tracking dividend-paying stocks in Canada.

Market Performance

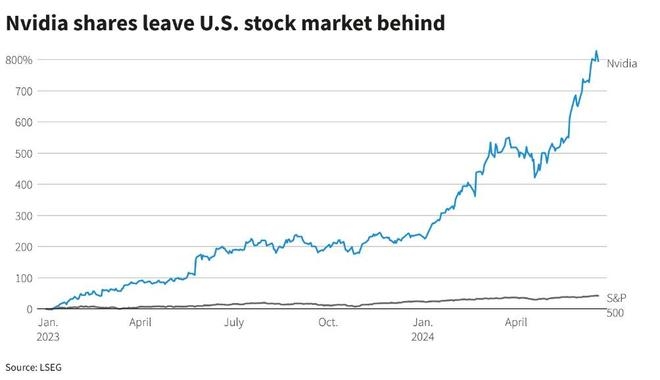

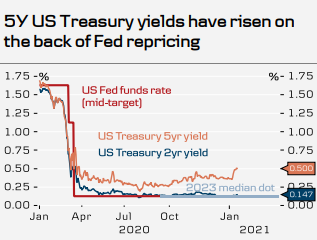

When it comes to market performance, both the Canadian and US stock markets have experienced periods of strong growth and volatility. The US market has historically outperformed the Canadian market over the long term, driven by its larger size and more diverse industry composition.

However, during certain periods, such as the 2008 financial crisis, the Canadian market has outperformed the US market. This can be attributed to the country's more stable economy and its reliance on natural resources, which provided a cushion during the downturn.

Conclusion

In conclusion, the Canadian and US stock markets offer unique investment opportunities and present distinct risks and rewards. Investors should consider their investment goals, risk tolerance, and market exposure when deciding which market to invest in. Whether you're looking for high-growth companies or stable dividend-paying stocks, both markets have something to offer.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....