The stock market is an ever-evolving landscape, and the outlook for 2025 is shaping up to be both promising and challenging for US equities. With technological advancements, geopolitical shifts, and economic trends at play, investors are keen to understand the trajectory of the US equity market. This article delves into the current outlook for 2025, analyzing key factors that could impact US equities.

Economic Growth and Interest Rates

One of the primary factors influencing the stock market is economic growth. As of now, the US economy is experiencing steady growth, driven by factors such as low unemployment rates and increasing consumer spending. However, the Federal Reserve's monetary policy plays a crucial role in shaping the market outlook.

The Federal Reserve has been raising interest rates to control inflation, and this has had a mixed impact on the stock market. On one hand, higher interest rates can lead to increased borrowing costs for companies, potentially affecting their profitability. On the other hand, a controlled inflation rate is essential for long-term economic stability.

Sector Performance

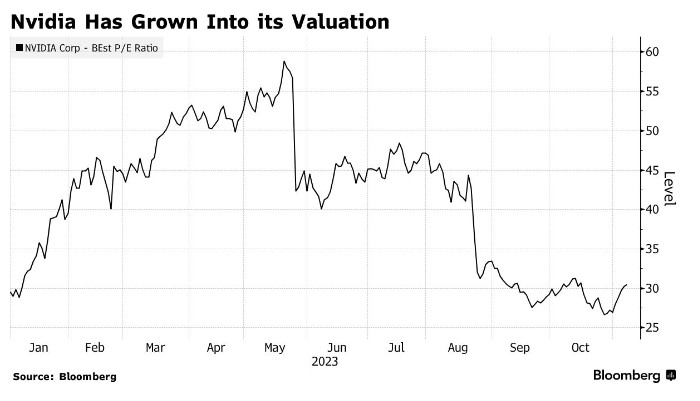

In the current landscape, certain sectors are expected to outperform others in 2025. Technology and healthcare are two sectors that have been at the forefront of growth, primarily due to their innovation and adaptability.

Technology stocks have been a major driver of the stock market's growth, thanks to advancements in artificial intelligence, 5G, and cloud computing. Companies like Apple, Amazon, and Microsoft have seen significant growth, and this trend is expected to continue in 2025.

Similarly, the healthcare sector is poised for growth, driven by an aging population and the increasing demand for medical services. Companies like Johnson & Johnson and Pfizer are expected to benefit from this trend.

Geopolitical and Regulatory Factors

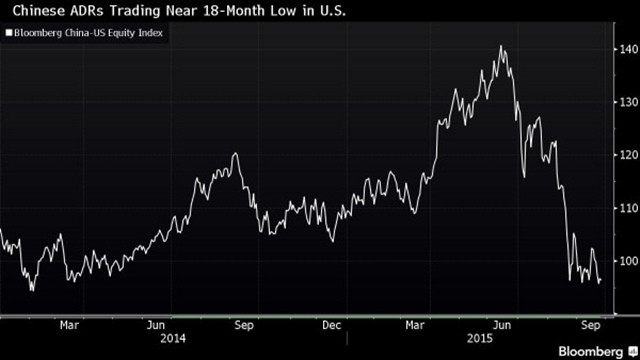

Geopolitical and regulatory factors also play a significant role in shaping the stock market outlook. The ongoing trade tensions between the US and China, along with the rise of populism in various parts of the world, could impact global markets and US equities.

Additionally, regulatory changes, such as the recent moves by the Securities and Exchange Commission (SEC) to regulate cryptocurrency markets, could have a significant impact on the stock market.

Case Studies

To illustrate the potential impact of these factors, let's consider two case studies:

Tesla (TSLA): As a leader in electric vehicles and renewable energy, Tesla has seen significant growth in recent years. However, with the increasing competition from companies like Ford and Volkswagen, and the potential impact of trade tensions, Tesla's future remains uncertain.

Facebook (Meta Platforms, Inc.) (META): The tech giant has faced scrutiny from regulators and the public over issues like privacy and content moderation. While Meta Platforms has made strides in diversifying its revenue streams, concerns over its regulatory and social impact could impact its stock price in 2025.

Conclusion

The current stock market outlook for 2025 US equities is complex, with a mix of opportunities and challenges. Investors need to stay informed about economic trends, sector performance, and geopolitical and regulatory factors to make informed decisions. As always, diversification and a long-term investment strategy are key to navigating the volatile stock market landscape.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....