In the ever-evolving world of finance, the question of whether the US stock market is overvalued is a topic that sparks heated debate among investors and financial analysts alike. As of late, there has been considerable speculation regarding the current state of the market, with many questioning if it's reached an unsustainable level. In this article, we'll delve into the factors contributing to the debate and explore whether the US stock market is indeed overvalued.

Understanding Stock Market Valuation

To determine if a stock market is overvalued, we must first understand the concept of valuation. Stock market valuation is a process of estimating the intrinsic value of a stock or a market. It involves analyzing various financial metrics, such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio, among others. When these ratios exceed historical averages, it often indicates that the market may be overvalued.

Historical Averages and Current Ratios

Historically, the US stock market has experienced periods of both undervaluation and overvaluation. During the dot-com bubble of the late 1990s, the market was considered overvalued, leading to a significant correction. Fast forward to the current market, and many investors are questioning if it's time for another correction.

As of early 2023, the S&P 500 has a P/E ratio of around 21.4, which is above its long-term average of around 16.8. Additionally, the P/B ratio stands at 3.2, also higher than the historical average of around 2.7. These ratios suggest that the US stock market may be overvalued.

Economic Factors Contributing to Overvaluation

Several economic factors have contributed to the potential overvaluation of the US stock market. Here are some key considerations:

- Low Interest Rates: For several years, the Federal Reserve has maintained low interest rates, making it cheaper for companies to borrow and invest. This has fueled stock market growth, but it has also led to a decrease in the attractiveness of fixed-income investments, causing investors to pour money into stocks.

- Corporate Profits: Corporate profits have been on the rise, driven by strong economic growth and low corporate tax rates. This has translated into higher stock prices and earnings, but it may also be contributing to the overvaluation of the market.

- Inflation and Deflation Concerns: Inflation has been a significant concern for investors in recent years, and the Federal Reserve has been implementing policies to combat it. However, some analysts argue that inflation may lead to higher interest rates, which could negatively impact the stock market.

Case Studies: Tech Stocks and the Dot-Com Bubble

One of the most notable examples of market overvaluation is the dot-com bubble of the late 1990s. At its peak, many tech stocks were trading at absurd valuations, with some P/E ratios exceeding 100. This frenzy eventually ended with a dramatic market correction, wiping out billions of dollars in investor wealth.

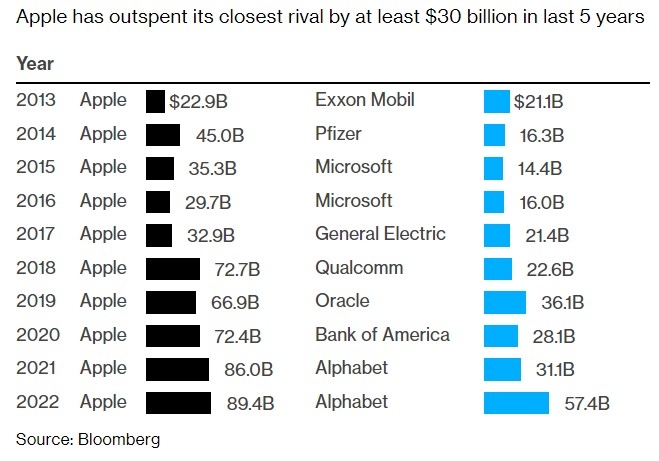

In the current market, tech stocks, particularly those in the FAANG (Facebook, Apple, Amazon, Netflix, and Google) category, have been driving much of the market's growth. However, some analysts argue that these stocks may be overvalued, similar to the dot-com era.

Conclusion

While it's difficult to predict the future of the US stock market, the current valuation ratios suggest that the market may be overvalued. Investors should be cautious and consider diversifying their portfolios to mitigate potential risks. As always, it's essential to stay informed and consult with a financial advisor before making any investment decisions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....