The stock market is a complex and unpredictable entity, and the phrase "market is crashing" sends shivers down the spines of investors and traders alike. But what does it really mean, and what should you do if you find yourself in the midst of a market crash? In this article, we will delve into the causes of a crashing market, the impact it has on investors, and some strategies to help you navigate through these turbulent times.

Understanding a Market Crash

A market crash refers to a rapid and significant decline in the value of stocks, bonds, and other financial assets. This can be caused by a variety of factors, including economic downturns, political instability, or unexpected events that shake investor confidence. The most famous market crash in history is the Black Tuesday of October 29, 1929, which marked the beginning of the Great Depression.

Causes of a Market Crash

- Economic Downturns: Economic indicators such as GDP growth, unemployment rates, and inflation can all contribute to a market crash. When these indicators suggest that the economy is slowing down or entering a recession, investors tend to sell off their assets, leading to a crash.

- Political Instability: Political events, such as elections, referendums, or political conflicts, can also cause a market crash. Investors often sell off their assets in anticipation of potential economic disruptions.

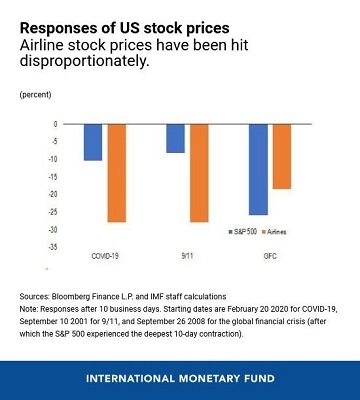

- Unexpected Events: Natural disasters, health crises, or technological disruptions can all lead to a market crash. These events can cause widespread panic and uncertainty among investors.

Impact on Investors

A market crash can have a devastating impact on investors, particularly those who are heavily invested in the stock market. Here are some of the key impacts:

- Loss of Capital: Investors can lose a significant amount of their capital if they are not properly diversified or if they are heavily invested in a particular sector or asset class.

- Emotional Distress: The uncertainty and volatility of a market crash can lead to emotional distress and anxiety among investors.

- Reduced Retirement Savings: For those saving for retirement, a market crash can significantly reduce their retirement savings, making it harder to achieve their financial goals.

Strategies for Navigating a Market Crash

- Diversify Your Portfolio: Diversification can help protect your portfolio from the impact of a market crash. By investing in a variety of asset classes, you can reduce your exposure to any single sector or asset class.

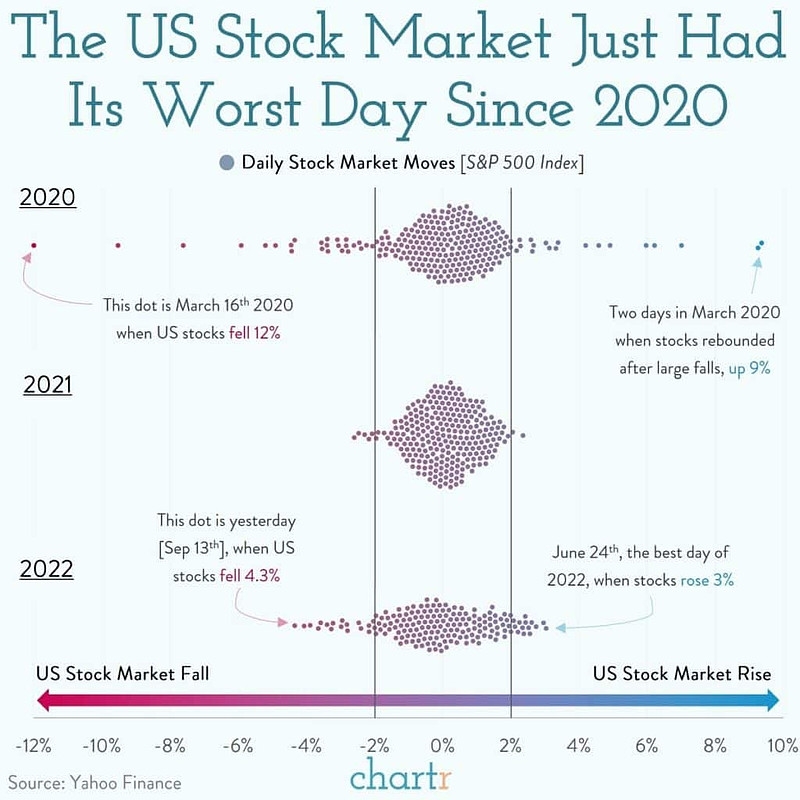

- Stay Calm and Invest: It's important to stay calm and not panic during a market crash. History has shown that markets often recover from crashes, and investing during these times can lead to significant gains.

- Review Your Investment Strategy: Take the opportunity to review your investment strategy and make any necessary adjustments. This may involve rebalancing your portfolio or adjusting your asset allocation.

- Seek Professional Advice: If you're unsure about how to navigate a market crash, seek the advice of a financial advisor. They can provide you with personalized guidance and help you make informed decisions.

Case Studies

One of the most recent market crashes occurred in 2020, triggered by the COVID-19 pandemic. The S&P 500 index dropped by nearly 30% in just a few weeks. However, the market quickly recovered and reached new highs within a year. Investors who stayed calm and invested during this period were able to recover their losses and even make significant gains.

In another example, the 2008 financial crisis led to a market crash that lasted for several months. Investors who panicked and sold off their assets during this time suffered significant losses. However, those who remained patient and invested in quality companies were able to recover their losses and even make a profit.

Conclusion

A market crash can be a daunting experience, but understanding its causes and impacts, and having a solid investment strategy, can help you navigate through these turbulent times. Remember to diversify your portfolio, stay calm, and seek professional advice when needed.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....