In the dynamic world of investments, US Steel Company stocks have emerged as a compelling option for investors looking to capitalize on the steel industry's growth potential. With a rich history and a strong market presence, US Steel offers a unique opportunity for those seeking to diversify their portfolios. This article delves into the key aspects of US Steel Company stocks, providing valuable insights for investors.

Understanding US Steel Company

Established in 1901, US Steel Corporation is one of the oldest and largest steel producers in the world. The company operates in various segments, including flat-rolled steel, tubular products, and specialty products. With a robust global presence, US Steel has the capability to cater to diverse market needs.

Market Performance and Growth Prospects

Over the years, US Steel Company stocks have showcased remarkable resilience, often outperforming the broader market indices. This can be attributed to the company's strategic focus on operational efficiency and cost optimization. Analysts predict that the steel industry is poised for significant growth in the coming years, driven by increasing demand in infrastructure, automotive, and energy sectors.

Key Factors Influencing US Steel Company Stocks

Several factors play a crucial role in determining the performance of US Steel Company stocks:

Economic Conditions: The global economic environment significantly impacts the demand for steel. During periods of economic growth, steel demand tends to rise, leading to increased profitability for US Steel.

Commodity Prices: As a major input in steel production, the prices of iron ore and coal have a direct impact on the cost structure of US Steel. Fluctuations in these prices can affect the company's profitability.

Supply Chain Dynamics: US Steel's ability to manage its supply chain efficiently is crucial for maintaining cost competitiveness. Any disruptions in the supply chain can impact the company's operations and financial performance.

Regulatory Environment: The steel industry is subject to stringent regulations, particularly in terms of environmental compliance. Changes in regulations can have a significant impact on the company's operational costs and profitability.

Investment Strategies

Investors interested in US Steel Company stocks can consider the following strategies:

Long-Term Investment: Given the company's strong market position and growth prospects, a long-term investment approach can be beneficial. This strategy allows investors to benefit from the company's steady growth and dividend payments.

Dividend Investing: US Steel has a history of paying dividends to its shareholders, making it an attractive option for dividend investors. The company's commitment to returning value to its shareholders is evident in its consistent dividend payments.

Sector Rotation: Investors can consider rotating into US Steel Company stocks during periods of economic growth and increased demand for steel.

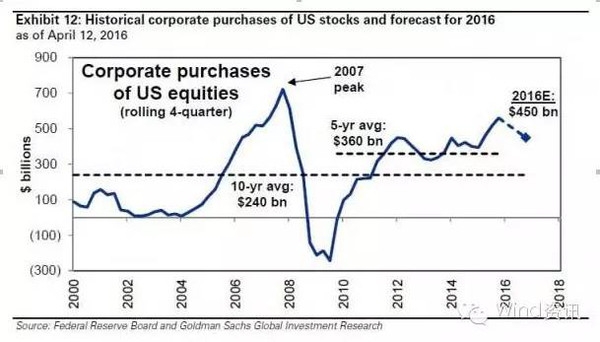

Case Study: US Steel's Response to the Global Recession

During the global recession of 2008-2009, the steel industry faced significant challenges. Despite the downturn, US Steel demonstrated resilience and adaptability. The company implemented cost-cutting measures, streamlined operations, and focused on improving efficiency. These efforts helped the company navigate the recession successfully and emerge stronger.

Conclusion

US Steel Company stocks present a compelling investment opportunity for those looking to capitalize on the growth potential of the steel industry. With a strong market presence, strategic focus, and a history of resilience, US Steel offers a unique proposition for investors. By understanding the key factors influencing the company's performance and adopting a well-informed investment strategy, investors can unlock the potential of US Steel Company stocks.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....