In recent times, the term "plunge stock market" has become a focal point for investors and financial analysts alike. A stock market plunge refers to a significant and rapid decline in the value of stocks, often triggered by economic, political, or market-related events. This article delves into the implications of a stock market plunge and explores effective recovery strategies for investors.

The Causes of a Plunge Stock Market

A plunge in the stock market can be attributed to various factors, including:

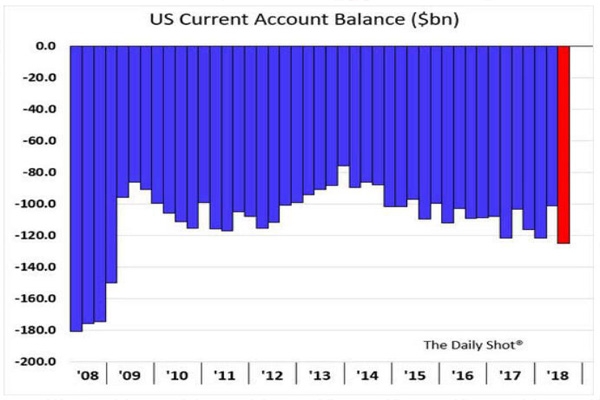

- Economic Downturns: Economic recessions, such as the 2008 financial crisis, can lead to a plunge in the stock market as investors lose confidence in the overall economy.

- Political Events: Events such as elections, political instability, or policy changes can also cause a plunge in the stock market, as investors react to uncertainty.

- Market Manipulation: Instances of market manipulation, such as insider trading or false information, can lead to a plunge in the stock market as investors react to the loss of trust in the market.

The Implications of a Plunge Stock Market

A plunge in the stock market can have several implications, including:

- Loss of Investor Confidence: A plunge in the stock market can lead to a loss of investor confidence, as investors become wary of investing in the market.

- Impact on Retirement Savings: Many individuals rely on their retirement savings, such as 401(k) plans, to fund their retirement. A plunge in the stock market can significantly impact these savings.

- Impact on the Economy: A plunge in the stock market can have a ripple effect on the economy, as businesses may cut costs and reduce hiring due to decreased revenue.

Recovery Strategies for Investors

In the event of a stock market plunge, investors can consider the following recovery strategies:

- Diversify Your Portfolio: Diversifying your portfolio can help mitigate the impact of a plunge in the stock market. By investing in a variety of asset classes, such as stocks, bonds, and real estate, you can reduce your exposure to any single investment.

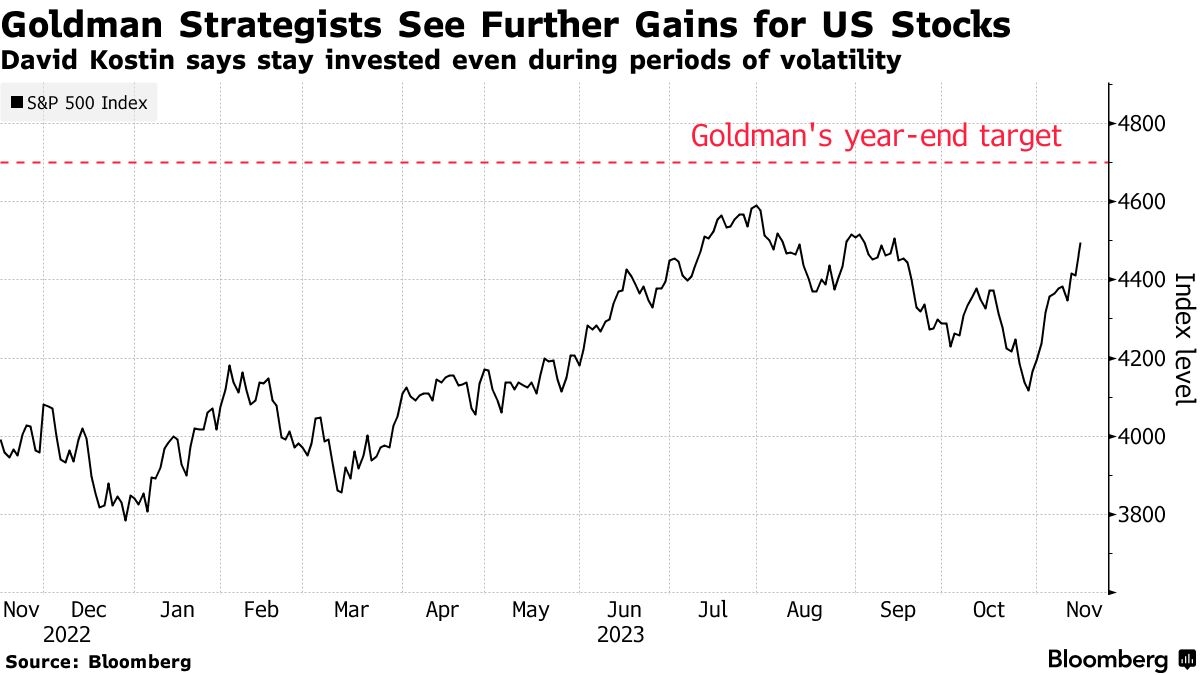

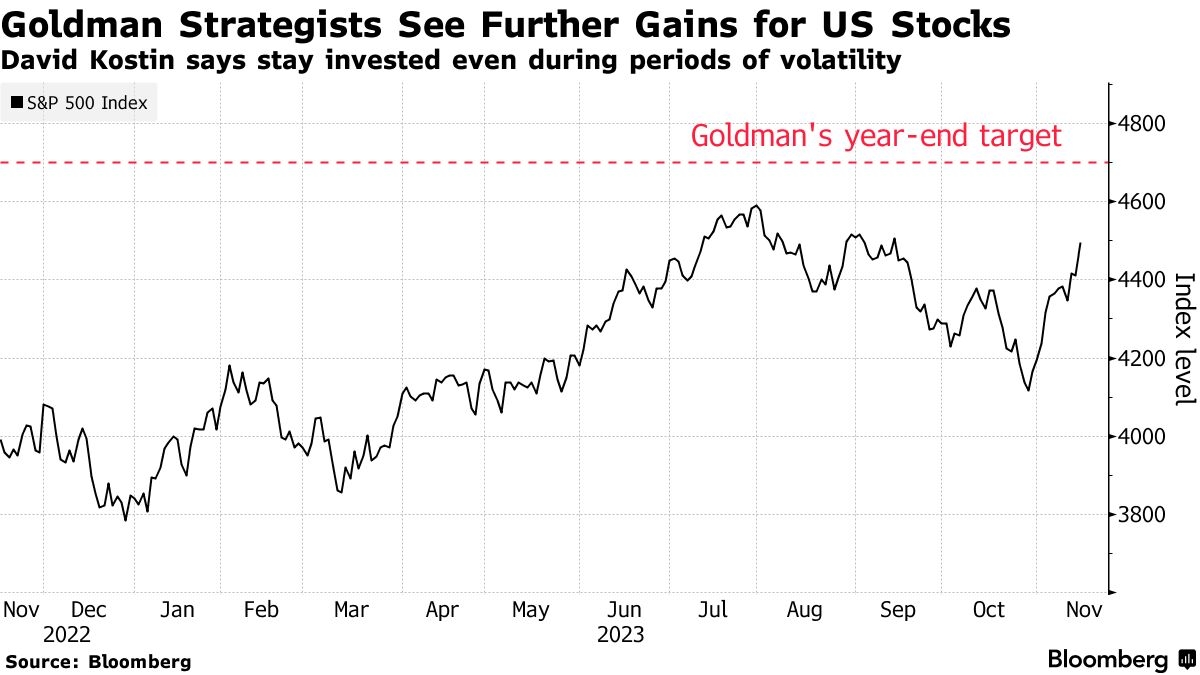

- Maintain a Long-Term Perspective: A plunge in the stock market can be a temporary phenomenon. Maintaining a long-term perspective and focusing on your investment goals can help you avoid panic selling.

- Review Your Investment Strategy: A plunge in the stock market may prompt you to review your investment strategy. Consider adjusting your asset allocation to better align with your risk tolerance and investment goals.

- Seek Professional Advice: If you're unsure about how to navigate a stock market plunge, consider seeking advice from a financial advisor.

Case Study: The 2020 Stock Market Plunge

One notable example of a stock market plunge is the 2020 plunge, which was triggered by the COVID-19 pandemic. The S&P 500 Index dropped by nearly 30% in a matter of weeks. However, the market eventually recovered, with the S&P 500 Index reaching new highs by the end of 2020. This case study highlights the importance of maintaining a long-term perspective and diversifying your portfolio during times of market volatility.

In conclusion, a plunge in the stock market can be a challenging time for investors. However, by understanding the causes and implications of a stock market plunge and implementing effective recovery strategies, investors can navigate these turbulent times and emerge stronger.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....