In the vast and dynamic world of finance, the activities of the U.S. government in the stock market often spark intrigue and curiosity. This article delves into the details of US government stock trades, exploring their impact, strategies, and regulatory frameworks. Whether you're a seasoned investor or a curious observer, understanding these transactions can provide valuable insights into the financial operations of the U.S. government.

Understanding the U.S. Government's Investment Strategy

The U.S. government, through various agencies and departments, actively participates in the stock market. This involvement is primarily aimed at managing its vast financial resources, which include pension funds, trust funds, and other investment accounts. The government's investment strategy is diverse, encompassing a mix of stocks, bonds, and other securities.

Strategic Investment Decisions

One of the key objectives of the U.S. government in stock market investments is to achieve long-term capital appreciation. To achieve this, government agencies employ a mix of active and passive investment strategies. For instance, the Treasury Inflation-Protected Securities (TIPS), managed by the U.S. Department of the Treasury, are designed to protect investors against inflation.

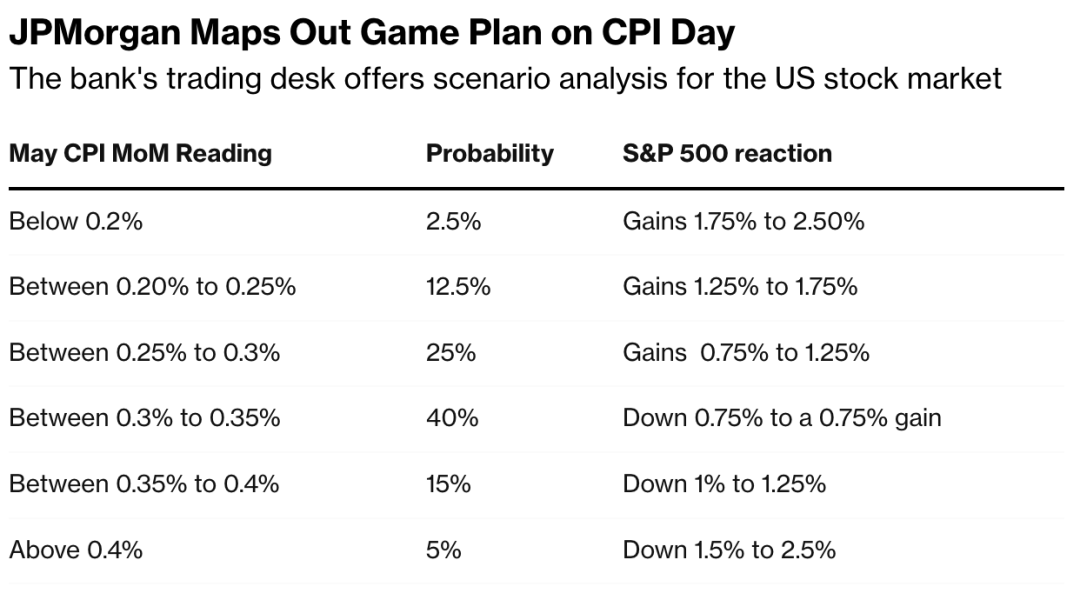

Impact on the Stock Market

The U.S. government's stock trades can have a significant impact on the stock market. Large-scale purchases or sales can influence stock prices, leading to market volatility. For instance, when the government buys a substantial number of shares in a particular company, it can lead to an increase in the stock's price, benefiting shareholders.

Regulatory Framework

The U.S. government's stock trades are subject to strict regulatory frameworks to ensure transparency and prevent conflicts of interest. The Investment Company Act of 1940 and the Securities Exchange Act of 1934 are key regulations that govern these transactions. These regulations require government agencies to disclose their investment activities to the public, ensuring accountability.

Case Studies: Notable U.S. Government Stock Trades

The U.S. Department of the Treasury's Purchase of AIG Shares in 2008: During the 2008 financial crisis, the U.S. government bailed out the American International Group (AIG) by purchasing a significant number of shares. This move helped stabilize the company and restore confidence in the financial markets.

The U.S. Department of the Treasury's Sale of GM Shares in 2013: After the 2008 financial crisis, the U.S. government invested billions of dollars in General Motors (GM). In 2013, the government sold its remaining shares, recouping its investment and even making a profit.

Conclusion

Understanding the intricacies of US government stock trades is crucial for anyone interested in the financial operations of the U.S. government and its impact on the stock market. By exploring the government's investment strategy, regulatory frameworks, and notable case studies, we gain a deeper insight into the world of government investments.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....