The stock market's performance is a key indicator of the health of the economy and investor sentiment. But when the market experiences a downturn, many investors are left scratching their heads, wondering what caused the decline. In this article, we delve into the reasons behind the recent stock market drop and what it could mean for investors.

Economic Indicators and Data Reports

One of the primary reasons for the stock market's downward trend yesterday was the release of negative economic indicators and data reports. For instance, if the unemployment rate rose or if a major economic report, such as the GDP growth rate, was lower than expected, investors might become concerned about the future of the economy. This concern can lead to a sell-off as investors rush to protect their portfolios.

Correlation with Geopolitical Events

Geopolitical events can also have a significant impact on the stock market. If there was a political instability or a conflict in a major oil-producing country, for example, it could lead to a spike in oil prices. This, in turn, could negatively impact the stock market, as higher oil prices can lead to increased inflation and reduced consumer spending.

Correlation with Corporate Earnings Reports

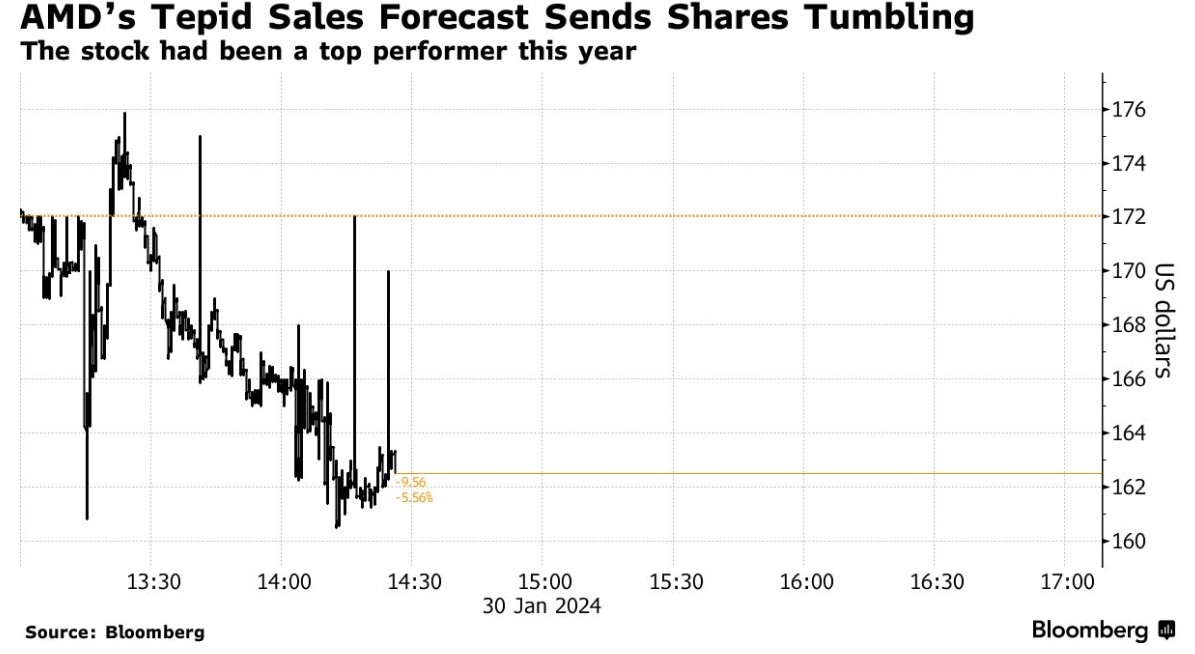

Another possible reason for the stock market's decline could be the release of disappointing corporate earnings reports. If companies are not meeting their financial targets or if there are signs of a slowdown in growth, investors might become concerned and sell off their stocks.

Technological Factors

Technological factors can also play a role in the stock market's performance. For instance, if there was a major cybersecurity attack or if there was news of a company experiencing technical difficulties, it could lead to a sell-off in that company's stock and potentially drag down the entire market.

Behavioral Factors

Finally, behavioral factors can also contribute to the stock market's volatility. Investors often react to news and rumors, which can lead to panic selling or overreacting to positive news. This behavior can create a self-fulfilling prophecy, where investor sentiment drives the market's performance.

Case Study: Tech Sector Decline

A recent example of a sector-specific downturn was the decline in the tech sector. If a major tech company, such as Apple or Google, released a weak earnings report or if there were concerns about the growth of the tech industry, it could lead to a sell-off in tech stocks and potentially drag down the overall market.

What Does This Mean for Investors?

If you're an investor, it's important to understand the factors that can influence the stock market. While it's impossible to predict the future with certainty, being aware of these factors can help you make more informed decisions about your investments.

In conclusion, the stock market's recent downturn could be attributed to a variety of factors, including economic indicators, geopolitical events, corporate earnings reports, technological factors, and behavioral factors. By understanding these factors, investors can better navigate the stock market and make more informed decisions about their portfolios.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....