In the globalized world of finance, investing in foreign stocks has become increasingly accessible. For Indian investors, exploring opportunities in the US stock market presents a wealth of possibilities. This guide delves into the essentials of investing in US stocks from India, providing you with a clear roadmap to succeed in this dynamic market.

Understanding the US Stock Market

The US stock market is one of the most robust and diverse in the world, offering a wide array of investment options. From tech giants like Apple and Microsoft to energy companies and financial institutions, there is a vast array of sectors to choose from. Understanding the US market is crucial before making any investment decisions.

How to Invest in US Stocks from India

1. Choose a Reliable Broker

Your first step is to select a reliable and registered broker who can facilitate your investments in the US stock market. Many Indian brokerage firms offer services to trade US stocks. Look for brokers that have a strong presence in both markets and offer competitive fees.

2. Open a Brokerage Account

Once you have chosen a broker, open a brokerage account with them. This process typically involves filling out an application form, providing necessary documentation, and verifying your identity. Some brokers might require you to submit proof of your investment experience or net worth.

3. Convert INR to USD

To invest in US stocks, you need to convert your Indian rupees (INR) to US dollars (USD). You can do this through your brokerage firm or any authorized money exchange. Keep in mind that currency exchange rates fluctuate, which can affect the amount you receive in USD.

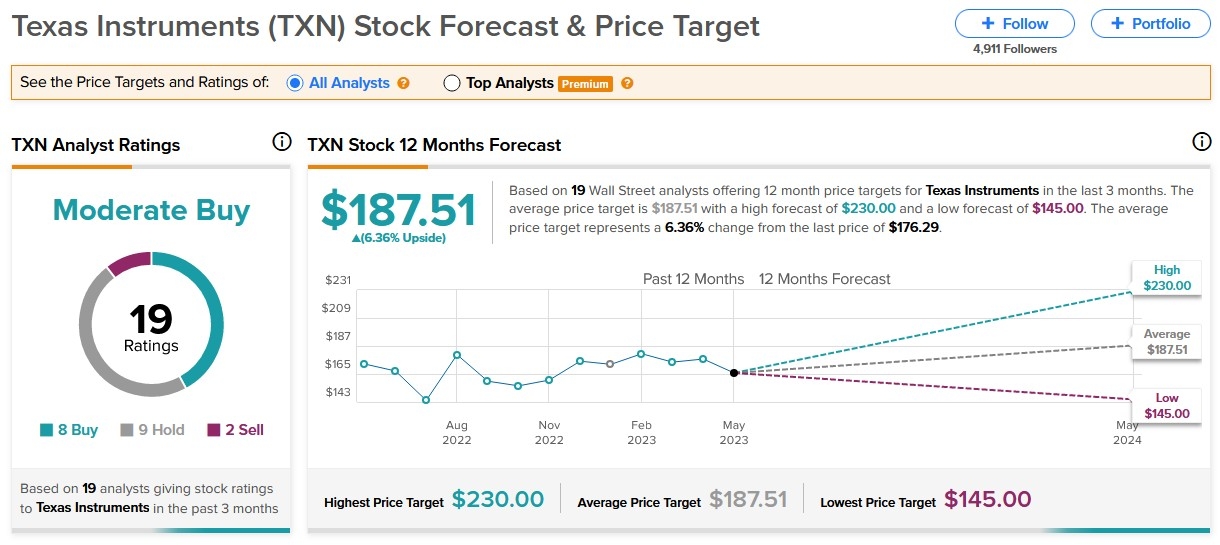

4. Research and Analyze Stocks

Before investing, conduct thorough research on the stocks you are interested in. Analyze financial statements, stock charts, and other relevant data to assess the company’s performance and potential. Utilize tools and resources provided by your broker to gain insights.

5. Place Your Order

Once you have selected a stock, place your order through your brokerage platform. You can choose from various order types, including market orders, limit orders, and stop orders, depending on your investment strategy.

Top US Stocks for Indian Investors

1. Technology Sector

The technology sector has been a powerhouse for US stocks. Companies like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN) have shown remarkable growth and are often favored by Indian investors.

2. Healthcare Sector

The healthcare sector offers stability and potential growth. Johnson & Johnson (JNJ) and Merck (MRK) are two healthcare giants that have consistently performed well.

3. Energy Sector

Energy companies like ExxonMobil (XOM) and Chevron (CVX) are known for their resilience and steady returns, making them attractive investments for Indian investors.

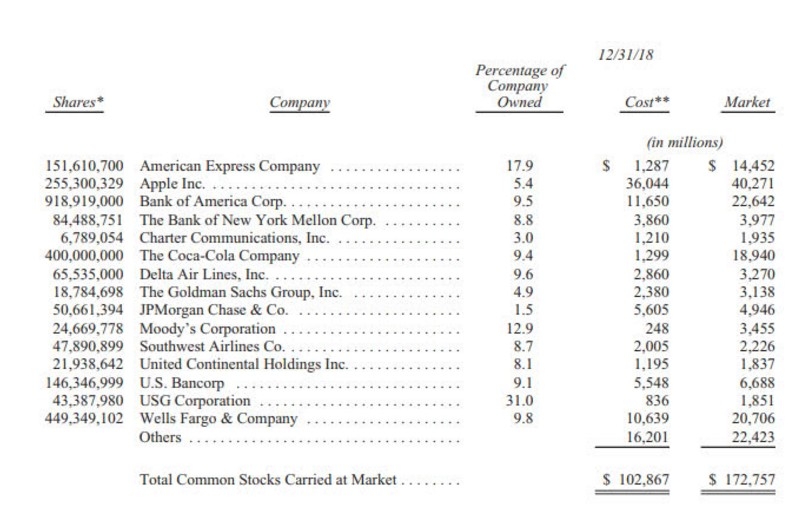

4. Financial Sector

The financial sector includes blue-chip companies such as Bank of America (BAC) and JPMorgan Chase (JPM), which have been reliable performers over the years.

Conclusion

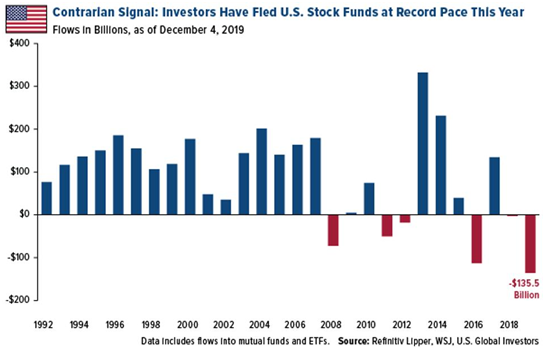

Investing in US stocks from India can be a lucrative venture, but it requires careful planning and research. By understanding the market, selecting the right broker, and conducting thorough research, you can make informed investment decisions. Remember to stay updated with market trends and adjust your portfolio accordingly. Happy investing!

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....