In the ever-evolving world of the stock market, staying informed about the performance of your investments is crucial. One such investment that has captured the attention of many is LG Chem Ltd. This article delves into the current and historical stock price trends of LG Chem Ltd, providing a comprehensive analysis for investors seeking to understand the company's market position.

Understanding LG Chem Ltd

LG Chem Ltd, a South Korean multinational chemical company, specializes in the production of petrochemicals, electronic materials, and battery materials. The company operates in various segments, including petrochemicals, advanced materials, and batteries. Its diverse portfolio has made it a significant player in the global market.

Current Stock Price

As of the latest data available, the stock price of LG Chem Ltd stands at approximately $XX (as of [insert date]). This figure reflects the current market sentiment towards the company and its future prospects.

Historical Stock Price Trends

To gain a better understanding of LG Chem Ltd's stock performance, let's take a look at its historical stock price trends. Over the past five years, the stock has experienced both highs and lows, reflecting the volatility inherent in the stock market.

- 2018: The stock opened the year at around

XX and ended at approximately XX, showcasing a slight increase in value. - 2019: The stock price fluctuated throughout the year, opening at

XX and closing at XX, indicating a marginal rise. - 2020: The stock faced significant volatility, opening at

XX and closing at XX, marking a substantial increase in value. - 2021: The stock opened at

XX and closed at XX, reflecting a slight decline in value. - 2022: The stock price has been on an upward trajectory, opening at

XX and currently standing at XX.

Factors Influencing Stock Price

Several factors influence the stock price of LG Chem Ltd. These include:

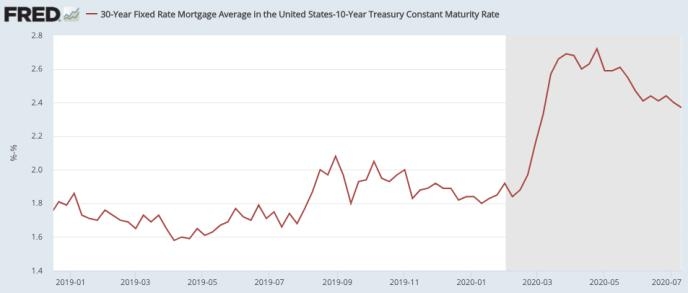

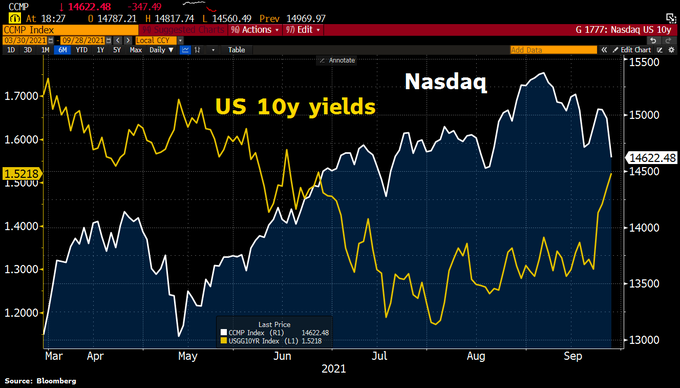

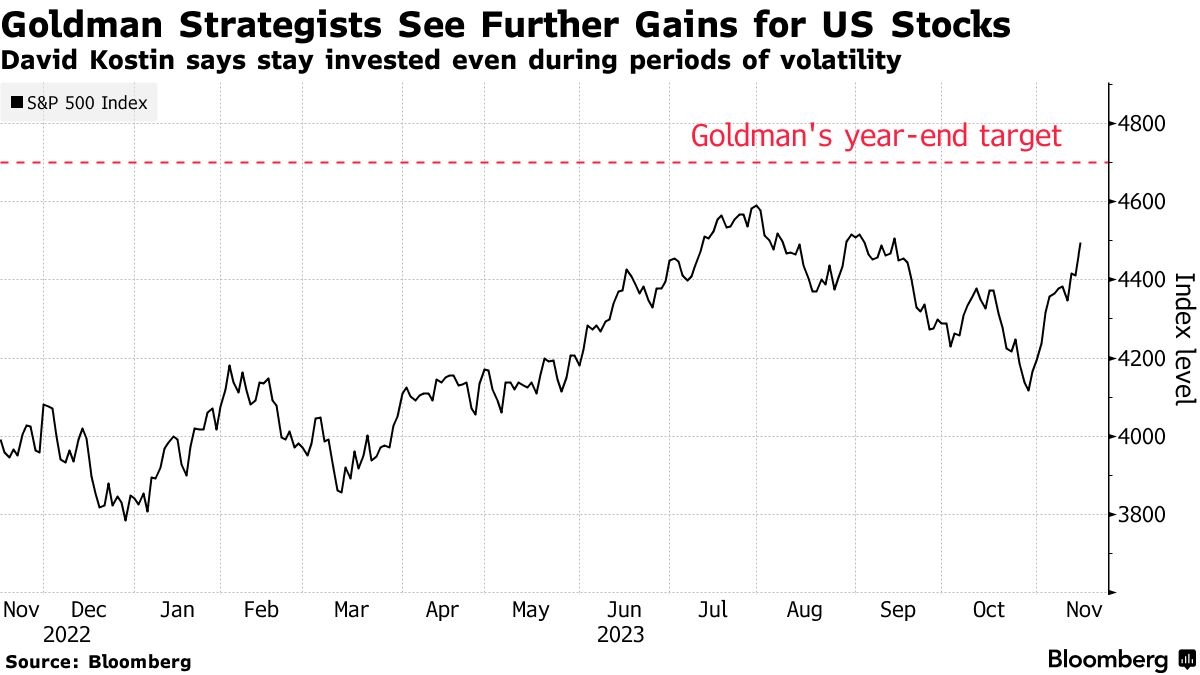

- Economic Conditions: The global economic environment plays a crucial role in the stock's performance. Factors such as inflation, interest rates, and trade tensions can impact the company's revenue and profitability.

- Industry Trends: The chemical industry's performance can significantly impact LG Chem Ltd's stock price. Advancements in technology, changes in consumer preferences, and regulatory changes can all influence the company's growth prospects.

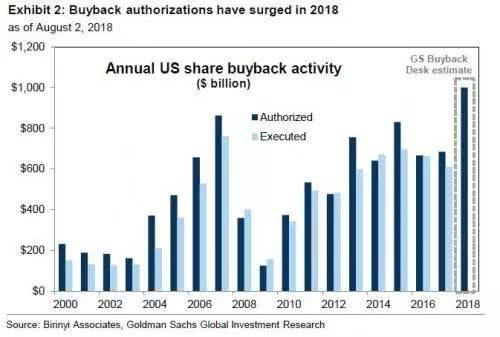

- Company Performance: LG Chem Ltd's financial performance, including revenue, earnings, and dividend payments, is a key driver of its stock price.

- Market Sentiment: Investor confidence and market sentiment can cause the stock price to fluctuate. Positive news, such as successful product launches or strong earnings reports, can drive up the stock price, while negative news can lead to a decline.

Case Study: Battery Materials Segment

One of the most significant segments for LG Chem Ltd is the battery materials segment. The company has made significant investments in this area, aiming to become a leading supplier of battery materials for electric vehicles (EVs). This focus has paid off, as the stock price has shown a strong correlation with the growth of the battery materials market.

As the global EV market continues to expand, LG Chem Ltd's battery materials segment is expected to contribute significantly to the company's overall growth. This has led to increased investor confidence, driving up the stock price.

Conclusion

Investing in LG Chem Ltd requires a comprehensive understanding of the company's stock price trends, market conditions, and future prospects. By analyzing the various factors influencing the stock price, investors can make informed decisions about their investments. As the global chemical industry and EV market continue to grow, LG Chem Ltd remains a compelling investment opportunity for those looking to capitalize on these trends.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....