In today's volatile market, the term "stocks plummeting today" has become a common phrase among investors. The stock market's unpredictable nature often leads to sudden drops, leaving many investors in a state of panic. This article aims to provide you with a comprehensive understanding of the factors contributing to today's stock market crash and how you can navigate through this turbulent period.

Understanding the Reasons Behind the Stock Market Crash

Several factors have contributed to today's stock market crash. Here are some of the key reasons:

- Economic Uncertainty: The ongoing global economic crisis has created a sense of uncertainty among investors. Factors such as rising inflation, slowing economic growth, and geopolitical tensions have all played a role in the current market downturn.

- Interest Rate Hikes: The Federal Reserve's decision to raise interest rates has made borrowing more expensive for businesses and consumers. This has led to a decrease in corporate profits and a subsequent drop in stock prices.

- Tech Stocks Decline: The technology sector, which has been a major driver of the stock market's growth in recent years, has experienced a significant decline. This is due to concerns about valuation and regulatory scrutiny.

- Coronavirus Pandemic: The COVID-19 pandemic has continued to impact the global economy, leading to supply chain disruptions and increased uncertainty.

How to Navigate Through the Stock Market Crash

If you're an investor, it's important to stay calm and not panic during a stock market crash. Here are some tips to help you navigate through this turbulent period:

- Review Your Portfolio: Take a close look at your portfolio and assess the performance of your investments. Identify any underperforming assets and consider selling them.

- Diversify Your Investments: Diversification is key to protecting your portfolio from market downturns. Ensure that your investments are spread across different sectors, asset classes, and geographic regions.

- Rebalance Your Portfolio: As the market changes, it's important to rebalance your portfolio to maintain your desired asset allocation.

- Avoid Making Emotional Decisions: Don't let your emotions drive your investment decisions. Stick to your long-term strategy and avoid making impulsive moves.

Case Studies: How Investors Have Navigated Previous Stock Market Crashes

To illustrate the importance of maintaining a long-term perspective, let's look at a few case studies of investors who navigated previous stock market crashes:

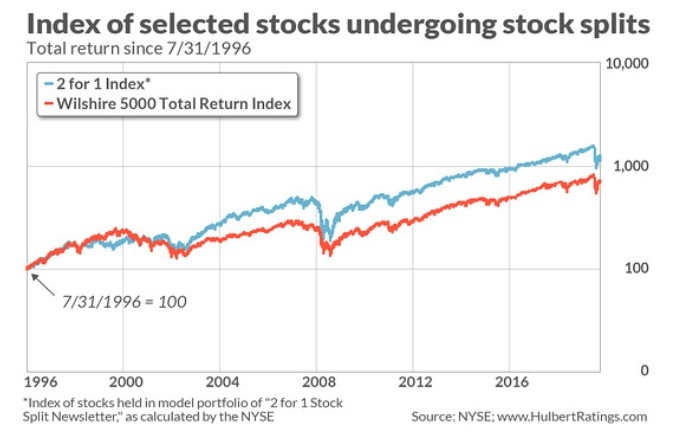

- The Dot-Com Bubble: In the early 2000s, the dot-com bubble burst, leading to a significant drop in stock prices. Investors who stayed invested and diversified their portfolios were able to recover their losses over time.

- The Financial Crisis of 2008: The financial crisis of 2008 was one of the worst economic downturns in history. Investors who maintained a diversified portfolio and avoided panic selling were able to recover their losses and even earn profits over the long term.

Conclusion

In conclusion, the stock market's unpredictable nature can be daunting, but it's important to stay calm and maintain a long-term perspective. By understanding the reasons behind the current market downturn and following sound investment strategies, you can navigate through this turbulent period and protect your investments.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....