In the financial world, the term "US money stock measures" refers to a set of metrics used to gauge the total amount of money in circulation within the United States. These measures are crucial for understanding the country's economic health and for making informed financial decisions. This article delves into the various types of money stock measures, their significance, and how they are used to assess the economy.

What are US Money Stock Measures?

US money stock measures are categorized into different types, each representing a different aspect of the money supply. The most common types include M1, M2, M3, and M4. Here's a brief overview of each:

- M1: This is the narrowest measure of money supply and includes currency in circulation, demand deposits, and traveler's checks. It represents the most liquid assets that are readily available for spending.

- M2: M2 is broader than M1 and includes M1 plus savings deposits, money market mutual funds, and small time deposits. It provides a more comprehensive view of the money supply.

- M3: M3 is even broader than M2 and includes M2 plus large time deposits and institutional money market funds. It is used primarily by monetary authorities.

- M4: M4 is the broadest measure and includes M3 plus certain types of repurchase agreements and money market funds.

The Significance of US Money Stock Measures

Understanding the different money stock measures is crucial for several reasons:

- Economic Indicators: These measures are used as economic indicators to assess the health of the economy. For example, an increase in M1 and M2 may indicate a growing economy, while a decrease may suggest a slowdown.

- Interest Rates: The Federal Reserve uses money stock measures to make decisions about interest rates. By adjusting interest rates, the Fed aims to control inflation and stimulate economic growth.

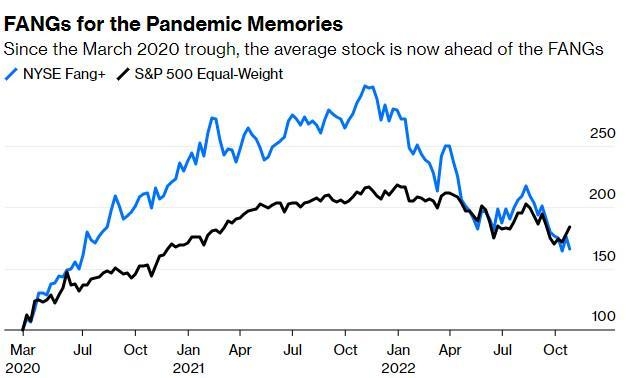

- Investment Decisions: Investors use these measures to make informed decisions about where to allocate their investments. For example, an increase in M2 may indicate a growing stock market, while a decrease may suggest a bear market.

Case Studies

To illustrate the importance of US money stock measures, let's look at two case studies:

- 2008 Financial Crisis: Prior to the crisis, M3 was on the rise, indicating an excessive amount of money in circulation. This contributed to the bubble in the housing market and ultimately led to the financial crisis.

- 2019 Economic Boom: In 2019, M2 experienced a significant increase, which was attributed to the Federal Reserve's expansionary monetary policy. This policy helped to stimulate economic growth and keep inflation in check.

Conclusion

US money stock measures are essential tools for understanding the economy and making informed financial decisions. By understanding the different types of money stock measures and their significance, you can gain valuable insights into the financial health of the United States.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....