Investing in the top 1000 US stocks can be a game-changer for your portfolio. These companies represent some of the most successful and stable businesses in the world. However, navigating the market and selecting the right stocks can be overwhelming. In this article, we'll guide you through the process of investing in the top 1000 US stocks, providing you with valuable insights and tips to help you make informed decisions.

Understanding the Top 1000 US Stocks

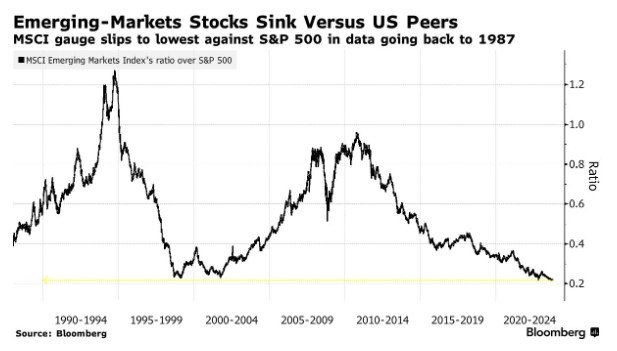

The top 1000 US stocks are typically those that are part of the S&P 500 index. This index includes the largest companies by market capitalization in the United States. These companies operate across various industries, including technology, healthcare, finance, and consumer goods.

1. Research and Analyze

The first step in investing in the top 1000 US stocks is to conduct thorough research. Here are some key points to consider:

- Company fundamentals: Look for companies with strong financial health, including high revenue growth, solid profitability, and low debt levels.

- Industry trends: Stay updated on industry news and trends to identify companies that are poised for growth.

- Market capitalization: Focus on companies with a market capitalization that aligns with your investment goals and risk tolerance.

2. Utilize Online Resources

There are numerous online resources available to help you research and analyze stocks. Some popular tools include:

- Stock analysis websites: Websites like Yahoo Finance, Google Finance, and Motley Fool provide detailed company information, news, and analysis.

- Financial news platforms: Keep up with financial news to stay informed about market trends and company developments.

- Stock market apps: Mobile apps like Robinhood and TD Ameritrade offer real-time stock prices, news, and research tools.

3. Consider Dividend Stocks

Investing in dividend-paying stocks can be a great way to generate income. Many of the top 1000 US stocks offer dividends, providing investors with a regular stream of income. When considering dividend stocks, look for companies with a history of increasing dividends over time.

4. Diversify Your Portfolio

Diversification is crucial when investing in the top 1000 US stocks. By spreading your investments across different sectors and industries, you can reduce your risk exposure. Consider using a mix of stocks, bonds, and other assets to create a well-diversified portfolio.

5. Use a Robo-Advisor

A robo-advisor is an automated investment platform that uses algorithms to manage your investments. Robo-advisors can help you invest in a diversified portfolio of top 1000 US stocks with minimal effort. They also offer lower fees compared to traditional financial advisors.

Case Study: Apple (AAPL)

Apple is a prime example of a top 1000 US stock that has consistently delivered strong performance over the years. With a market capitalization of over $2 trillion, Apple is one of the largest companies in the world. The company's strong fundamentals, coupled with its innovative products and services, have made it a favorite among investors.

By focusing on company fundamentals, staying informed about market trends, and diversifying your portfolio, you can successfully invest in the top 1000 US stocks. Remember to do your research, stay patient, and be disciplined in your investment approach.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....