This week has been a rollercoaster ride for the stock market, with investors on edge as they await the latest results. In this article, we'll delve into the key developments, market trends, and potential impacts on investors' portfolios. From tech giants to energy stocks, we'll cover it all.

Tech Sector Dominance

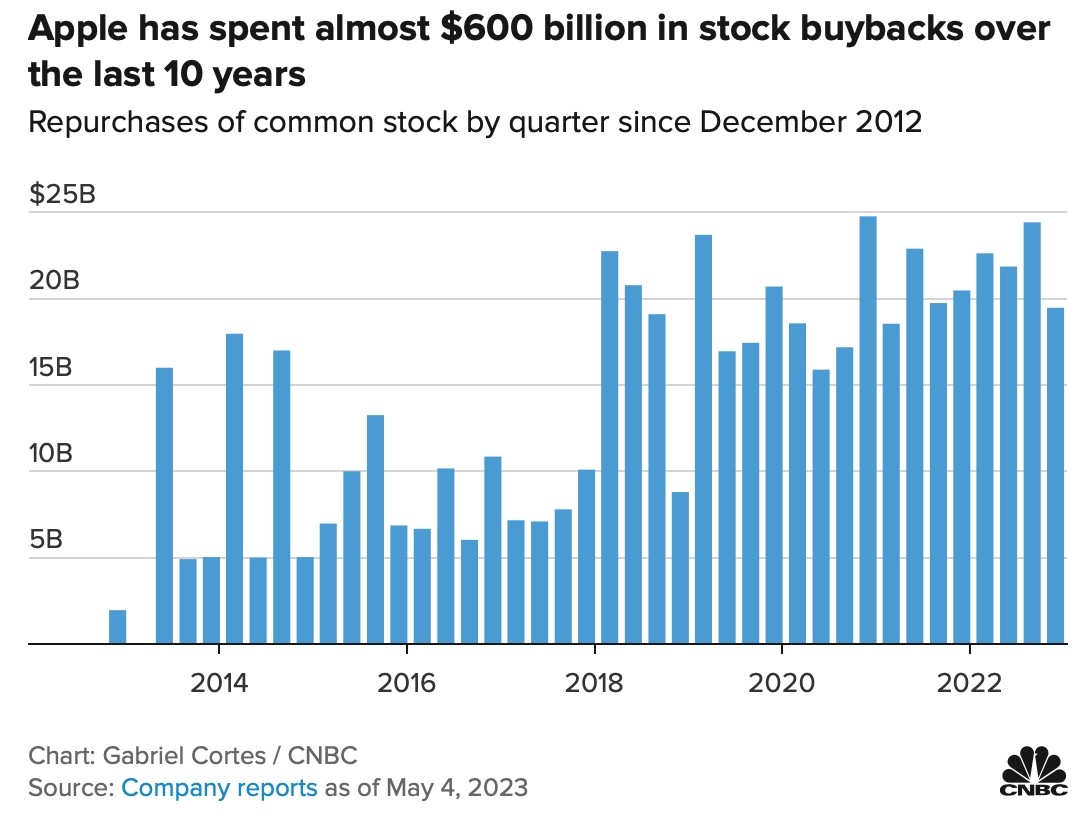

The tech sector has been a major driver of this week's stock market results. Apple, Microsoft, and Amazon have all seen significant gains, driven by strong earnings reports and positive outlooks. Apple's new iPhone lineup has been a hit, and Microsoft's cloud services continue to grow. Amazon's success in the e-commerce and cloud computing markets has also contributed to its strong performance.

Energy Sector Struggles

On the other hand, the energy sector has faced challenges this week. Oil prices have fallen due to concerns about global demand and supply, and energy stocks have followed suit. Companies like ExxonMobil and Chevron have seen their shares decline, reflecting the broader market trends in the energy sector.

Market Volatility

Market volatility has been a hallmark of this week's stock market results. Stock prices have swung wildly, with investors reacting to news and economic data. The VIX, or "fear gauge," has been on the rise, indicating increased uncertainty in the market.

Economic Data and Policy

Economic data and policy announcements have also played a significant role in this week's stock market results. The Federal Reserve's decision to keep interest rates unchanged has been a key factor, as has the latest unemployment data and inflation figures.

Investor Sentiment

Investor sentiment has been a mixed bag this week. Some investors are optimistic about the long-term prospects of the stock market, while others are concerned about the short-term volatility. This mixed sentiment has contributed to the overall uncertainty in the market.

Case Studies

Let's take a closer look at a couple of case studies to illustrate the impact of this week's stock market results.

Case Study 1: Apple

Apple's strong earnings report and new iPhone lineup have driven its shares higher. Investors are optimistic about the company's future growth prospects, particularly in the areas of services and hardware.

Case Study 2: ExxonMobil

ExxonMobil has seen its shares decline due to falling oil prices and concerns about the energy sector. While the company remains a strong player in the industry, investors are cautious about its future performance.

Conclusion

This week's stock market results have been a mixed bag, with the tech sector leading the way and the energy sector struggling. Market volatility and economic data have played a significant role in shaping investor sentiment. As we move forward, it will be important for investors to stay informed and adapt to the changing market conditions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....